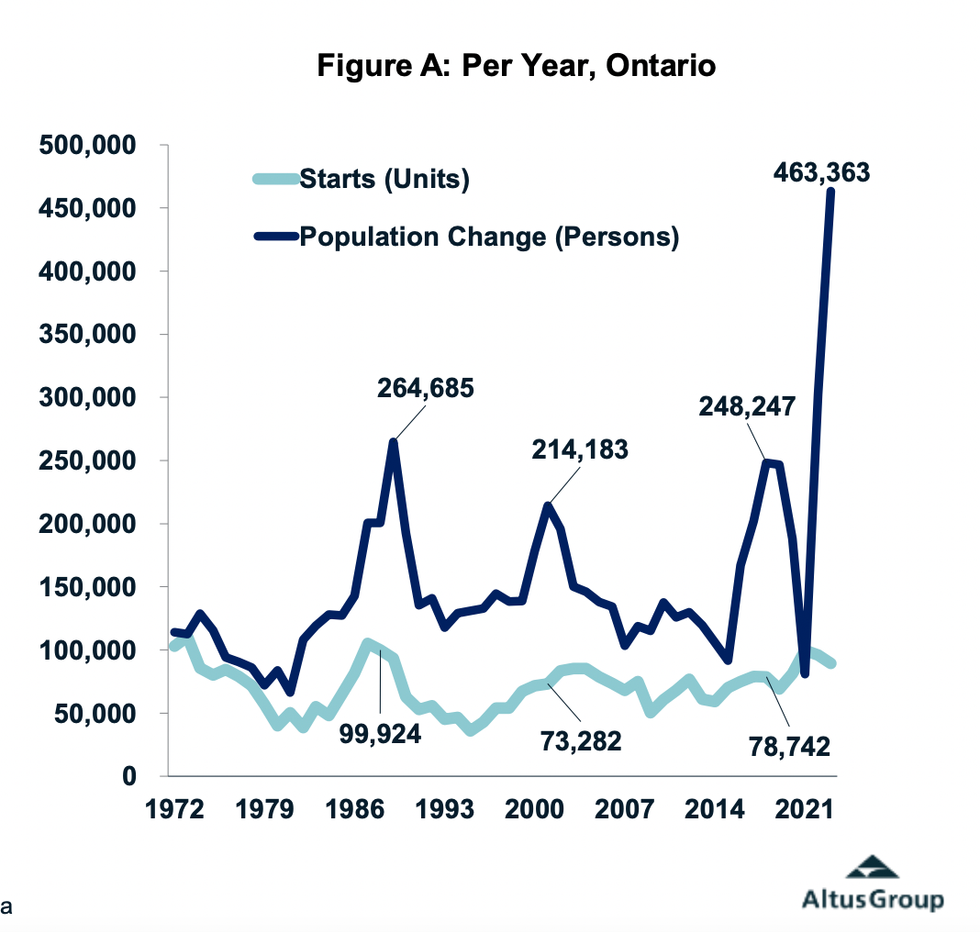

The gap between the growth in GTA housing stock and the region's population is the widest it has been in over 50 years, according to the Building Industry and Land Development Association's (BILD's) 2024 GTA Municipal Benchmarking Study.

Back in 1972 — the year this data began being collected — the population of the GTA would have been significantly smaller than the 5.9 million who call the area home today. Just between 2021 and 2023, immigration levels in the GTA hit 1.9 million, though on average, the region is growing less quickly than it was pre-pandemic as an increasing number of people move to other parts of Ontario and Canada, notes the report.

Still, while some are moving farther afield, data shows that the cohort that most drives housing demand (those aged 22-44) in the GTA has grown by an average rate of 64,000 people per year between 2019 and 2023.

Despite this growth, it seems as if sometime in the last 50 years we forgot how to keep up with housing demand. And we know very well why. As the report explores, the lethargy endemic to the GTA's (and Canada's) housing sector largely comes down to out of control costs, delays, and the cost of those delays.

"This is a bright red warning light on the dashboard for all levels of government," says President and CEO of BILD David Wilkes. "Without bold steps, the housing crisis in the GTA is going to get far worse in the years ahead."

Soaring Fees = More Expensive Homes

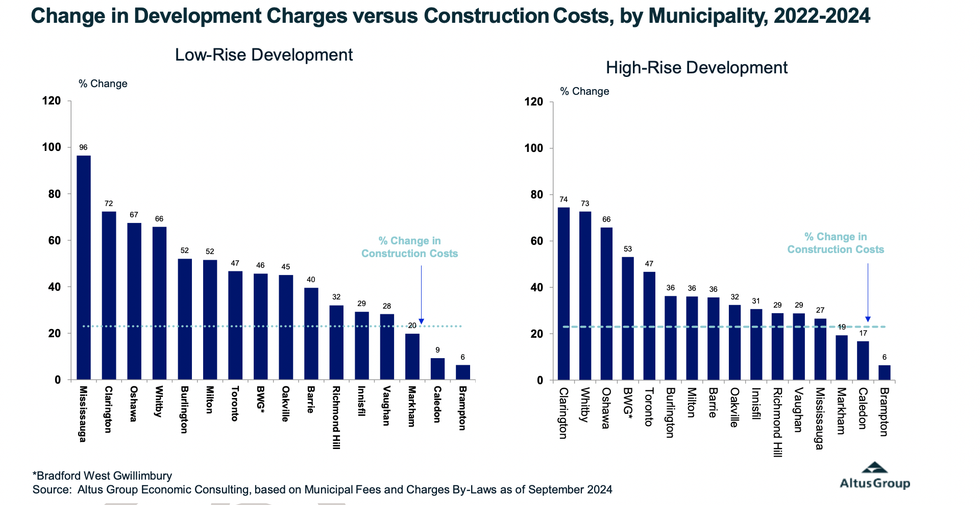

Since the last Municipal Benchmarking Study in 2022, average municipal fees have risen by $42,000 per unit on low-rise developments and $32,000 on high-rises. Across all municipalities, the average total fees for a low-rise is $165,000, but in Toronto, that number jumps to $195,000 per unit. And for a high-rise, the average total fees amount to $122,000, the study found.

RELATED: "It Defies Logic”: Is Toronto's Approach To Development Charges Broken?

These fees are largely made up of development charges, parkland dedication, and community benefit charges, but development charges take the cake. In 2022, development charges used to increase by a rate of 6%, but by 2024, the growth rate had increased to 74%, greatly outstripping the cost of building infrastructure. This increase, paired with other fees, taxes, and charges from all levels of government has led to fees amounting to around 25% of the cost a new homebuyer might pay for a house.

And thanks to higher fees and longer timelines (which we'll get into), the cost a new homebuyer might pay is 60% of their monthly income going towards servicing a mortgage in one of the GTA's more expensive regions, the study says. In fact, if you buy an average-priced $1,126,453 low-rise in the GTA, $164,920 of that would be municipal fees — $42,000 more than in 2022.

Timelines Improving Though Still "Excessively High"

The other factor cinching supply and driving up prices are "excessively high" timelines. Due to building application submissions falling "significantly over the last two years," municipalities have had more time and resources to tackle applications, leading to 10 municipalities having shorter timelines than they did in the 2022 study. Still, the average number of months is takes to approve an application only ticked town 2.4 months and, overall, the average timeline remains at an arduous 20.3 months.

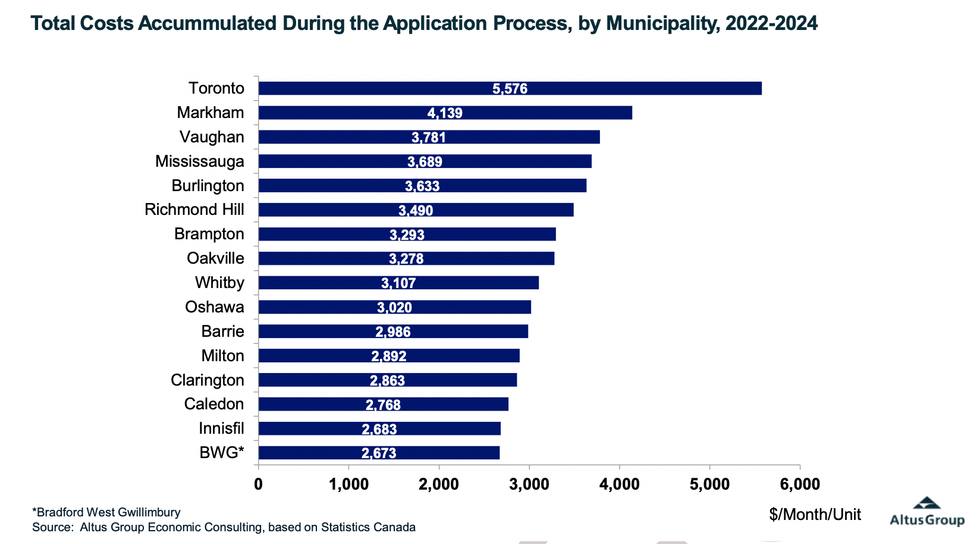

And the cost of these delays are "hefty," says the report. Due to annual property taxes on vacant land, cost escalation, and opportunity cost of holding land vacant, monthly costs can amount to between $2,673 and $5,576 per month on a single unit. With current wait times, those costs can accumulate to anywhere from $43,000 to $90,000 per application submission, further driving up the end cost for homebuyers.

"The GTA housing market faces structural challenges that have driven up construction costs, including unattainably high government fees and taxes — which are among the highest in Canada," said Wilkes. "To improve affordability, governments must act to accelerate approvals and reduce the overall tax burden they are placing on new home buyers. Without bold and immediate action, the region's housing crisis will be exacerbated, leading to fewer housing starts, reduced jobs, and compounded affordability issues in the years ahead."

According to the study, leading the region in lowest fees, approval times, and least improvements needed on planning features, among 16 municipalities, were Barrie, Oakville, and Mississauga and among the highest were Caledon, Oshawa, and Richmond Hill.

- "From Bad To Worse": Construction Productivity In Canada At 30-Year Low ›

- GTA Reaches New "Historical Low" With Fewer Than 500 New Home Sales In August ›

- "It Defies Logic”: Is Toronto's Approach To Development Charges Broken? ›

- New Condo Construction In Toronto To “Fall Off A Cliff” ›

- Mississauga Lowers Development Charges By Up To 100% ›