The Greater Toronto Area's (GTA) "prolonged downturn" in new home sales continued with its sloping trajectory in June, according to the latest data from Building Industry Land and Development Association (BILD) and Altus Group.

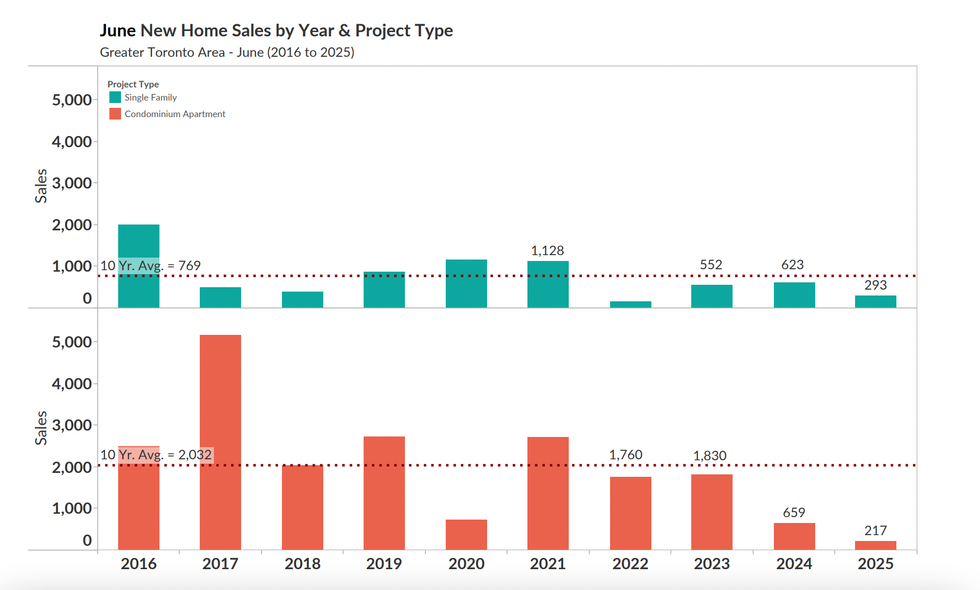

In a "near-historic low," just 510 new homes were sold last month, up from a measly 345 in May — however, that figure was higher than it was in any month since the beginning of the year. Still, June's sales remain 60% below June 2024 and 82% below the 10-year average. For reference, a typical June would have seen around 2,801 new homes sold — more than five times the sales recorded last month.

June's weak numbers are no outlier, coming amid what BILD has called "the worst downturn of new home sales in the region on record." Sales hit record lows multiple times in 2024 and this May marked the eighth consecutive month of record all-time lows, as higher interest rates, affordability issues, and economic uncertainty have slowed demand to a trickle.

“June 2025 new home sales across the GTA extended the prolonged downturn plaguing the new home market” said Edward Jegg, Research Manager at Altus Group. “Consumers are lacking the confidence to enter into one of their largest purchases as the economic uncertainty centred largely on US tariff policies weighs heavily on potential homebuyers.”

BILD President and CEO David Wilkes also highlights that alongside a downturn in demand, high development costs in the GTA are putting further strain on an already struggling industry.

“This is not a healthy or sustainable environment," he says. "[...] To revitalize the market — a sector that is critical to Canada’s economic health — we need bold, immediate action from all levels of government. That includes measures like significant GST relief and broadening the work we have seen on DC reductions so far."

In recent months, a number of municipalities in the GTA have lowered development charges, including Vaughan, Peel, and Mississauga, while Toronto will vote later today on whether or not to exempt sixplexes from development charges. Still, many feel more reform is necessary or that development charges should be eliminated entirely.

"Without urgent intervention," says Wilkes, "the future housing supply and economic wellbeing of the GTA is at serious risk.”

Of the 510 sales recorded in June, 217 were condominium apartments, down 67% from June 2024 and 89% below the 10-year average, while 293 were single-family home sales, down 53% year over year and 62% below the 10-year average.

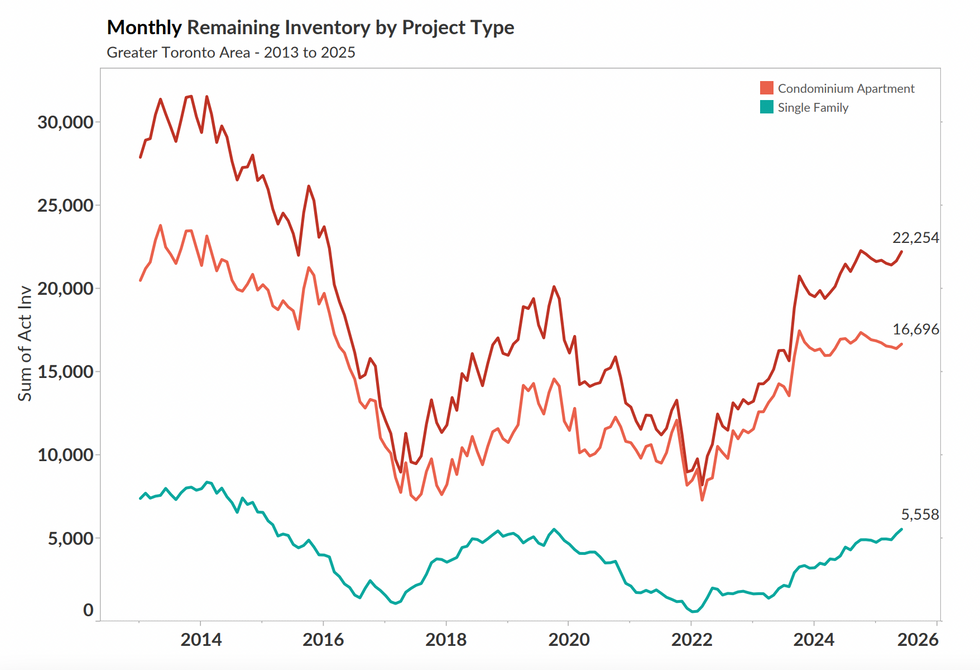

With sales low, listings continued to pile up last month, hitting 22,254 units made up of 16,696 condominium apartments and 5,558 single-family homes. This marked a slight increase from the 21,571 units listed in May and represents a combined inventory of 19 months — the highest inventory level seen to date, according to BILD's records.

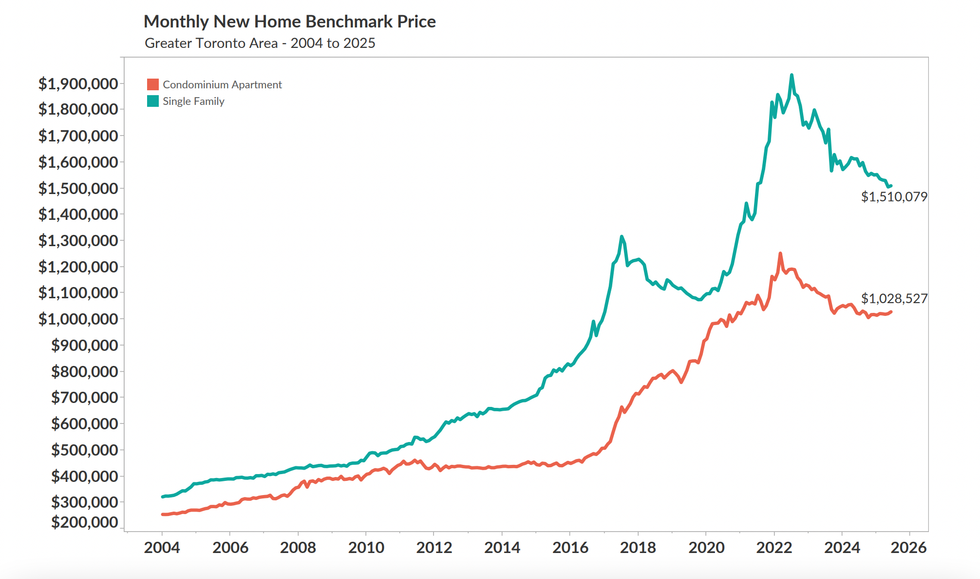

On the price front, the benchmark price for condo apartments was $1,028,527, showing "no material change" from last June, while single-family homes fell 6.4% year over year to $1,510,126. Month over month, condo prices increased from $1,021,339 in May and single-family homes ticked up from $1,505,539.