While new homes sales in the Greater Toronto Area (GTA) remained low in January, the Building Industry and Land Development Association (BILD) says low prices and steady inventory are creating buyer-favourable conditions.

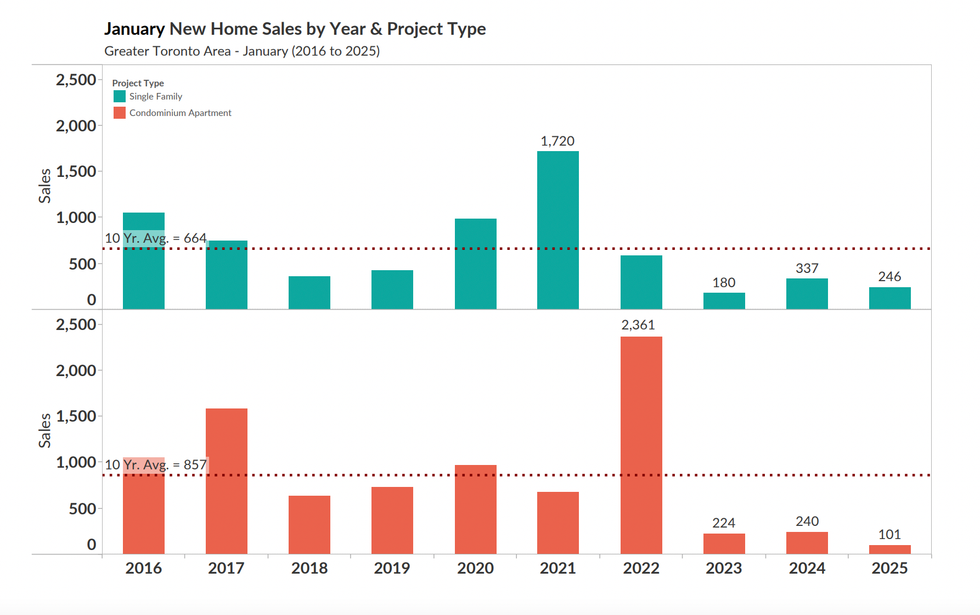

After months of historic lows, including a December that saw new home sales hit their lowest point in 40 years, January posted 347 new home sales, down 40% year over year and 77% below the 10-year average, but up from only 319 sales in December.

“January 2025 new home sales across the GTA recorded a near record low,” said Edward Jegg, Research Manager at Altus Group, in a press release. “Despite a further Bank of Canada cut, excessive inventory and falling prices, GTA new home buyers are nowhere to be found.”

Of the 347 new homes sold in January, the majority were single-family homes at 246 sales, and condominium apartments brought up the rear with 101 units sold, down a staggering 58% from January 2024 and 88% below the 10-year average.

Inventory dipped in January but remained more or less the same as December with a combined inventory level of 14 months. That inventory is currently made up of 16,906 condominium apartment units and 4,599 single-family dwellings for a total of 21,505 units.

January is also the first month BILD included data from Simcoe County, which posted 47 new home sales last month, including 41 single-family home sales and six condominium apartments. If you're feeling the pinch in the city, you might be interested to know a Simcoe single-family home averaged $1,115,176 in January, while a condominium apartment in the northern county averaged $857,338.

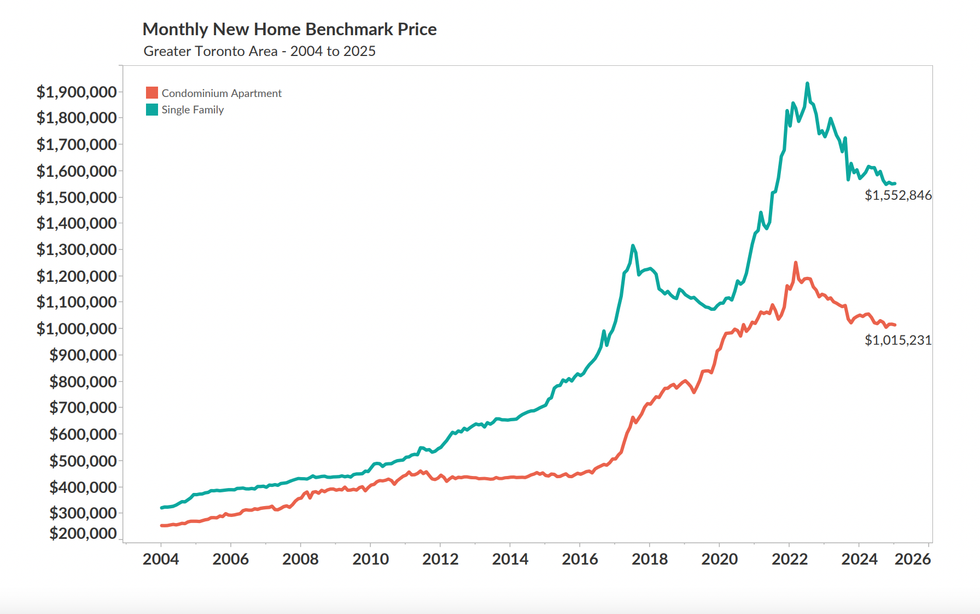

With demand at historic lows, BILD says new home prices in the GTA have likely bottomed out. In January, the benchmark price for new condominium apartments was $1,015,231, down 3.5% year over year, and for new single-family homes the average price sits at $1,552,846, which was down 1.2% compared to January 2024. In December, the benchmark price for condo apartments and single-family homes were $1,018,170 and $1,551,228, respectively, representing a slight month-over-month decline for both home types as well.

“With spring on the horizon, now is a prime time for new home buyers to step into the market. Prices have dropped approximately 20% from the peak in 2022, and with interest rates easing, buyers have a unique opportunity to secure a new home at a favourable price,” said Justin Sherwood, Senior Vice President of Communications, Research, and Stakeholder Relations.

“However, it is important to recognize that the ‘cost to build’ a new home remains high, due to fixed factors like labour and material costs. This means we are likely at the floor on prices. With current inventory levels, the market is also offering more choice than ever, but this combination of lower prices and reduced interest rates may not last long. For buyers, now is an ideal time to act before conditions shift again."

- New Home Construction In Trouble As Prices See Biggest Drop Since 2009 ›

- GTA New Home Sales "Continued To Languish" In November ›

- GTA New Home Sales At 40-Year Low In December, Capping Off "Worst Year Since 1990" ›

- GTA Home Sales Slump 27% Amid Trade Fears, Mortgage Rates ›

- "Rock Bottom": GTA New Home Sales See Worst February On Record ›