The sky-high cost of living has young Canadians reconsidering their home-buying plans, according to a new survey.

With everything from gas and grocery tabs to real estate making more of a dent on the wallet these days -- due in part to higher interest rates and rising inflation -- the survey found that young people are parking their plans to purchase real estate.

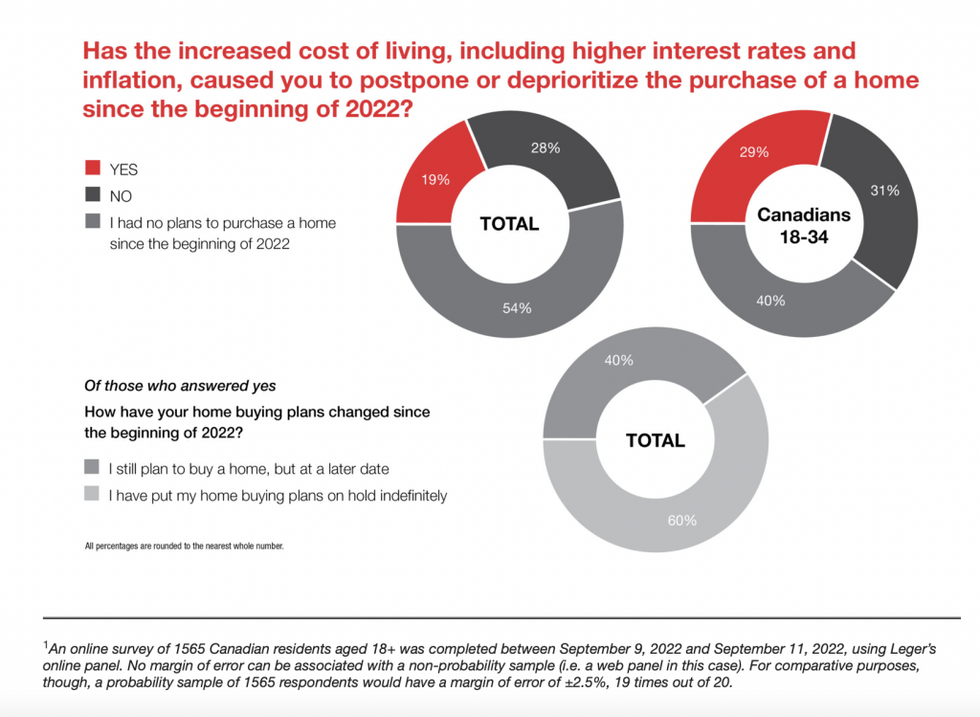

Conducted by Royal LePage and Leger, it found that nearly one third (29%) of Canadians aged 18-34 have delayed their home-buying plans since the start of the year. When not broken down by age of respondents, one in five Canadians (19%) reported that the current climate has influenced their decision to delay or deprioritize the purchase of a home.

Of course, the survey results aren't exactly a surprise (the same way a pricey grocery tab fails to shock anymore).

Last month, the Bank of Canada increased its overnight lending rate for the fifth time this year. So, while home prices may have simultaneously softened across the country, high mortgage payments render homeownership a pipe dream for countless Canadians. Not to mention, the rising cost of consumer goods makes it more of a challenge to save for a down payment in the first place. Oh, and let’s not forget that rents have climbed back to pre-pandemic levels, further hindering the saving-for-down-payment cause.

“A large portion of homebuyers have moved to the sidelines since the cost of borrowing began its rapid increase in March. Everyday expenses have gone up, and compared to periods of pandemic lockdown, Canadians are saving less and spending more money on services today, including travel and entertainment,” said Karen Yolevski, COO, Royal LePage Real Estate Services Ltd.

Of those who have delayed the purchase of a home, 40% say they still plan to buy… just at a later date. Meanwhile, 60% say they have put their home buying plans on hold indefinitely.

“In the most expensive markets in the country -- Toronto and Vancouver and the surrounding areas -- part of the sidelined demand is putting increased pressure on the rental market," says Yolevski. "However, many of those buyers are expected to return to the market once interest rates stabilize and buyer confidence is regained."

In the meantime, a new forecast predicts that Canada's central bank could hike rates to 4.5%.