In news that’s not exactly surprising, a new report from RBC Economics reveals that low-income Canadians will feel the sharpest financial sting from climbing inflation and rate hikes.

While rising prices and borrowing costs will impact all Canadian households, those with lower incomes will be particularly hard-hit -- a burden that will only grow heavier in 2023, write authors Claire Fan, Nathan Janzen, and Naomi Powell.

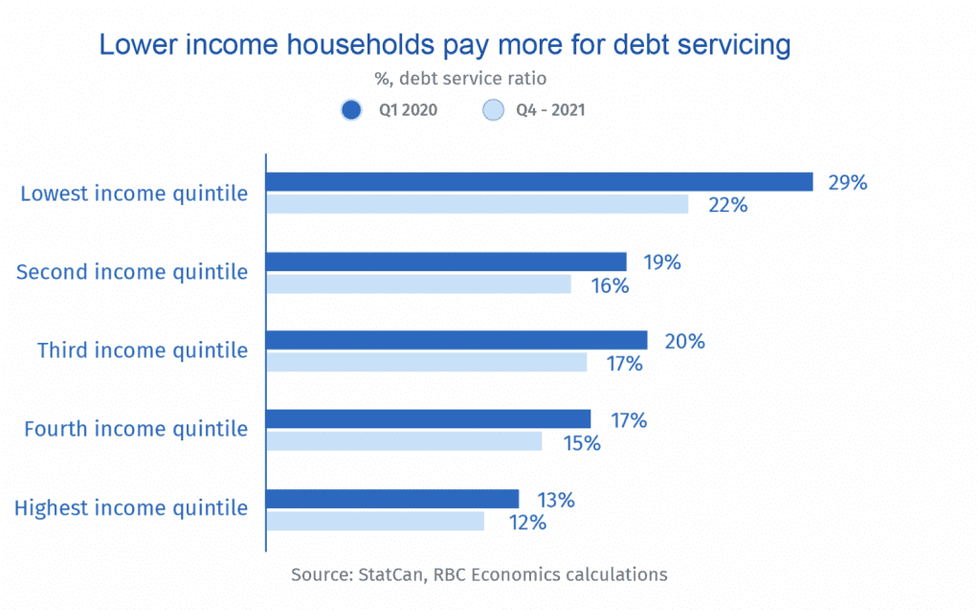

As the report highlights, a return of the overnight rate to 2% -- which is expected by October -- will hike average Canadian household debt payments by nearly $2000, or 15%, next year. This will significantly reduce spending power, especially for the lowest earning fifth of households, who spend 22% of their after-tax income on debt servicing (including mortgage principle and interest payments), says RBC Economics. By contrast, those in the highest income quintile spend just half of that amount.

Lower income Canadians will also see their debt service ratio (the amount of disposable income needed to meet debt payments) increase much faster through 2023 -- at twice the speed of the highest income households.

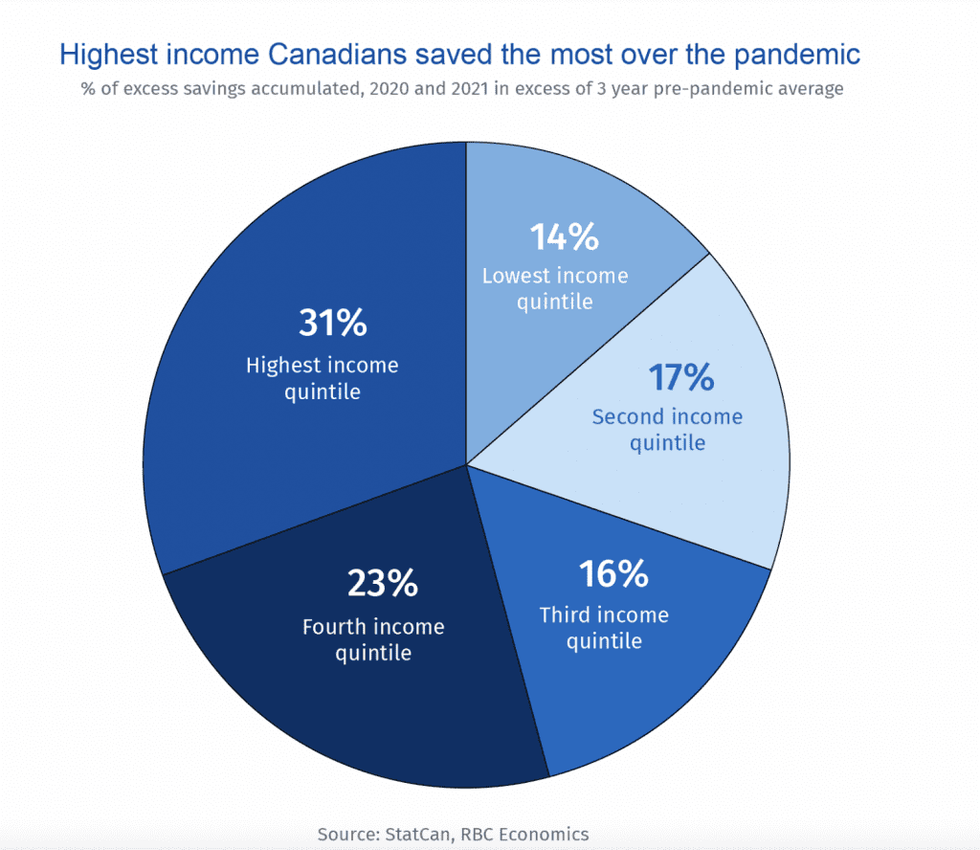

The pandemic may have boosted debt but it also left Canadian households sitting on $300 billion in savings, likely due to an elimination of spending on things like travel, restaurants, gas, and entertainment. That amount is enough to cover about a year and a half of total household debt payments, highlights the report. That is, in theory; those savings are by no means evenly distributed. While the top income households (those earning ~$178,000 a year) retain almost a third of the total, the lowest income Canadians (earning ~$34,000 a year) hold less than a fifth. “For these households, a large portion of excess savings wasn’t socked away, but was used to pay down consumer debt. These households now have a much smaller cushion against rapidly rising borrowing costs,” reads the report.

The pandemic heightened the debt held by Canadians, with mortgage debt exploding, reports RBC Economics. As many Canadians sought more living space in a climate of low borrowing costs, mortgages grew by an average $150 billion per year in 2020 and 2021 -- almost doubling the annual growth rate between 2015 and 2019, according to RBC. By the end of 2021, mortgages accounted for over 70% of all household debt. Meanwhile, the amount of consumer credit (credit cards, personal loans, and lines of credit), declined in 2020.

And rising debt payments aren’t the only things eating into Canadian households’ real income. Everything from gas to groceries now make a bigger dent in the wallet. Canada’s March CPI reading hit 6.7%, with pretty much everything outside of clothing and footwear growing more expensive, more quickly. These price hikes will inevitably cut more deeply into the purchasing power of low-income Canadians, who tend to spend a much larger share of their earnings on consumer purchases, says RBC economists. In the current environment, pre-pandemic 2019 purchases would soak up 10% more of these households’ disposable income, compared to just 3.5% more for the highest income households.

According to RBC economists, tight labour markets will result in climbing wages, which -- together with the savings stockpile -- will sustain consumer spending in the near-term. “But Canadians are already among the most indebted in the world,” reads the report. “And even after accounting for wage growth, an accelerated increase in the overnight rate will push the share of disposable incomes spent on debt back over pre-pandemic levels.”

This increase, combined with soaring prices for basic goods and necessities will make a significant dent in the real earnings of low-income Canadians.

But a more aggressive rate increase -- like a hike above 3% -- would curb the economic growth that’s already being curbed by production capacity limits and ongoing labour shortages, says RBC economists. “The challenge for the Bank of Canada at this point in the economic cycle is to hike interest rates enough to rein in prices, relieving pressure on Canadians, without sparking a downturn,” reads the report. “That will be no easy task.”