The City of Vancouver's permit program is not recovering all of the costs associated with the issuance of permits like it should be, a thorough performance audit conducted by Auditor General Mike Macdonell has found.

The City's collection of permit fees is, in theory, "aiming for cost and revenue neutrality," the Auditor General noted. Not only does this ensure the permit program is self-sufficient, but it also ensures that the fees applicants pay only cover the costs associated with permit issuance, and that there is no excess revenue subsidizing other unrelated services.

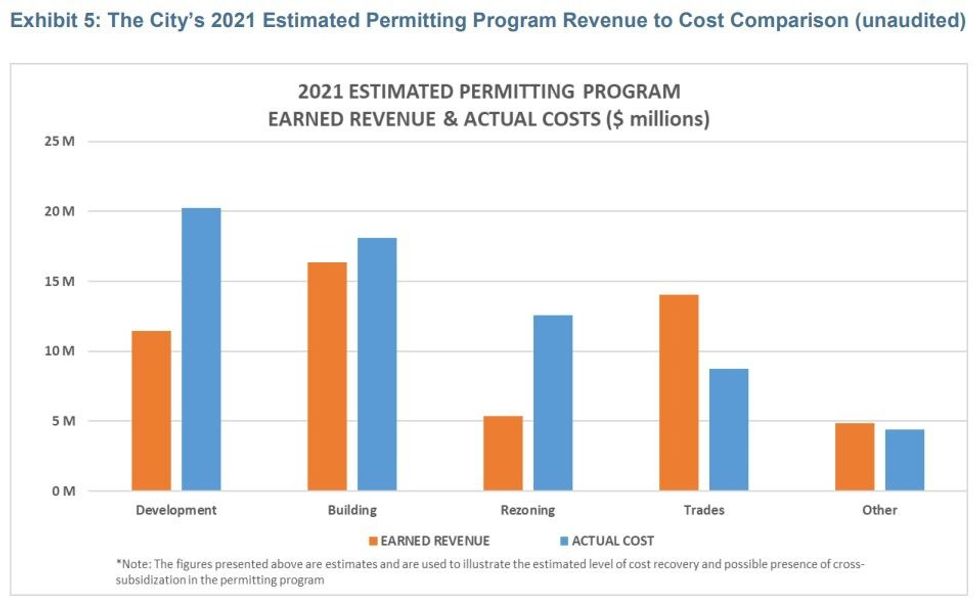

The audit, however, found that from 2016 to 2021, Vancouver experienced an $11.9M program deficit after setting permit fees using a cash-revenue-based cost recovery model with "misaligned cost and revenue components." In 2021 alone, the City received 34,819 permit applications and collected $69.3M, according to data it provided.

For 2022, the City began changing its processes ahead of forthcoming changes in financial reporting standards. The City received 37,224 permit applications in 2022 and collected $72.2M, according to City data, but the audit was unable to determine the level of cost recovery for 2022 because of the changes. It did, however, conclude that "funding from other sources would be required to complete outstanding permit work," and that management requested approval to draw $10M from the Stabilization Reserve.

The Auditor General is making eight recommendations to the City.

The first recommendation is to review and document fees for subdivision permits and rezoning applications against the actual cost of processing those applications, in order to ensure the fees charged do not exceed the average cost of processing similar applications.

Currently, the City groups permits and fees in a way that results in the City being unable to "ascertain the degree to which a particular fee raises excess or insufficient revenue for that service." Additionally, under the Vancouver Charter, subdivision permit fees and rezoning application fees cannot exceed the average cost of processing similar applications. The audit found that the City of Vancouver did not exceed that, but also does not have a process in place to ensure that.

Another recommendation is to improve the accuracy of cost recovery by recording costs based on an earned-revenue basis rather than a cash-revenue basis.

Currently, the City records revenue when permit fees are collected (cash-revenue) rather than when applications are processed (earned revenue), which the Auditor General says makes it difficult to accurately determine the permit program's surplus or deficit, as well as the amount to be transferred to the permitting program reserve.

Yet another recommendation is that the City calculate the annual projected cost of unprocessed permit applications and to compare it to the deferred revenue balance, which would help the City address a surplus or deficit.

As it stands, permit fees collected for unprocessed applications may not correspond to the cost of processing those applications because fees are collected at the time of the application, while costs are incurred afterwards when the application is being processed, during which time the costs can potentially increase, resulting in more costs than revenue collected.

The Auditor General is also recommending that the City develop guidance on target levels of cost recovery for each of the City's permit categories, which would allow for a better assessment of the level of cost recovery and help identify fee adjustments as needed.

"Cross-subsidization occurs when revenue from one permit category supplements the costs of another permit category within the overall permitting program," the audit notes. "Most staff we interviewed from the permitting departments were aware of possible cross-subsidization within the permitting program. However, they were unsure which permit categories subsidized the costs of other permit categories, at what level cross-subsidization existed, and whether it was reasonable."

Remaining recommendations include publicizing additional information about the permit program, such as the net surplus/deficit, and levels and sources of subsidization; breaking down permit program costs by factors such as development type, size, or complexity; and developing cost and revenue projections that extend beyond a single year in order to support long-term self-sufficiency.

Last Thursday, in a response to the audit, the City said that the recommendations provided valuable input towards improving cost recovery and that the City is in support of all eight recommendations. According to an action plan the City provided to the Auditor General, the City is aiming to implement all of the recommendations between Q4 2023 and Q4 2024.

The Auditor General report is set to be presented to the Auditor General Committee for endorsement on Thursday, June 1.

Earlier this year, the Auditor General also published a report targetting the City's building permit fees, which also found several areas for improvement.