While average rents continue to decline across the country, there are now early signs that the rental market is "hitting bottom."

In March, the average asking rent for all Canadian properties listed on Rentals.ca hit $1,685 per month -- down $157 (or 8.5%) from $1,842 in March 2020. This comes after average rents hit a high of $1,954 in August 2019, before showing healthy declines over the years -- now down $269 from this peak, and down $29 month-over-month from February, according to Rentals.ca’s and Bullpen Research & Consulting’s latest National Rent Report.

According to the latest numbers, Vancouver still remains the most expensive city for renters on the hunt for one and two-bedroom homes, with average monthly rents now sitting at $1,932 and $2,598, respectively.

Once again, Toronto finished second with average monthly rent for a one-bedroom home in March at $1,810 and average monthly rent for a two-bedroom home at $2,370.

READ: Average Rent in Toronto for Condos and Apartments Down Nearly 20% Annually

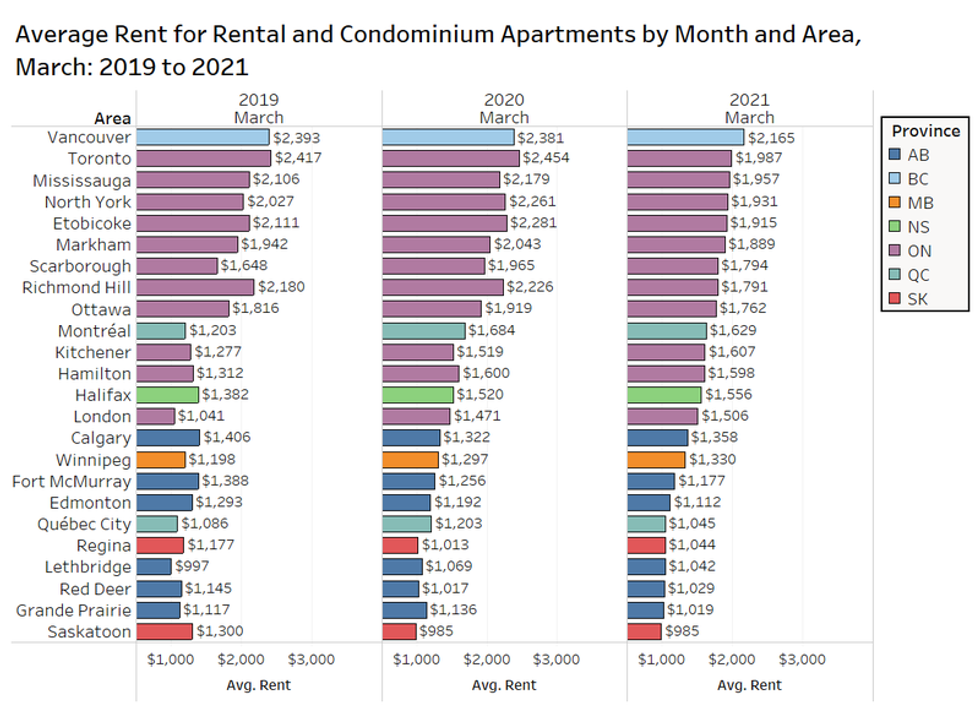

Four of the five largest cities in Canada experienced year-over-year rent declines in average rent for all property types in March, including Toronto with a dramatic decline of 18.7%, the highest of the areas reviewed, followed by Vancouver at 8.8%, Edmonton at 6.6%, and Montreal at 4.4%. Only Calgary saw an increase, and that was a small 1.8% increase.

“Despite the drop in rent on a national level, there are signs the rental market has bottomed out, with monthly rent increases in Vancouver, Toronto and Montreal," says Ben Myers, president of Bullpen Research & Consulting.

The signs of the rental market hitting the bottom are most apparent in major cities like Vancouver, Toronto, and Montreal, where the average rents increased in March over February. Average rents reached $2,165 in Vancouver last month, while Toronto's average rent hit $1,987, followed by $1,629 in Montreal.

The report also revealed that median rent levels by bedroom type show that studios, two-bedroom, three-bedroom, and four-bedroom properties have all increased year-over-year, suggesting that outliers have had a big impact on the averages, and the market might look a little different from what some of the data suggests.

Additionally, as the work-from-home phenomenon continues, renters are looking for larger units for a home office, which has resulted in smaller units being listed on Rentals.ca, pulling the average rent down.

And, finally, the report says there is now anecdotal evidence from leasing agents that suggests that rental demand could be increasing in the downtown areas of Canada’s major cities, as tenants look to get in at the bottom before rents rise in conjunction with the rise in vaccine distribution.

Myers told STOREYS, "the rental market has been experiencing some declines even before the pandemic, and even before right now, as the market is slower during the early months of the year. That being said, it has finally turned up, even if by the smallest amount month-over-month."

Myers said while it's hard to predict if the rental market has hit bottom, with the vaccine rollout underway and with increases happening in the new home market, people are anticipating that within a year they’ll be back to the office.

"They might be thinking to renew their leases now and lock in a rental rate in a rent-controlled building knowing that they won’t be paying much more than what they’d be paying now," explained Myers.

That being said, for the market to hit bottom, it indicates that prices are likely to not increase much more in the coming months, with Meyers hinting that rents could increase by only another 2% this year, as supply continues to be absorbed in the market place quicker than it has before.