The Bank of Canada kickstarted the year with an eighth consecutive interest rate hike, and the effects were plain in the mortgage space. A new report from BMO Economics shows that, aside from the “pandemic blip,” which saw borrowing demand decline due to strong growth in disposable income, mortgage borrowing grew at the slowest pace since 2003 in the first quarter of this year. That drop off in borrowing put mortgage loan growth at a 20-year low.

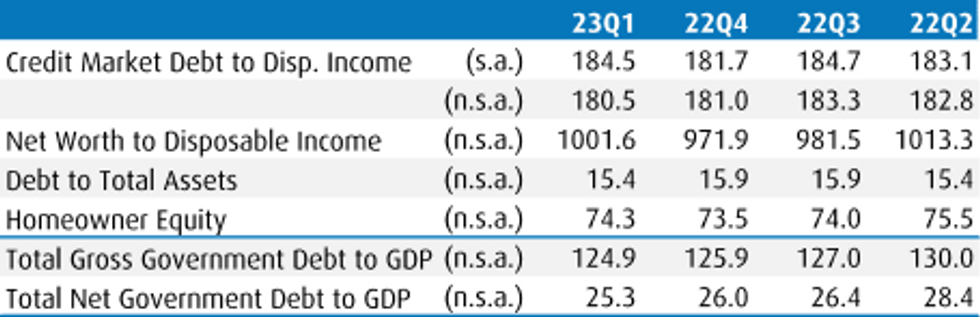

The report, authored by BMO Economist Shelly Kaushik, discusses how elevated interest rates have impacted Canadian households, pointing to the country’s household debt-to-income ratio, which edged up to 184.5% in Q1 from 181.7% the quarter prior on a seasonally-adjusted basis.

Also on an adjusted basis, disposable incomes slipped as government transfers receded and interest costs rose.

“Lower disposable income led to a deterioration in household debt ratios in Q1 despite a slowdown in mortgage demand following the Bank of Canada's aggressive rate hike campaign,” writes Kaushik.

The report additionally draws attention to Canada’s household debt service ratio (classified as interest and principal as a share of disposable income) which grew to 14.9% in the quarter. With that rise, the ratio now sits at its highest level since 2019 and is “just a tick” below the all-time high recorded in 2007.

“The increase was driven by rising debt payments, which are expected to climb further in the coming quarters,” explains Kaushik.

Also reflected in BMO’s report is household net worth, which increased to 1001.6% in Q1 following three straight quarters of decline. This is attributed to rising equities and housing market recovery. On par with the housing market upturn, equity in real estate increased from 73.5% to 74.3%. With support from rising home prices, that figure is poised to grow further in the second quarter.

Kaushik concludes by saying, “Household debt remains a key vulnerability to the Canadian economy, and one that the Bank will watch closely as it determines how much more tightening is required this cycle.”