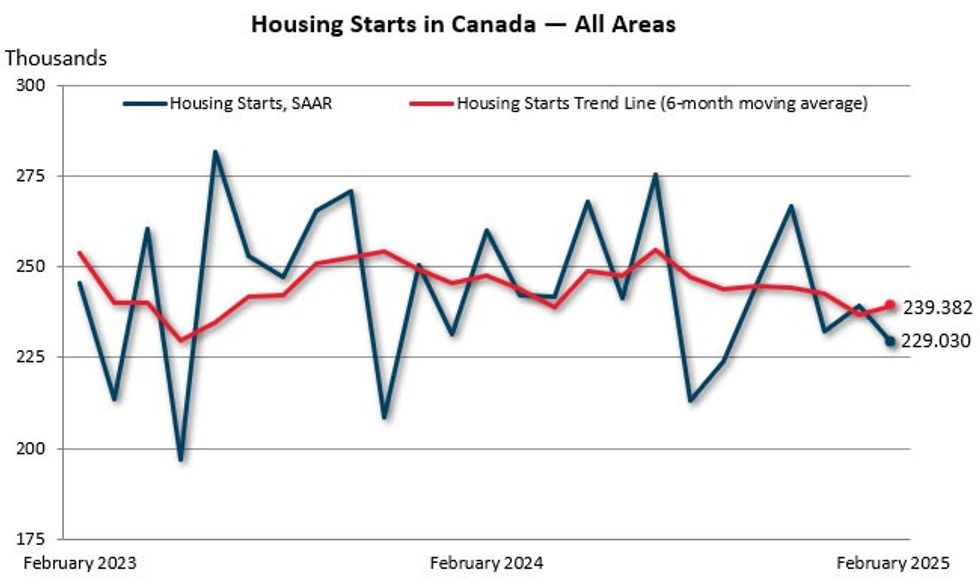

After posting a 3% gain in January, the annual rate of housing starts slipped 4% in February, new data from Canada Mortgage and Housing Corporation (CMHC) shows. The agency reported on Monday that, on a national basis, the seasonally adjusted annual rate (SAAR) of starts came in at 229,030 units last month, down from 239,322 units in January. Meanwhile, the six-month moving average of the SAAR edged up 1.1% in February to 239,382 units.

CMHC also revealed that actual starts in centres with populations of at least 10,000 fell 5% between January and February to 209,784 units, with the bulk of that decline concentrated in the multi-family segment, where starts slipped 6% to 166,508 units. Meanwhile, single-detached starts decreased by 1% to 43,276 units between January and February. Year over year, the actual rate of starts in centres with populations of at least 10,000 fell 17% to 14,459 units.

In an analysis of Monday’s data, TD Economist Rishi Sondhi pointed out that starts “surprised market consensus to the downside in February and have fallen 5% compared to their fourth quarter average so far in Q1.” He added that this “raises the risk” that we will see downward pressure on residential investment and GDP growth by the end of this quarter.

“Housing starts were elevated on a trend basis last month, although are likely to trend lower moving forward reflecting uncertainty, upwardly pressured construction costs, and slower population growth,” Sondhi also said. “We've also received recent indications that home sales are weakening, which would also weigh on homebuilding if sustained.”

In that vein, the Canadian Real Estate Association (CREA) released its latest statistics package on Monday, and that showed sales slumped 10.4% year over year and 9.8% month over month in February, “marking the lowest level for home sales since November 2023, and the largest month-over-month decline in activity since May 2022.” CREA’s data from January also showed transactions down on annual and monthly bases as tariff uncertainty weighed heavily on home-buying sentiment.

Coming back to CMHC’s data, the agency revealed that the actual rate of starts plunged 68% year over year in Toronto and 48% in Vancouver — “both driven lower by decreases in multi-unit and single-detached starts.” In January, those same metrics came in at 41% for Toronto and 37% for Vancouver. As was the case nationally, the latest releases from the Toronto Regional Real Estate Board and Greater Vancouver Realtors have shown softening housing market dynamics, with sales down compared to year- and month-ago levels. In the Greater Toronto Area in particular, sales were down over 27% compared to February 2024, and over 28%, seasonally adjusted, from January 2025.

On the upside, the actual rate of starts rose 6% year over year in Montreal last month, according to CMHC, however, this follows a 112% spike in the metric recorded in January.