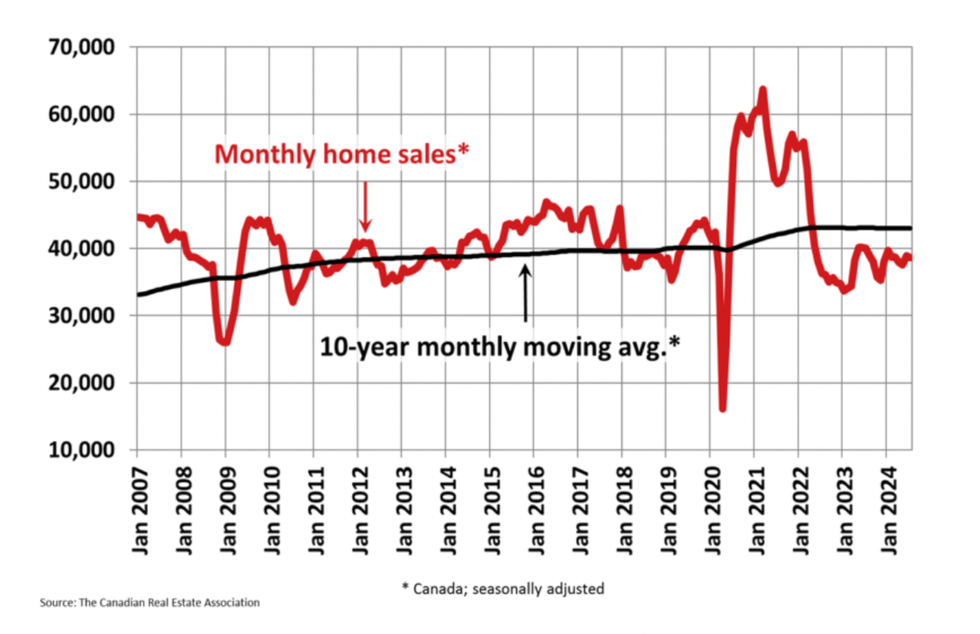

After a somewhat promising June, data from Canadian Real Estate Association's (CREA) July 2024 statistics report reveals housing market activity effectively stalled in July, despite the July 24 interest rate cut.

In June, the "fledgling" market saw slight increases in month-over month sales, tighter year-over-year market conditions, and the national average home price increase for the first time in 11 months. But in July, progress halted, with home sales ticking down 0.7% from June's 3.7% month-over-month increase. According to the report, decreases were minimal in larger centres, and drops in the GTA and Calgary markets were largely offset by increased sales activity in Edmonton and Hamilton-Burlington.

New listings increased by a nominal 0.9%, largely due to the delivery of "much-needed" housing supply in Calgary, landing us at 183,450 active listings recorded at the end of July, continuing an upwards trend in listings. This represents a significant 22.7% year-over-year increase, though still 10% below historical averages of more than 200,000 for this time of the year.

With sales dipping and listings inching up, the national sales-to-new listings ratio slipped back down to 52.7% compared to 53.5% in June — well within the 45% and 65% range generally consistent with balanced housing market conditions. And in July, national months of inventory remained at the 4.2 average we saw in June, slightly below the long-term average of 5 months.

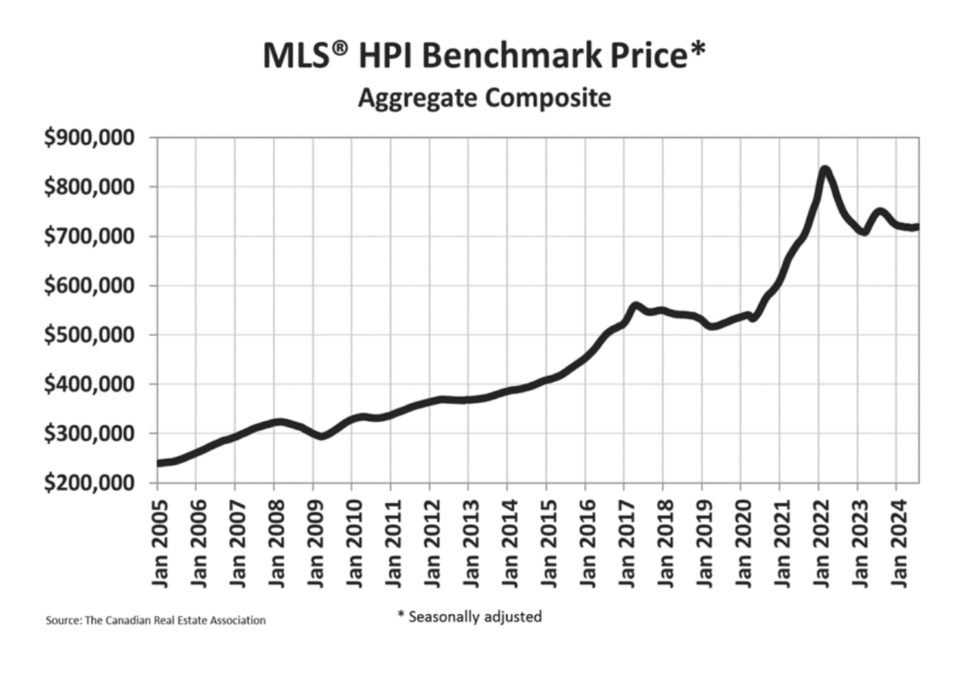

Meanwhile, the National Composite MLS® Home Price Index (HPI) saw an increase in July, albeit by a meagre 0.2%, which, if you can believe it, is the largest gain in the last year, according to the report. Numbers show that the majority of markets are actually on the ups, but the national average price was stunted by declines in the "largest and most expensive" British Columbia and Ontario markets. The actual average (not seasonally adjusted) price was $667,317 — almost unchanged (-0.2%) from July 2023.

Despite a languid July, Shaun Cathcart, CREA’s Senior Economist, is enthusiastically optimistic about what the coming months will bring.

"With another rate cut announced on July 24, we’ve now seen two rate cuts in a row, and the expected pace of future policy easing has steepened considerably, with markets now anticipating rate cuts at every remaining Bank of Canada decision this year,” he said in the report. “Combine that with a record amount of demand waiting in the wings, and the forecast for a rekindling of Canadian housing activity going into 2025 has just gone from a layup to a slam dunk.”

In that vein, Cathcart points to August as the time to truly see the impact of July's interest rate cut, which could set the tone heading toward 2025.

“I think the main reason for the pause in July is that we didn’t get that 2nd interest rate cut until the end of the month. I think we can expect further increases in activity following each additional rate cut, but as for this most recent rate cut, the earliest you’re likely to see that show up in the resale housing date is August.”