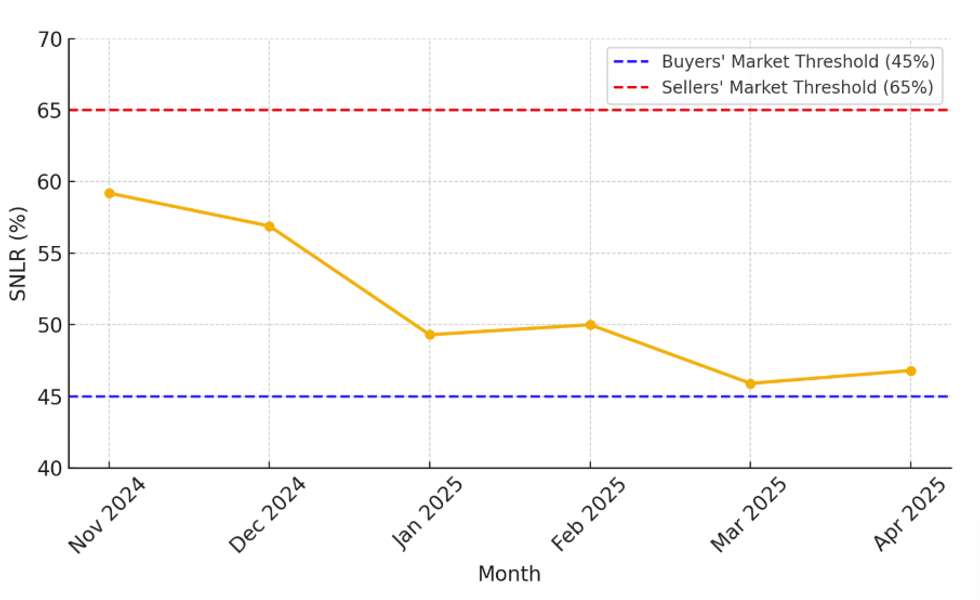

Since November 2024, the national sales-to-new-listings ratio (SNLR) has been on a persistent tumble, making its way towards what would be considered buyers’ territory. According to the Canadian Real Estate Association (CREA), a ratio below 45% points to buyers’ territory, and so far this year, the metric has come in at 49.3% in January, 49.9% in February, 45.9% in March, and 46.8% in April. Last month’s slight rally is attributed to the fact that new supply edged down slightly (by 1.2%) on a monthly basis to 94,234 listings, while sales, at 44,300 units, saw little change.

CREA’s Senior Economist Shaun Cathcart explains that the SNLR tells us “what direction the market is moving”, but it’s not necessarily an indication of the reality right now.

“So for example, when something like the Trump tariffs were announced, you could have a sales-to-new-listings ratio that quickly moves to one standard deviation below average,” he says, “but it would have to remain there for many months in order to pull the number of months of inventory up to what would be considered a full-on buyers’ market, as every month that sales and new listings are out of balance only causes a little bit more of a build-up in overall inventories.”

As far as months of inventory go, there were 5.1 months at the end of both March and April, with CREA considering anything over 6.4 months to be a buyers’ market.

Some Markets Still Favouring Sellers

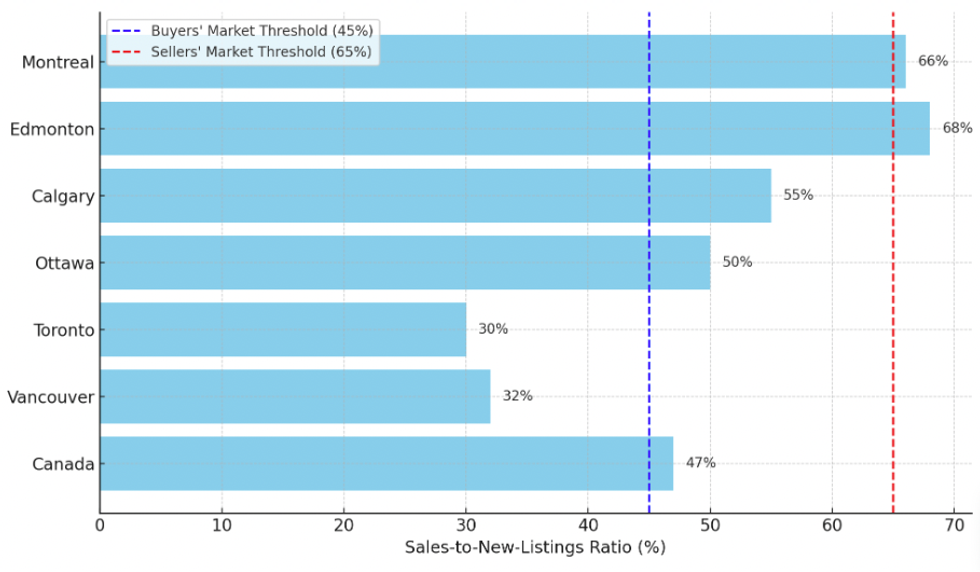

As Cathcart suggests, SNLR needs to be taken with a grain of salt — not only because it’s not an entirely concrete indicator of whether a market is favouring buyers and sellers, but also because there’s plenty of nuance when looking at what’s going on in individual markets.

For example, according to the April stats from the Quebec Professional Association of Real Estate Brokers (QPAREB), there were 5,126 sales recorded in Montreal and 7,721 new listings, putting the SNLR at around 66%. According to the Realtors Association of Edmonton, there were 2,710 sales and 4,012 new listings, putting the SNLR at around 68%. By CREA’s definition, a ratio above 65% suggests the market is more in favour of sellers. Meanwhile, there were 2,236 sales and 4,038 new listings in Calgary, (according to the Calgary Real Estate Board), and 1,306 sales and 2,589 new listings in Ottawa, (according to the Ottawa Real Estate Board), putting the SNLRs at around 55% and 50%, respectively — in both cases, indicating the markets are in a place of balance.

“It's really our two most expensive metropolitan areas, Toronto and Vancouver, that are having the crisis of confidence since the start of the trade war with the Trump administration,” says President and CEO of Royal LePage Phil Soper. To his point, there were 5,601 sales and 18,836 new listings reported last month by the Toronto Regional Real Estate Board, putting the SNLR at around 30%. And across Greater Vancouver, the local real estate board reported 2,163 sales and 6,850 new listings, putting the SNLR at around 32%.

“So, nationally, the market is turning to a buyers’ market with sharply lower transactions and higher supply, but the size of the Toronto market in particular is skewing the national numbers,” says Soper. “And while the whole market in Toronto was slower in March and April, it’s also the condominium sector in particular that’s skewing the statistics, and painting a picture that... looks worse than it is, simply because of the weight of the condominium market, just how slow it is and how large the supply is right now.”

Buyers’ Markets Don't (Always) Equal Affordability

In a market like Toronto, where the SNLR is well below 45%, conditions are more buyer-favourable than they’ve been in decades. In fact, Desjardins Economist Kari Norman pointed out in a recent report that, as of April, Toronto is in the “deepest buyers’ market territory since 1991,” which is when Canada entered into a two-year recessionary period — one of the longest ones in Canadian history — with home sales falling a staggering 45% between 1988 and 1990.

“Now, we have a deep buyers’ market in Toronto and to a lesser extent in Vancouver. New listings are outpacing sales, giving prospective buyers plenty of choice. And in some cases, homes are sold below the asking price,” she adds. But even with that being the case, Norman underscores that buyers’ market conditions and affordability do not go hand-in-hand — in today's circumstance especially.

“Even though in parts of the country home prices have fallen from their recent peaks, they’re still elevated. And mortgage rates have come down, but they’re still higher than they were in the early pandemic years,” she says. “Putting it all together, affordability has improved slightly over the past year or so, but nowhere near where it was even pre-COVID.”