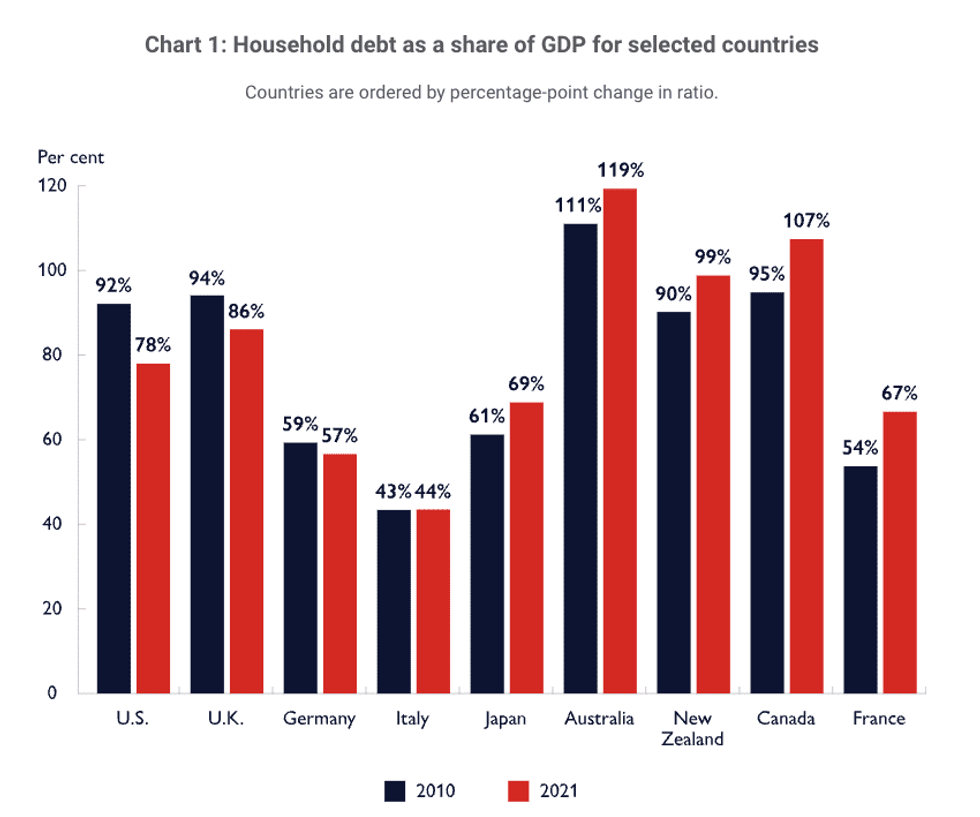

Canada is drowning in more debt than any other G7 country, with the escalated cost of mortgage borrowing to blame for three-quarters of the country’s total household debt burden.

Canada Mortgage and Housing Corporation (CMHC) reported on Tuesday that the country's very high levels of household debt -- which has edged past its GDP -- “makes the economy vulnerable to any global economic crisis.”

Unsurprisingly, the elevated interest rate environment is to blame.

“Over time, these higher interest rates translate into higher mortgage payments for households when those on fixed five-year terms renew at higher rates," writes CMHC Deputy Chief Economist Aled ab Iorwerth. "Those facing the most challenges are those with variable rate mortgages who see higher interest rates immediately."

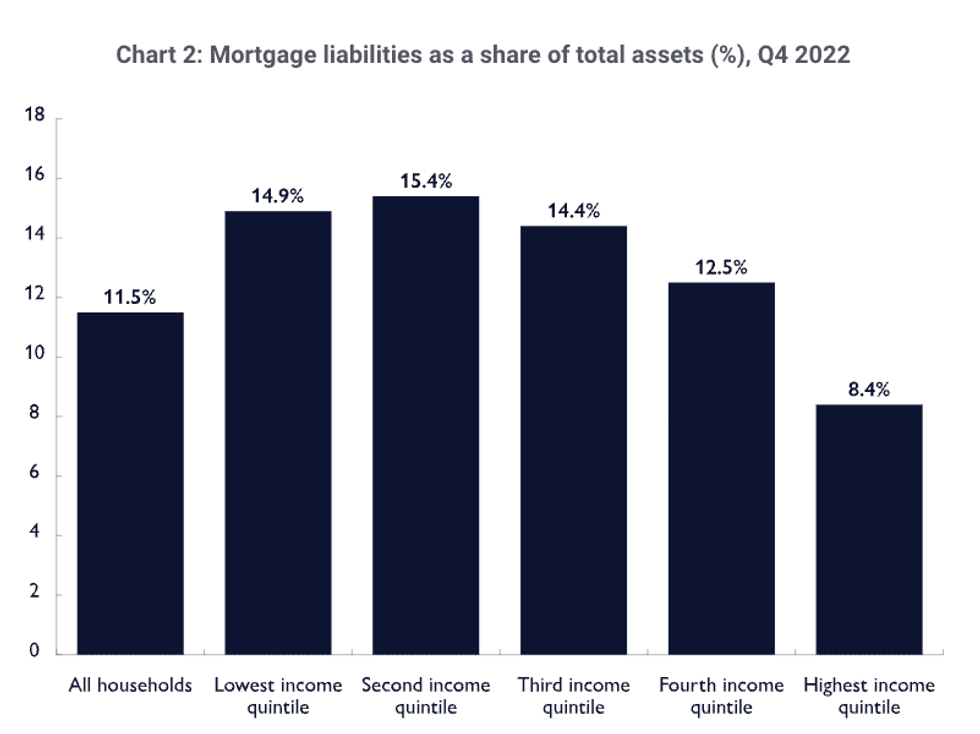

The report also draws attention to “distributional concerns” -- more specifically with respect to lower-income households, which tend to be more highly indebted and "disproportionately" implicated by economic downturns and rising housing costs.

Mitigating Canada’s debt pressures will hinge on restoring housing affordability, says CMHC, which is certainly no simple feat.

“Reestablishing affordability means less debt will need to be taken on by first-time homebuyers,” continues ab Iorwerth. “By lowering the share of income spent on housing and creating more options, increased housing supply is key in this respect. Renewing and rebuilding Canada’s rental stock to be modern and attractive will help prevent Canadians from being compelled to be homeowners.”

CMHC’s latest report comes on the heels of the agency's latest housing market outlook, released in late April, which revealed insights to a similarly bleak tune. In addition to slashing any hope that Canadian home prices will revert to pre-pandemic levels, the agency forecasted a drop-off in housing starts through 2025, citing labour shortages and elevated material and project financing costs.

That said, CMHC Chief Economist Bob Dugan alluded to a light at the end of the tunnel in that same report, saying that once inflation returns to the Bank of Canada's 2% target, mortgage rates will gradually decline, “supporting both housing demand and a recovery in the construction of new housing supply.”