Today’s homebuyers can’t get a break -- and the reminders of this stark reality are abundant.

While Canada's home prices have softened throughout the year after a red-hot and record-breaking run that began not long after the onset of the pandemic, the country remains in a concerning housing affordability crisis. Would-be homebuyers are forced to remain renters in a climate of climbing rents and sky-high living costs.

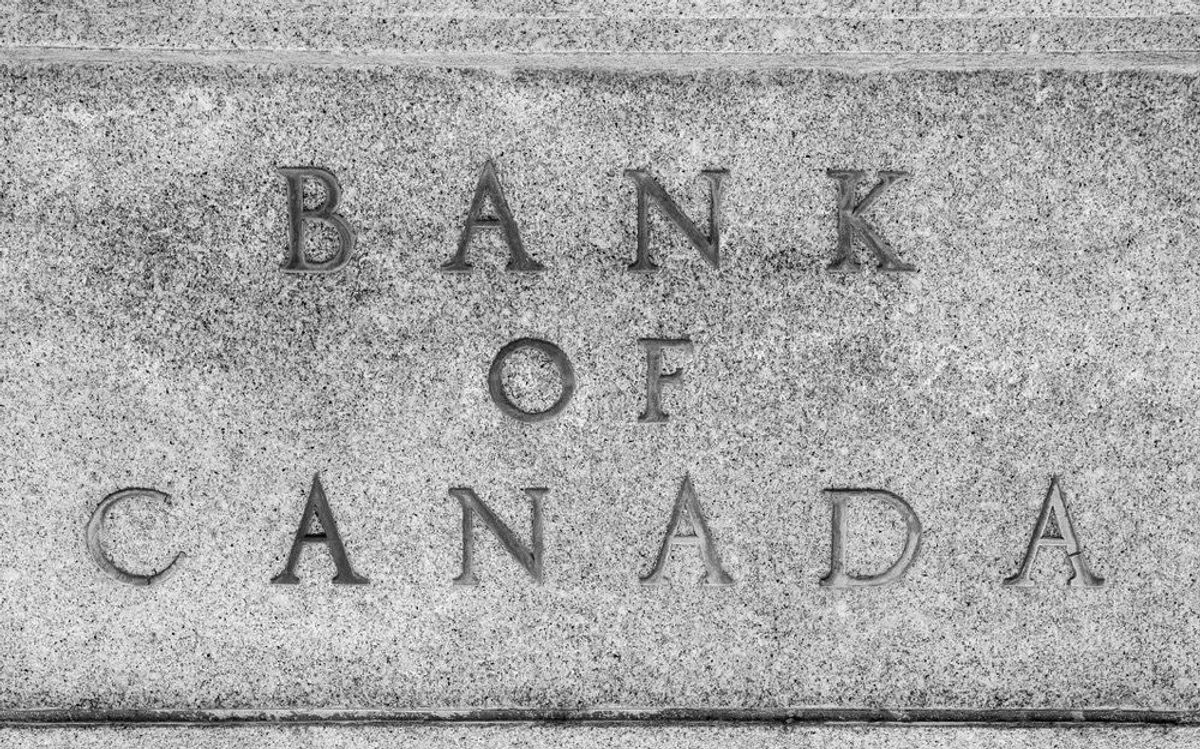

Rapidly rising interest rates are to blame for the widespread unattainability of Canada's housing market.

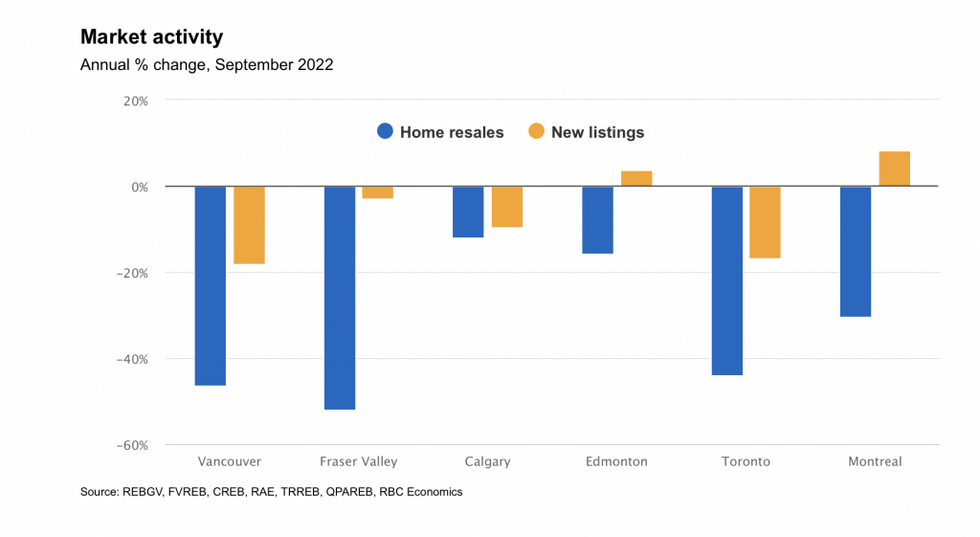

In a new report, RBC’s deputy chief economist Robert Hogue says that homebuyers are “on the defensive.” He highlights how Canada’s housing markets ended the summer on a soft note, followed by price drops in September -- something he says was no surprise.

“Buyers are in an exceptionally tight squeeze, facing the worst affordability conditions ever in large parts of the country,” writes Hogue. “They’re clearly on the defensive at this stage. Activity is particularly soft -- far below pre-pandemic levels -- in Vancouver, Toronto, and other markets (including the Fraser Valley and Victoria) where affordability pressures are most intense. The negative impact of higher interest rates on prices is still running its course, depressing the values of (higher-priced) single-detached first and foremost.”

And prospective homebuyers likely won’t see any cooling on the interest rate front any time in the near future, either. With the expectation that the Bank of Canada will raise its policy rates by another 75 basis points – to a tough-to-swallow 4% -- by the end of the year, Hogue says that “the bottom is still some ways away.” Sigh.

On a more positive note, Hogue says there are “pockets of strength out there.” To illustrate his point, he highlights Calgary. “A much improved provincial economy and rebounding in-migration no doubt help keep activity humming at this juncture,” writes Hogue. “But the lesser sensitivity to interest rates of relatively affordable markets -- like Calgary -- plays a big role too. We believe this factor will in fact contain the price correction in the Prairies, and parts of Quebec and Atlantic Canada.”

Hogue highlights the “quiet” end of summer experienced in the Toronto housing market. “Price trends vary across the Greater Toronto Area (GTA) but the stillness in activity is widespread,” he writes. He points to how home resales remained soft in both the 416 and 905 regions last month, down 49% and 42% year over year, respectively. When viewed by housing type, single-detached homes fell 40% YoY and condos fell 50% YoY.

Overall activity reversed a monthly gain in August in the GTA, declining 11% month over month on a seasonally-adjusted basis to its lowest level since early-2009 (excluding the spring 2020 lockdown), highlights Hogue. Hogue says that the market downturn is affecting property values differently by housing type and location.

“Single-detached (benchmark) prices are now below year-ago levels -- or will soon be -- in many areas, including Halton and Durham regions, the City of Toronto, and Dufferin and Simcoe counties,” writes Hogue. “Condo prices, however, are holding up better -- still up 13-18% from year ago for the most part. Demand for more affordable options like condos remains relatively strong. The very tight rental market also sustains keen investor interest in these units. We expect diverging trends to persist in the near term.”

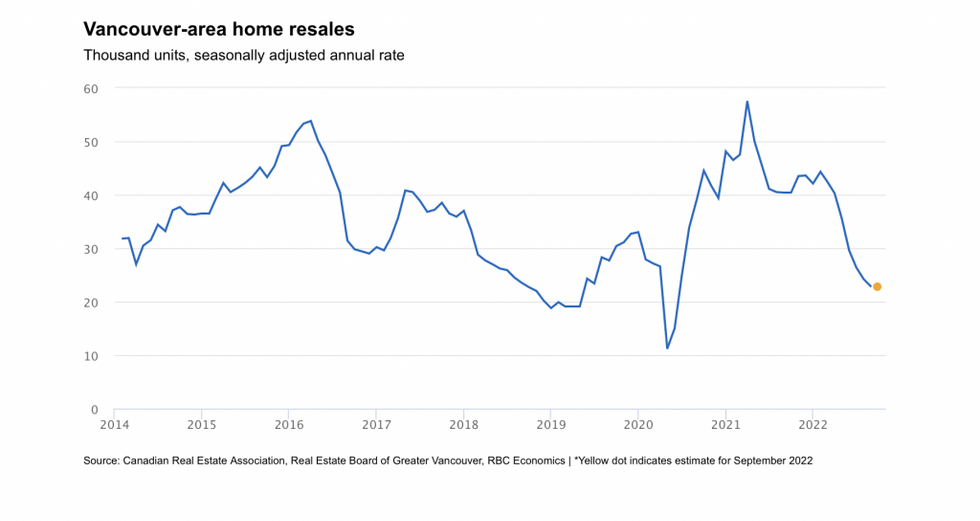

Meanwhile, in the equally as pricey Vancouver region, Hogue says that the market slide is moderating. Hogue estimates that seasonally-adjusted resales fell slightly, by less than 1% MoM in September, following drops averaging 7% in the previous two months and 13% between April and June.

“Vancouver buyers remain under tremendous pressure at this point,” writes Hogue. “Higher interest rates hits them especially hard given the (still) sky-high property values they face in the area. The softening in prices in time will help but so far it’s done little to ease severe affordability issues.”

Hogue highlights how the composite MLS HPI has declined for five straight months in Vancouver, down a cumulative 8.7% (or $109,000, not seasonally adjusted). He calls this a widespread trend within the region, with local areas recording declines ranging between 3% and 17%. According to Hogue, pressure is most intense for single-family homes (off 9.2% since peak) but condos aren’t immune to the general softening in this market, either (off 6.2%).

“We expect excessively poor affordability and the prospects for higher interest rates to keep buyers on the defensive and drive prices lower still in the period ahead,” writes Hogue.