"Sales gains are now three for three in the months following interest rate cuts, which is a trend even though the increases weren’t headline-grabbing,” said Shaun Cathcart, CREA’s Senior Economist in the Canadian Real Estate Association's (CREA) September statistics report.

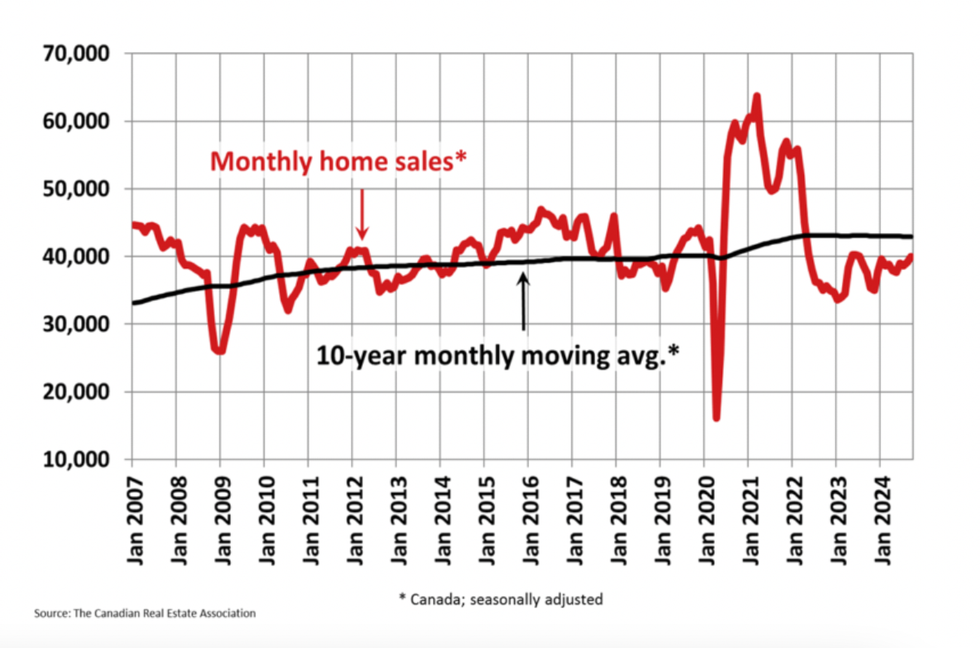

The report shows that home sales increased 1.9% on a month-over-month basis in September, reaching the highest level since July 2023. The growth, though nominal, is preceded by a 1.3% increase in August, a slight 0.7% decline in July, and a 3.7% jump in June.

But Cathcart keeps things real. "With the pace of rate cuts now expected to be much faster than previously thought, it’s possible some buyers may choose to hold off on a purchase for now," he said. "This could further boost the rebound expected in 2025 at the expense of the last few months of this year."

So, the market is arguably still in the grips of that "holding pattern" described by Cathcart last month, but the payoff come 2025 will make it all worth it, is CREA's sentiment. In fact, in a separate report issued Tuesday, CREA forecasted that national home sales will climb 6.6% in 2025 — as opposed to their July prediction of a 6.2% increase. The revised prediction comes in response to the Bank of Canada's shift towards a more condensed rate cut timeline that will see the return to "a 'neutral' rate by sometime next spring or summer, as opposed to the multi-year path anticipated back in July," explains the report.

On the listings front, we saw a 4.9% growth in new listings in September as sellers listed their properties in "larger than normal numbers for the first weeks of the month," according to the report. By the end of the month, total active listings hit 185,427 properties, up 16.8% from a year earlier but still below historical averages of around 200,000 listings for that time of the year.

With listings outstripping sales once again in September, the national sales-to-new listings ratio eased to 51.3%, down from 52.8% in August. The average months of inventory now sits at 4.1 months, slightly down from August's 4.2 months.

“The beginning of September saw a burst of new supply for buyers to choose from before things generally quiet down for the winter,” said James Mabey, CREA Chair. “While some buyers may choose to take advantage, others may be inclined to wait as the bulk of future rate cuts from the Bank of Canada are now expected to show up in a matter of months as opposed to years."

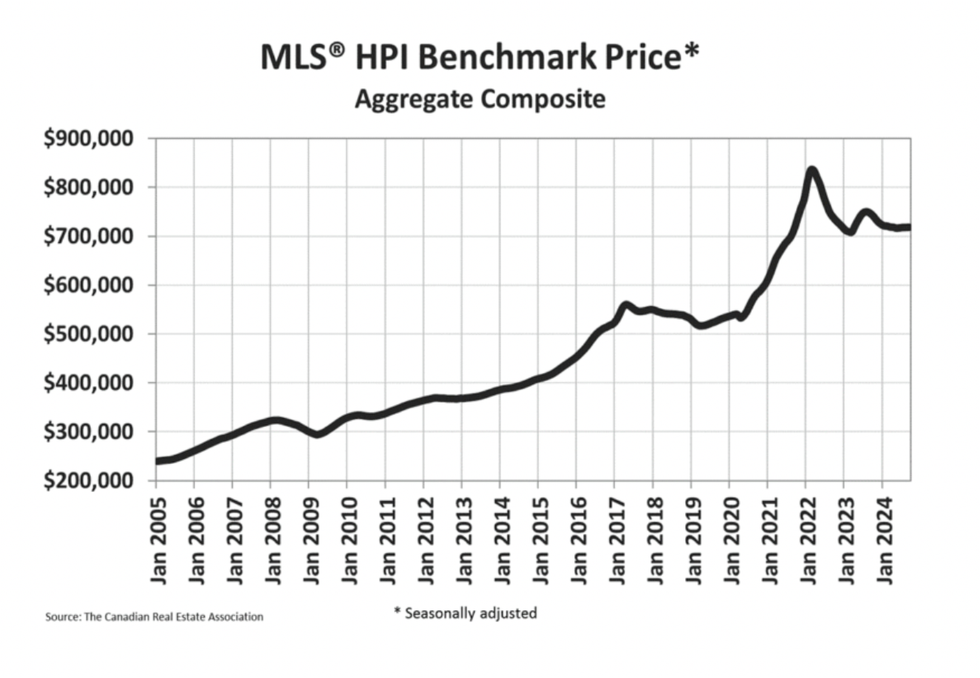

Along with sales, prices also inched up in September, putting the actual (not seasonally adjusted) national average home price at $669,630, up 2.1% from September 2023. The National Composite MLS® Home Price Index (HPI) inched up 0.1% from August to September, "however, small ups and downs aside, the bigger picture is that prices at the national level have remained mostly flat since the beginning of the year," said the report.

- Is This (Finally) The Bottom? ›

- CREA Predicts 2025 Will Be A "Slam Dunk" For Home Sales, Despite Slow July ›

- Canadian Housing Market Stuck In "Holding Pattern": CREA ›

- How Key Are Rate Cuts To Restoring Housing Affordability? ›

- CREA Members Vote To Shift REALTOR.ca To For-Profit ›

- Canadian Home Sales Reach Highest Levels Since April 2022 ›