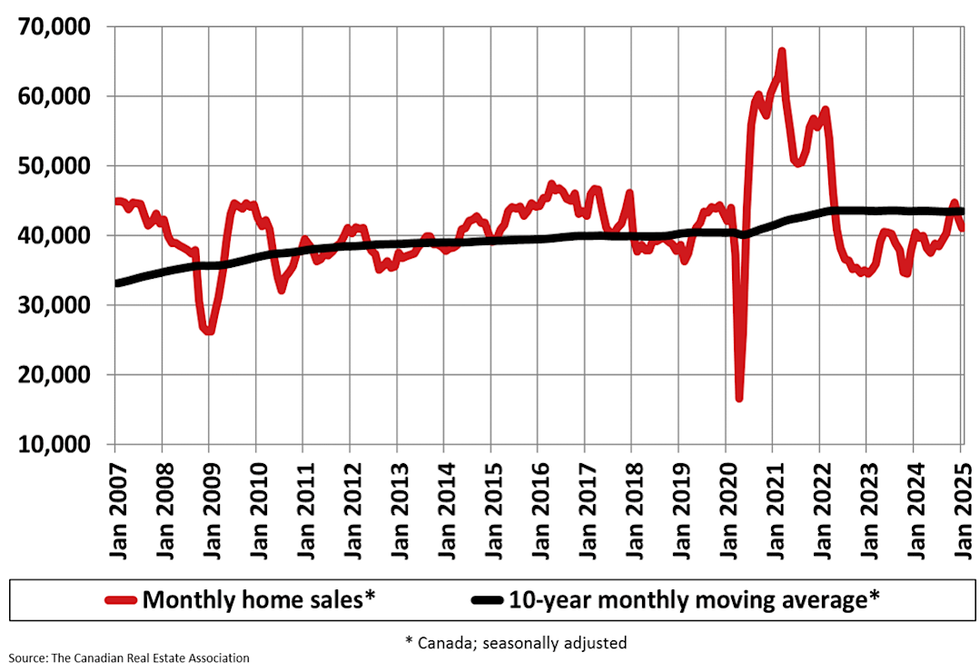

After dipping in December, Canadian home sales continued to underperform in January. Meanwhile, listings unexpectedly jumped 11% — the biggest monthly increase since the late 1980s, outside of the pandemic.

According to the Canadian Real Estate Association's (CREA) January stats package, home sales were up 2.9% annually but fell 3.3% month over month, with the largest drop recorded in the last week of January. To CREA Senior Economist Shaun Cathcart, the timing of the dip points to tariff fears.

“The timing of that change in demand leaves little doubt as to the cause — uncertainty around tariffs," he says. "Together with higher supply, this means markets that had been steadily tightening up since last fall are now suddenly in a softer pricing situation again, particularly in British Columbia and Ontario.”

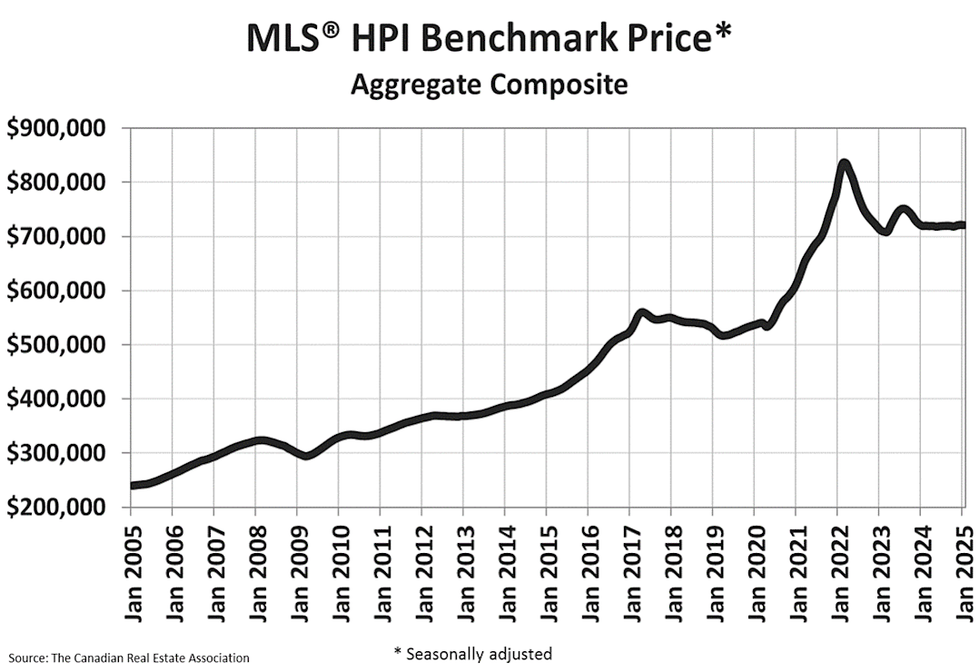

In fact, the softer pricing in BC and Ontario left the Home Price Index (HPI) little changed between December and January, with the metric posting a negligible 0.08% decrease despite rising prices in the Prairies, Quebec, and across the East Coast, according to CREA.

As of January, the non-seasonally adjusted national average home price was $670,064, up 1.1% from January 2024 but down from $676,640 in December.

On the listings front, the unusual 11% jump brought the total listings up to 136,000 from 128,000 in December, though this still lands us below November's 160,000 listings, which also happens to be the long-term average for January.

Cathcart tells STOREYS that though a jump in listings isn't uncommon at the beginning of the year, an 11% increase is "definitely larger than normal." He says the increase could be attributed to a number of factors, including lower interest rates, new mortgage rules that came into effect in mid-December that make selling higher-priced homes easier, and COVID-era buyers looking to sell and downsize to avoid mortgage payment increases when mortgage renewals start this summer at higher rates.

With sales down and listings up, the national sales-to-new listings ratio fell to 49.3%, down from 56.9% in December and below the long-term average and ideal balanced market ratio of 55%.

There are now 4.5 months of inventory on the market, up from readings in the high threes in October, November, and December, CREA says, keeping us within a balanced territory where below 3.6 months would be a seller's market and above 6.5 months would be a buyer's market.

January has shown that as the Canadian housing market continues to grapple with economic and political uncertainties, there will be both upsides and downsides.

“While we continue to anticipate a more active spring for the housing sector, the threat of a trade war with our largest trading partner is a major dark cloud on the horizon,” says CREA Chair James Mabey in a press release. “While uncertainty about the economy and jobs will no doubt keep some prospective buyers on the sidelines, a softer pricing environment alongside lower interest rates will be an opportunity for others."

- Canadian Home Sales Reach Highest Level Since April 2022 ›

- "A Return To Stability": Royal LePage Releases 2025 Home Price Forecast ›

- Canadian Home Sales Dip In December, Expected To Surge In Spring ›

- GTA Home Sales Slump 27% Amid Trade Fears, Mortgage Rates ›

- Tariff Fears Drive "Sharp" Decline In Canadian Home Sales ›