One of the many subplots of the ongoing trade war with the United States is that it has raised the value of the Canadian dollar, somewhat covering up the fact that the CAD has been on years-long slide.

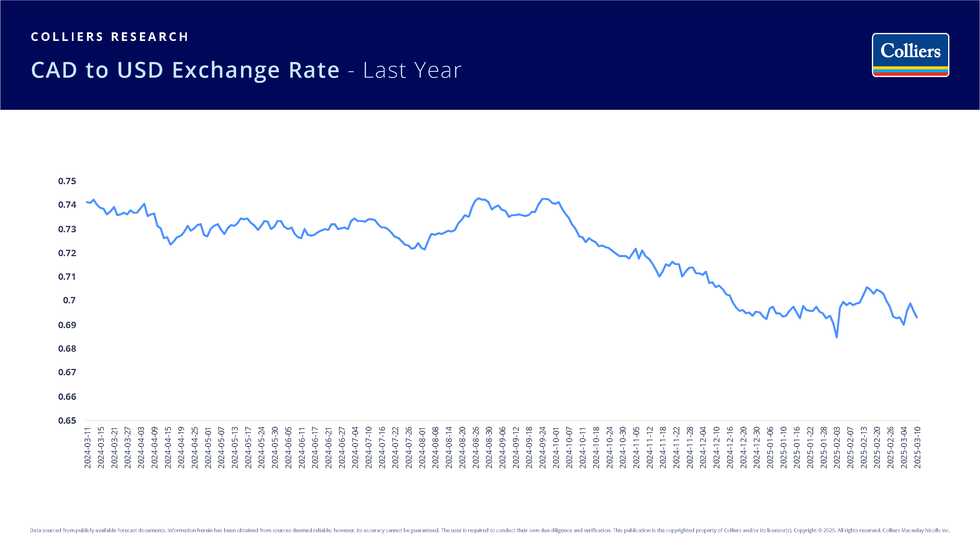

In March 2024, the CAD to USD exchange rate was at about $0.74 and then stayed above $0.70 — with fluctuations — before dipping to a 22-year low of $0.68 on January 31, the day before 25% tariffs levied by US President Donald Trump on nearly all goods from Canada and Mexico were set to come into effect.

"I think everybody knows that the CAD has been coming off quite a bit in the last year, but that's within the context of a longer run, said CoStar Group Chief Economist & Head of Market Analytics Carl Gomez in an interview with STOREYS this week. "The depreciation has been happening since the pandemic. Even going back before that, since the ['08-'09] financial crisis and the oil implosion in 2015, the CAD has really come off."

In a vacuum, however, a weakend Canadian dollar may not be a bad thing, at least for commercial real estate.

"We are one of those weird industries where up is down, black is white, and sometimes bad news is good news for us," says Colliers National Head of Research Adam Jacobs. "It's a negative in the sense that it could cause more inflation if you're sourcing materials outside Canada, but it could also be a positive because it does put Canada somewhat 'on sale,' you could say, for an investor who's coming from Japan, who's coming from Germany, who's coming from England."

Jacobs says that Canada has not historically been a huge target market for global investors when it comes to real estate investment, but both he and Gomez believe the weakened CAD creates an opportunity where Asian or European investors, for example, can get into Canada and acquire a quality asset at a lower cost.

"There's also direct impacts on how businesses make locational decisions," said Gomez. "Basically, the cost of doing business in Canada becomes cheaper for American companies when the CAD goes down. That could make them want to locate here, whether as an office tenant expanding into Canada or an industrial tenant who operates in goods distribution."

The weakened Canadian dollar is just one of many factors that affect the investment environment in Canada, however. Although Canada has generally discouraged foreign investment through federal policies and taxation, there are other tailwinds that are having a positive impact.

"Currency is only one factor," said Jacobs. "There's other tailwinds at the same time. Not only has the currency come down, inflation has come down, interest rates have come down. It looks like they're probably going to cut rates again next week. The investment environment, generally, I would say is certainly better than it was a year or two ago and the currency is kind of just one more thing to get people off the sidelines."

More recently, however, the Canadian dollar has increased back up over the $0.70 mark, although things can change dramatically from day to day, as we've seen over the past week.

"That's generally the gist of why I think central banks and policymakers don't necessarily have a big problem with the CAD going down in this environment," said Gomez. "It gives a break to exporters, it gives a bit of a safety cushion that way to make Canada more appealing, but at the same time, it's not necessarily the right solution over the long term."

"The CAD is a very big part of how monetary policy is crafted in Canada," he adds. "If the CAD is left to slide on its own devices, one [thing] that would happen is it would limit the amount of room the Bank of Canada has to cut interest rates. Within all of that noise, we all want lower interest rates because it lowers the cost of capital, but with the CAD sliding, there's only so far you can go. It brings benefits, but over the long haul, it's not the right way to get those benefits."

In an insight article last month that factored in a "moderate and targeted tariff scenario," RBC said that it was forecasting three more rate cuts from the Bank of Canada and no rate cuts by the American Fed, which would further widen the gap between the two economies and slow the recovery of the CAD.

"We do see a little bit more Canadian dollar weakness going through to the middle of the year, and that's predicated by a continuation of this widening in interest rate differentials," said RBC Capital Markets Managing Director of Fixed Income, Currencies & Commodities George Davis. "We think that's going to have a negative impact on currency through the middle of the year, but we think it could turn a little more positive in the second half."

In other words, the weakening Canadian dollar creates a window of opportunity and that window has cracked open.