Amid global economic uncertainty and lingering fears of recession, Canadians are -- unsurprisingly -- reporting low hopes about the economy.

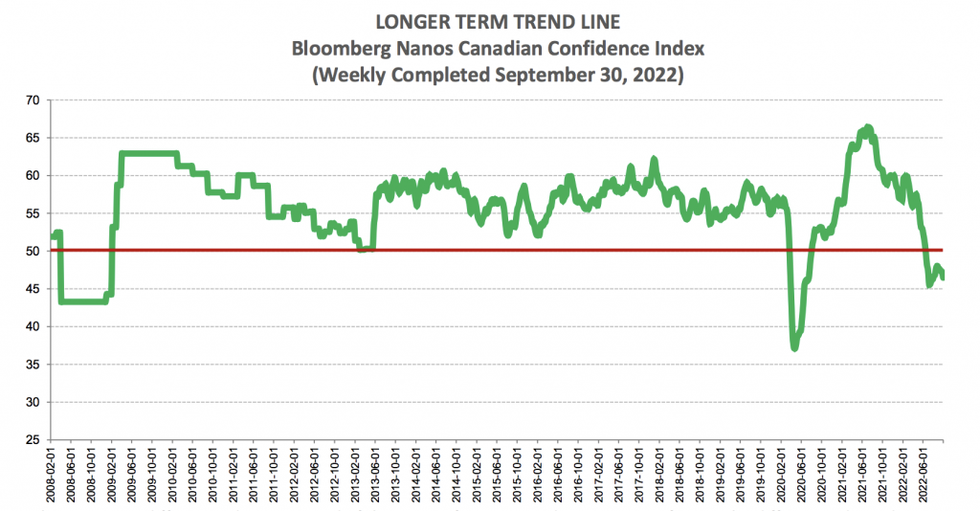

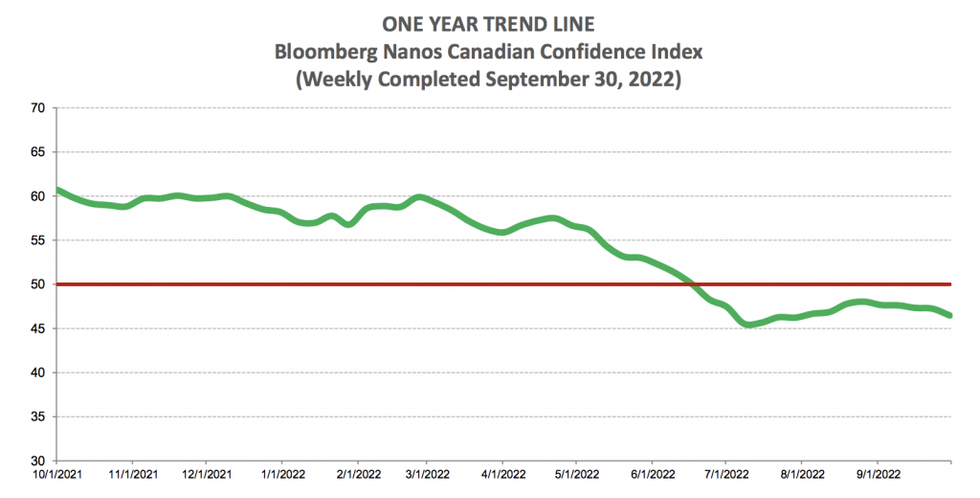

This is according to the latest data from the Bloomberg Nanos Canadian Confidence Index (BNCCI), which showed that Canadian consumer confidence has been sinking for five consecutive weeks, following a mini-rebound in August. In fact, consumer confidence is lower than it has been outside of a low point during the height of the pandemic and the last two economic crises in 2008 and 2009.

The BNCCI fell to 46.47 last week -- its lowest level since July 2022, and substantially lower than the 12-month high (60.70) and this year’s average (52.69). Since 2008, the average BNCCI has been 56.30, which includes a low of 37.08 in April 2020 and a high of 66.42 in July 2021. The BNCCI has rarely dropped below 50 in the past decade.

“Canadians have rarely been so pessimistic about the economy since the index was launched in 2008,” says Bloomberg. “Half of Canadians expect the economy will weaken over the next few months, with only 14% anticipating a stronger economy.”

A “sharply deteriorating outlook for the nation’s housing market” is one of the major drivers of consumer pessimism. According to Nanos-Bloomberg’s polling, 37% of consumers are expecting home prices to decline in the next six months, while 26% are anticipating an increase. The 11-point differential is the largest it has historically been with the exception of the early weeks of the pandemic and global financial crises.

The sentiments reflected in last week’s BNCCI measure suggest that Canadian households are feeling the heat of rising consumer prices, higher borrowing costs, housing correction, and plunging stock markets, and taking talk of recession to heart.

“The souring mood casts doubt on whether Canadian consumer spending can continue to drive the nation’s economic expansion,” says Bloomberg.

The BNCCI is a joint endeavour by Bloomberg and Nanos Research, and a reflection on how Canadian consumers are feeling about personal finances, job security, the economy, and real estate prices. 250 consumers are polled on a weekly basis.