Canada’s third quarter office figures are in.

According to a new report from commercial real estate services firm CBRE Canada, while the country’s office markets aren’t as healthy as they were pre-pandemic, they are doing relatively well compared to other nations.

The report’s overarching theme is that the Canadian market is inching closer to equilibrium (albeit slowly).

According to CBRE national managing director Jon Ramscar, while vacancy may still not be at pre-pandemic levels, Canada actually houses three cities with the lowest vacancy rates in North America. In Q3, Vancouver’s rate was at 7.1%, Ottawa’s was 11.5%, and Toronto’s was 11.8%. For comparison, Manhattan saw a vacancy rate of 15.2%, San Francisco’s was 24.2%, and this figure was 32.2% in Dallas. Ramsay says this is due to Canadian cities having lower vacancy rates pre-pandemic and to Canada’s relatively small number of major building owners.

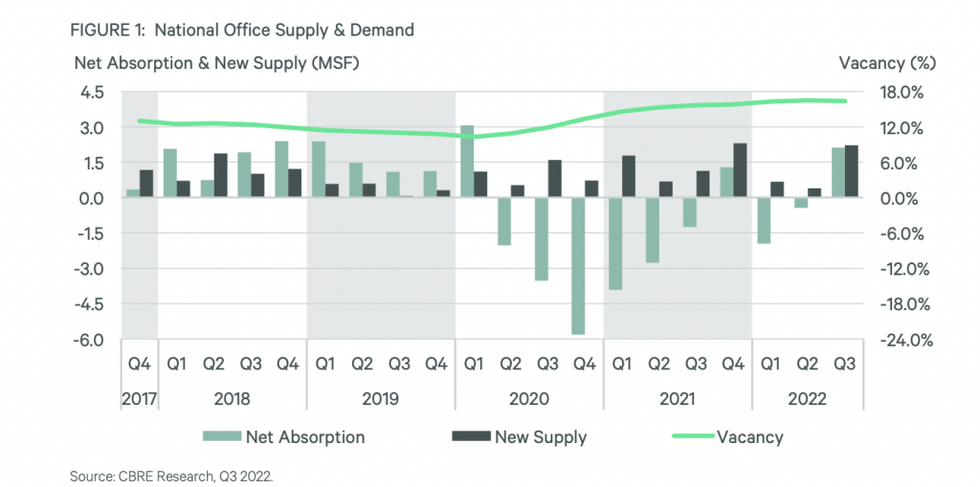

According to the report, 2.1M sq. ft of positive net absorption was recorded this quarter, though much of this was attributed to the delivery of pre-leased new supply. If excluding the gains from new supply, national net absorption would have still remained positive, totalling to 207,000 sq. ft.

Aligned with the four-quarter average of 14.5M sq. ft, the recovery of national sublet space has plateaued, says CBRE.

There is room for optimism on the pandemic recovery front for the country’s offices, even if remote or hybrid work is here to stay. According to the report, overall, minor recovery was noted over the quarter as vacancy decreased 10 basis points to 16.4% -- a first since the onset of the pandemic. This was led by further improvement in the suburbs as downtown markets remained stable at 16.9% vacant.

The report reveals that downtown tenants are prioritizing quality over cost. According to CBRE, the national vacancy rate of Downtown Class B office towers is nearly 50% higher than for that of Class A buildings.

Meanwhile, office construction levels have lowered to 12.7M sq. ft with major project deliveries coming to market in downtown Toronto, and suburban Montreal and Halifax this quarter.

Generally speaking, CBRE says most markets were relatively stable, with a few standouts. The report points to Calgary and the Waterloo Region as markets that experienced a pick-up in activity, primarily from engineering, financial services, and creative industry firms. On the other hand, Vancouver and Ottawa saw some softening, with tenants no longer requiring the full extent of their spaces after switching up “business as usual.” In both cases, this resulted in an uptick to sublease offerings, says CBRE.

The reality remains that there are a lot of unused commercial spaces in urban centres throughout the country. "Persistent elevated vacancy could trigger the conversion of outdated properties to other product types and has started to occur in select markets," highlights the report.