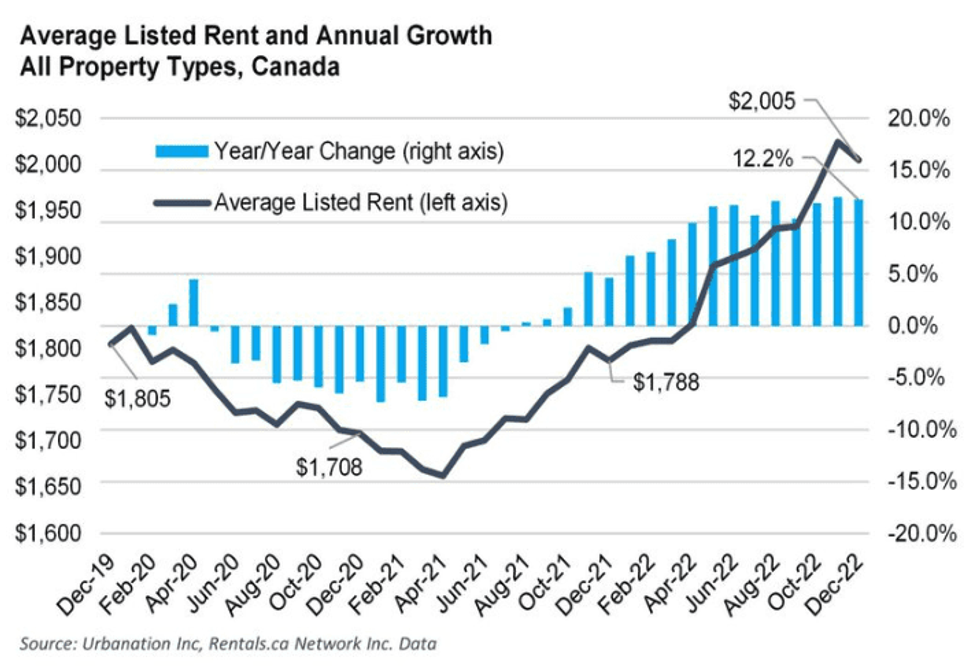

The Canadian rental market showed little signs of cooling down as 2022 came to a close. Average national rent remained above the $2,000 mark in December, for the second straight month, and the story was similar in the majority of local markets.

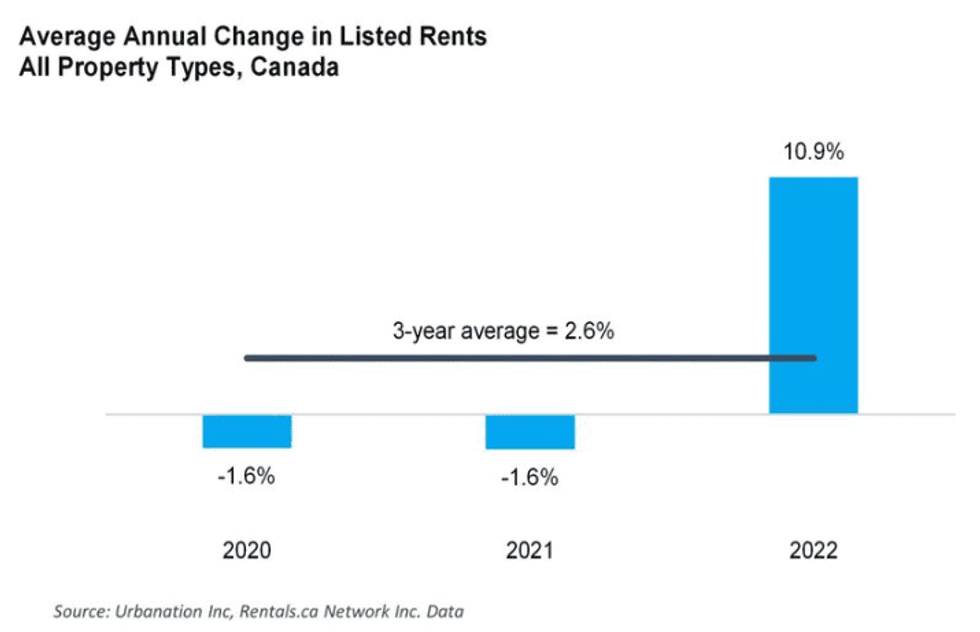

This is according to a new National Rent Report by Rentals.ca and Urbanation, based on data from RentFaster.ca, which put the average rate of annual rent increase for all of 2022 at 10.9%. This was the first year since 2019 in which the national market saw a positive rate of annual increase.

The report attributes the almost 11% increase to “a recovery from declines experienced during the pandemic, record-high population growth, a large pullback in home buying, and structurally low vacancy rates.” It also notes that “the strong growth in rents occurred in 2022 despite a record high for total apartment completions last year.”

“The Canadian rental market had one of its strongest years ever in 2022, more than reversing any weakness experienced during the pandemic,” said Shaun Hildebrand, President of Urbanation, of the data. “Rental demand is primarily being driven by a quickly growing population that is finding it increasingly more difficult to afford homeownership or find suitable rental housing. Looking ahead for 2023, rents are expected to continue rising, but less heated growth can be expected as the economy slows and new rental supply rises to multi-decade highs.”

On a national level, rents for purpose-built and condominium apartments observed the most growth in December, climbing 10.7% year over year. Annual rent growth was also strong for two-bedroom units (up 10.6%) and one-bedrooms (up 9.1%), while studios and three-bedrooms saw slower rates of appreciation, increasing 6.9% and 6.2%, respectively.

“Provincially, rent growth correlated with population growth,” states the report, adding that Nova Scotia, along with other Atlantic provinces, had the fastest growing populations in 2022, and thus, the greatest rent appreciation.

British Columbia and Alberta also saw annual rent growth on par with population growth, with rents increasing 18.5% and 16.8%, respectively. Ontario trailed behind, experiencing a 15.5% uptick in annual rent growth, while Quebec -- the slowest-growing province for both population and rents in 2022 -- saw a 6.9% annual rent increase.

Of all municipal markets included in the report, Toronto and Vancouver (unsurprisingly) remained the most expensive markets as of December, with rates increasing 22.7% and 21.2%, respectively. Meanwhile, “strong economic momentum” in Calgary spurred rent growth of 22.6%, earning it the second spot for rent growth. Ottawa and Edmonton saw annual increases of 14.5% and 11.7%, respectively, while Montreal lagged behind any other large city, observing just 6.6% in annual growth.

That said, rent growth observed in smaller markets outpaced appreciation recorded in larger cities, with Kitchener, Halifax, and London amongst the medium-sized markets that saw annual rent increases exceeding 30% in December.