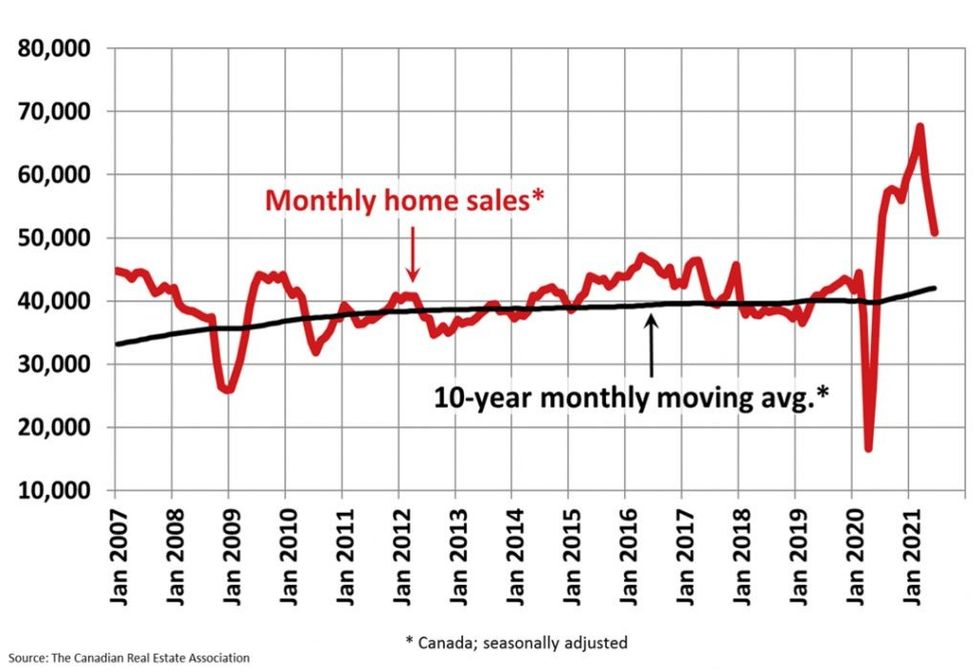

Keeping in line with seasonal trends, national home sales declined for the third month in a row in June, as the national housing market cooled from its March high. Though, June still wound up being a record-setting month.

Last month, national home sales fell 8.4% month-over-month, marking the third straight month of slowdowns and a 25% decline in activity from March's peak, the Canadian Real Estate Association (CREA) said Thursday.

The association said sales cooled in 80% of the country’s local markets, however, when compared with a year ago, sales in June rose 13.6% to set a new record for the month.

“While there is still a lot of activity in many housing markets across Canada, things have noticeably calmed down in the last few months,” said Cliff Stevenson, Chair of CREA.

The decline in sales comes as the number of newly listed homes across the country edged back a slight 0.7% in June compared to May, though CREA noted about half of local markets did see supply gains -- welcome news for frustrated buyers.

READ: GTA Shatters Records, Leads Canadian Luxury Real Estate Rebound

"There remains a shortage of supply in many parts of the country, but at least there isn’t the same level of competition among buyers we were seeing a few months ago,” added Stevenson.

The national sales-to-new listings ratio was 69.2% in June, marking the lowest reading since last August. That said, the long-term average for the national sales-to-new listings ratio is 54.6%, so it remains historically high, although, it has been steadily moderating since peaking at 90.8% back in January, the association said.

“Today’s decrease in home sales continues to show the state of the stressed housing market across Canada," Hash Aboulhosn, President of Windsor, Ontario-based Edison Financial told STOREYS.

"Many home buyers are having to choose between sitting on the sidelines or engaging in intense bidding wars which is pushing housing pricing skyward. Housing inventory levels must increase significantly if we’re going to break out of this cycle into a much more normal, stable housing market,” added Aboulhosn.

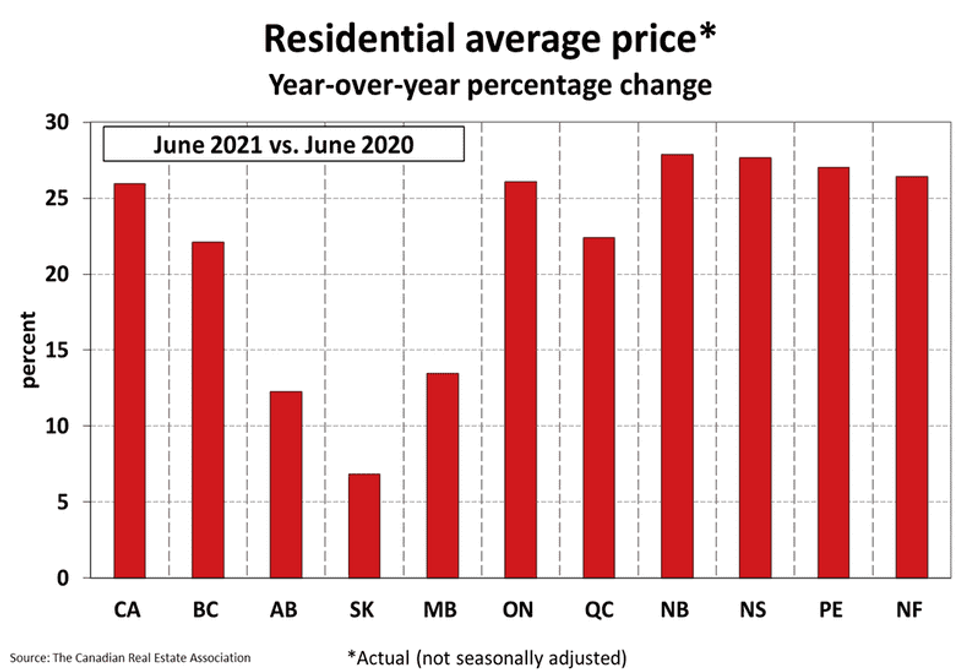

CREA said the actual national average price of a home sold in June was a little over $679,000, up 25.9% from $539,182 a year ago.

Looking across the country, year-over-year price growth is averaging around 20% to $909,810 in BC, though it is lower in Vancouver and higher in other parts of the province. Gains in the 10% range were recorded in Alberta ($432,159) and Saskatchewan ($288,500), and gains are closer to 15% in Manitoba ($346,943).

Ontario is seeing an average year-over-year rate of price growth in the 30% range with the average price in the province reaching $857,754 in June. However, as with BC, gains are notably lower in the GTA and considerably higher in most other parts of the province.

The opposite is true in Quebec, where Montreal ($498,900) is in the 25% range and Quebec City ($296,200) is in the 15% range. Price growth is running a little above 30% in New Brunswick ($245,600), while Newfoundland and Labrador ($308,000) are in the 10% range.

When looking at the country's largest real estate markets, Greater Vancouver saw its MLS HPI benchmark price reach $1,175,100 in June, up 14.5% year-over-year from $1,026,200 during the same month a year before. The Greater Toronto Area trailed at $1,050,300, a 19.9% year-over-year change from $875,900 in June 2020.

“It feels like maybe the theme of this summer is ‘slowly getting back to normal,’ in our own lives and for many housing markets across Canada as well,” said Shaun Cathcart, CREA’s Senior Economist.

“That said, it’s a long road to get back to normal, and for many housing markets the main issue is that supply shortages are as acute as ever," continued Cathcart. However, the economist noted that the lull in population growth is likely coming to an end.

"So while the frenzy and emotion of earlier in the pandemic seem to have dissipated for now, the key ingredients of a sellers' market are all still in place," added Cathcart.