The Canada Mortgage and Housing Corporation's (CMHC) annual Mortgage Consumer Survey was released this week and the findings reveal a varied, but overall optimistic, homebuyer landscape based on responses from 3,968 mortgage consumers collected in January 2025.

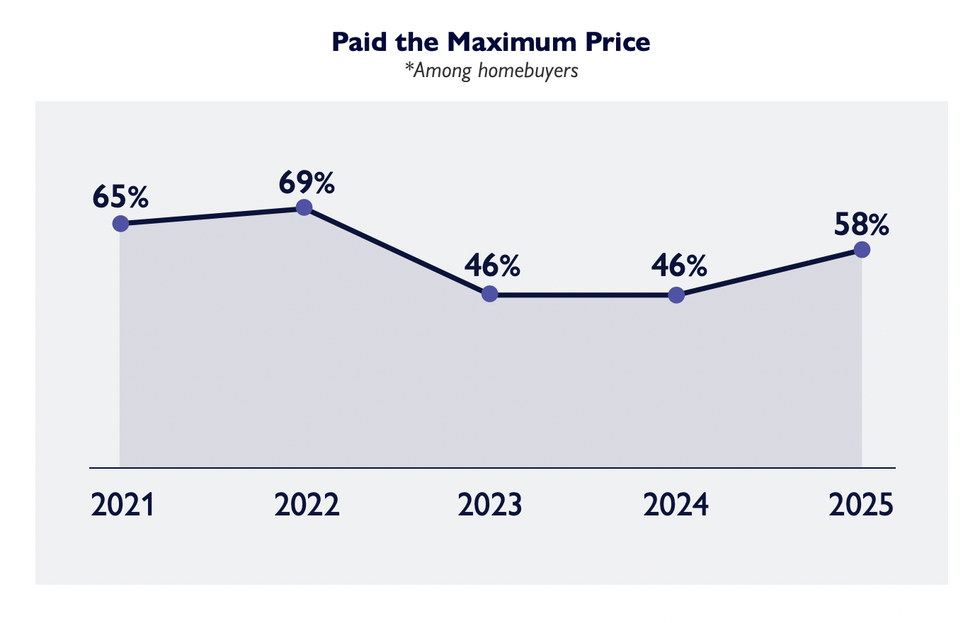

While an increasing amount of homebuyers paid the maximum that they can afford for a home and more consumers are struggling to make mortgage payments, respondents are more optimistic about their home purchase being a good investment than they were in 2024 and first-time homebuyers are making up a larger share of transactions than they did a year ago.

While 58% of homebuyers surveyed in 2025 paid the maximum amount they could afford (compared to 46% in both 2024 and 2023), the proportion of first-time homebuyers that paid the max was at 65%. First-time homebuyers, 47% of which are aged 25 to 34 years old and 35% of which make $60,000 to $105,000 a year, made up 12% of mortgage transactions, up from 10% in 2024.

But this statistic also varies depending on province, with homebuyers in British Columbia being most likely to have payed their max price (66%), followed by Ontario (64%).

Compared to first-time homebuyers, repeat buyers made up just 5% of mortgage purchases and a lesser 40% of this group paid the maximum price they can afford. The majority of this group is aged 35 to 44 with 39% making more than $120,000 a year.

On the debt front, a slight majority of mortgagers (51%) say they have trouble making debt payments, up from 42% in 2024. This stat is, unsurprisingly, more pronounced for the less stable first-time homebuyers, 60% of which have struggled to make debt payments, compared to just 29% of repeat buyers.

Meanwhile, the percentage of respondents concerned about defaulting on their mortgage increased slightly from 50% to 53%, with 70% citing economic factors like cost of living increases, economic recession, and interest rates rising. But despite these concerns, overall, homebuyers are feeling more optimistic about their purchases. In fact, 74% believe their home will increase in value over the next year, up from 63% in 2024, while 73% are comfortable with their mortgage debt.

Other positive trends include an increase in buyers prioritizing energy-efficient homes, up from 57% to 61%, and energy-efficient updates were also a top factor for home renovations in 2025. In general, renovations are on the rise with 55% of homeowners having carried one out within the last three years. Mortgagers are also increasingly interested in constructing secondary suites, with one in 10 expressing interest in the idea.

In terms of mortgage structures, the survey found that the majority of mortgagers continued to hold fixed-rate mortgages, although the total did fall 7% from 2024, made up mostly of older generations. Conversely, the popularity of variable-rate mortgages ticked up compared to last year from 23% to 25%. Of the variable rate mortgagers, 31% were refinancers.

Homeownership in Canada continues to be one of the largest expenses everyday consumers live with, and as economic uncertainty persists, some mortgage consumers will have to grapple with the impact on their personal finances. Still, high optimism and increased investment in value-enhancing upgrades will help buoy mortgagers through uncertain times.