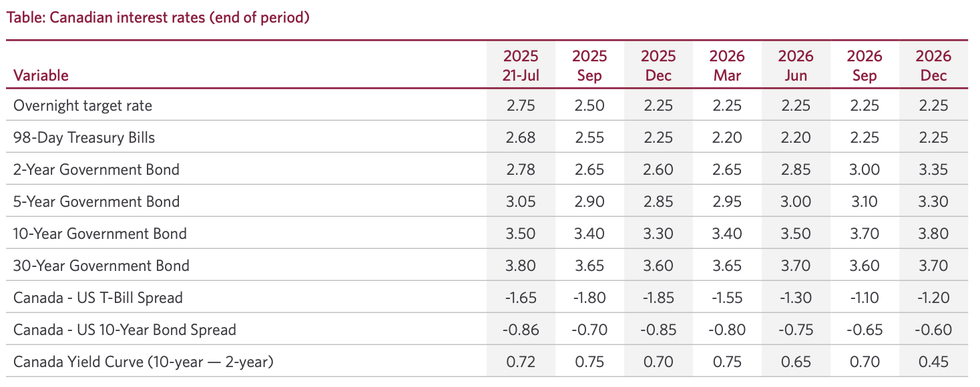

CIBC Economics released an updated interest rate forecast on Monday, revealing that they are now calling for the Bank of Canada’s (BoC) policy interest rate to be brought down a quarter-point to 2.50% in September and to 2.25% by December.

This comes a week before the central bank is set to meet for its next rate announcement, scheduled for the morning of Wednesday, July 30. Back in June, economists with CIBC were expecting a 25-basis point (bps) cut for next week’s decision, which would have brought the rate down to 2.50%.

However, CIBC’s latest forecast comes on the heels of a series of major data releases from Statistics Canada (StatCan) that will certainly play into Governing Council’s upcoming decision, including last week’s labour market numbers — which showed employment declining by 83,000, the unemployment rate falling to 6.9% — and Consumer Price Index print, which came in at 1.9% year over year, up from 1.7% in May.

“On the heels of a good job report and somewhat firm price pressures, we expect the BoC to remain on pause in July because this is a central bank that, by its own admission, isn’t very comfortable being forward-looking,” said CIBC Economist Ali Jaffery in a July 15 commentary. “Waiting until the fall will give them more time to observe cost pressures, the response of the economy to tariffs and the uncertainty shock, and perhaps most important, to have a clearer picture of Canada’s tariff outcome.”

For now, CIBC is in good company in anticipating an interest rate hold from the Bank of Canada next week, but looking forward, economists appear to be split on whether the remainder of the year will bring more cuts at all.

In CIBC’s camp, economists with both TD and BMO are calling for further easing, according to their most recent forecasts, with TD predicting a benchmark rate of 2.25% by the third quarter of the year and through to at least the end of 2026, and BMO predicting a rate of 2.25% not until October and through to the end of 2025.

“We are now dealing with a new wave of uncertainty, not least from Trump’s recent threat to raise Canadian tariffs as high as 35% by next month. Prime Minister Carney also appears to be embracing what could be the ‘new-normal’, acknowledging that a forthcoming trade deal will likely have tariffs included,” wrote TD Economist Marc Ercolao in a July 18 note. “Absent a clean and quick resolution on trade, which seems unlikely at this juncture, the economic backdrop faces downside risk and should give the BoC space to deliver more easing later this year.”

On the more hawkish side of things, economists with Scotiabank and RBC are of the belief that the BoC won't be cutting again any time soon. Economists with Scotiabank have long been calling for a series of holds through 2025, which would keep the policy rate steady at 2.75% — where it’s been since March and the early days of trade war fears. Further easing won't come until 2026, according to Scotiabank, and they are forecasting just a 25-bps cut to 2.50% at some point in the year.

Meanwhile, RBC’s updated forecast has the benchmark interest rate staying at 2.75% — potentially until end of 2026. “The central bank was already approaching the end of its easing cycle. It opted to pause at the last two policy meetings after an earlier and more aggressive easing cycle over the past year,” said Economist Claire Fan in a June 12 report. “Near term growth has shown resilience and future inflation after the recent upside surprises is still uncertain. Fiscal support is stepping up, and better able to provide timely, targeted, and temporary support needed to address the immediate impact of tariffs.”

- Bank Of Canada Cuts Interest Rate For First Time In Four Years ›

- What’s In Store For Interest Rates In 2025, According To Every Big Bank ›

- Bank Of Canada Holds Interest Rate For Second Time In A Row ›

- Where Every Big Bank Stands On July's Interest Rate Announcement ›

- Third Straight Hold: Bank Of Canada Keeps Interest Rate At 2.75% ›

- Bank Of Canada Holds Interest Rate In First 2026 Decision ›