For Canadians trying to break into the real estate market, two incomes tend to be better than one – combining financial forces with a partner can make all the difference in our nation’s priciest cities, as lenders tend to look more favourably on borrowers with dual incomes and stronger combined credit.

But nothing spells commitment like buying property with a partner, romantic or otherwise – once two names are on the deed, separating them comes with considerable headache – complete with the services of a lawyer, mortgage broker and real estate agent (in addition to heartache if co-ownership doesn’t work out).

Canadians Are Increasingly Buying Real Estate On Their Own

Perhaps that’s one of the reasons Canadians are becoming less inclined to wait for the right person before hopping into the housing market. According to Statistics Canada, single-person households have become the most common type in Canada for the first time in our nation’s history; the latest census data reveals the number of people living alone has doubled from 1.7 million in 1981 to 4 million in 2016.

These solo dwellers are also increasingly likely to own their own homes, with an ownership rate of 50% – up from 32% in the ‘80s – and one in five live in a condo apartment. That’s not surprising as apartment living offers amenities that are ideal for many single lifestyles such as a lower price point and smaller living space, with maintenance and repairs covered by a condo board.

The Most and Least Expensive Canadian Cities for Single Home Buyers

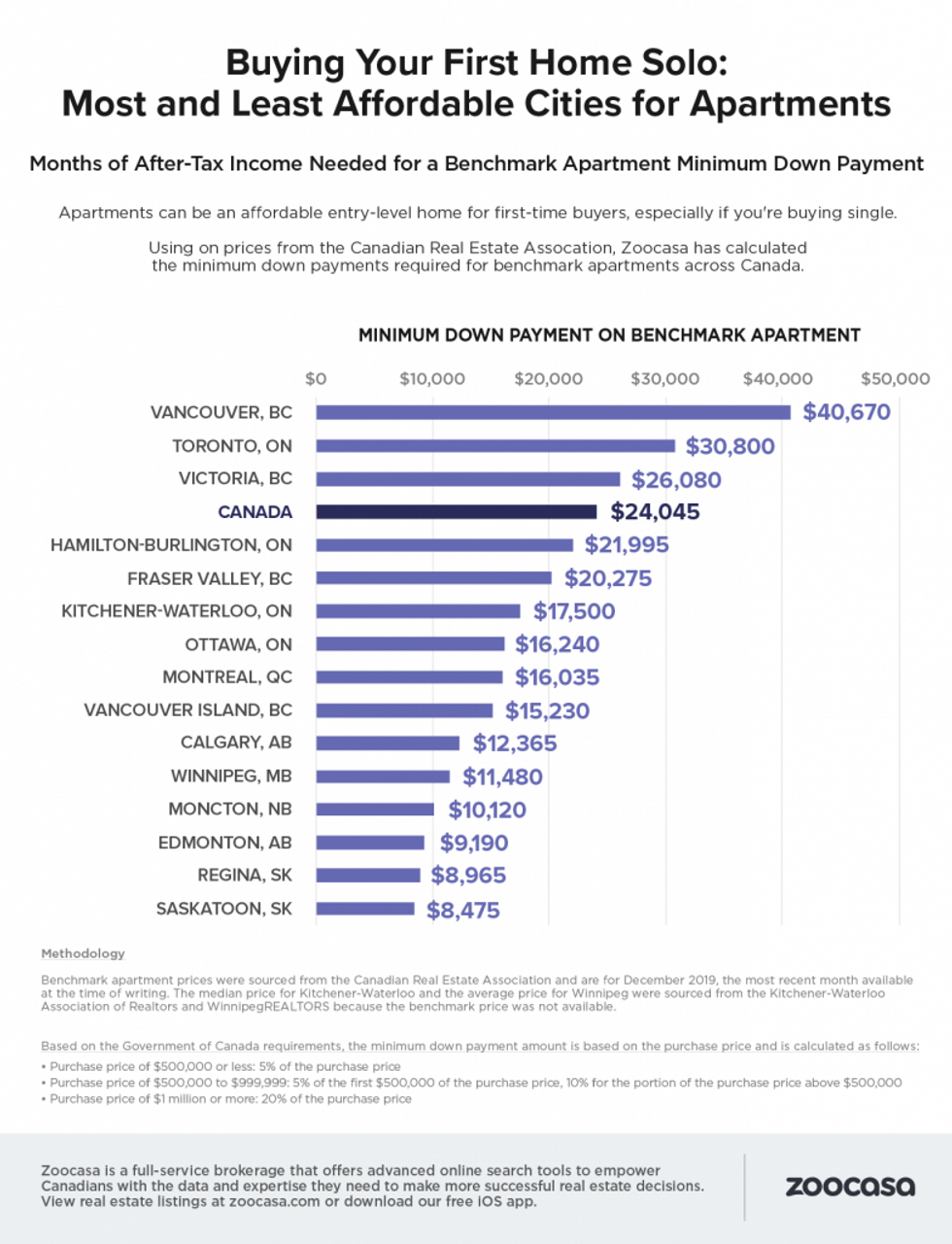

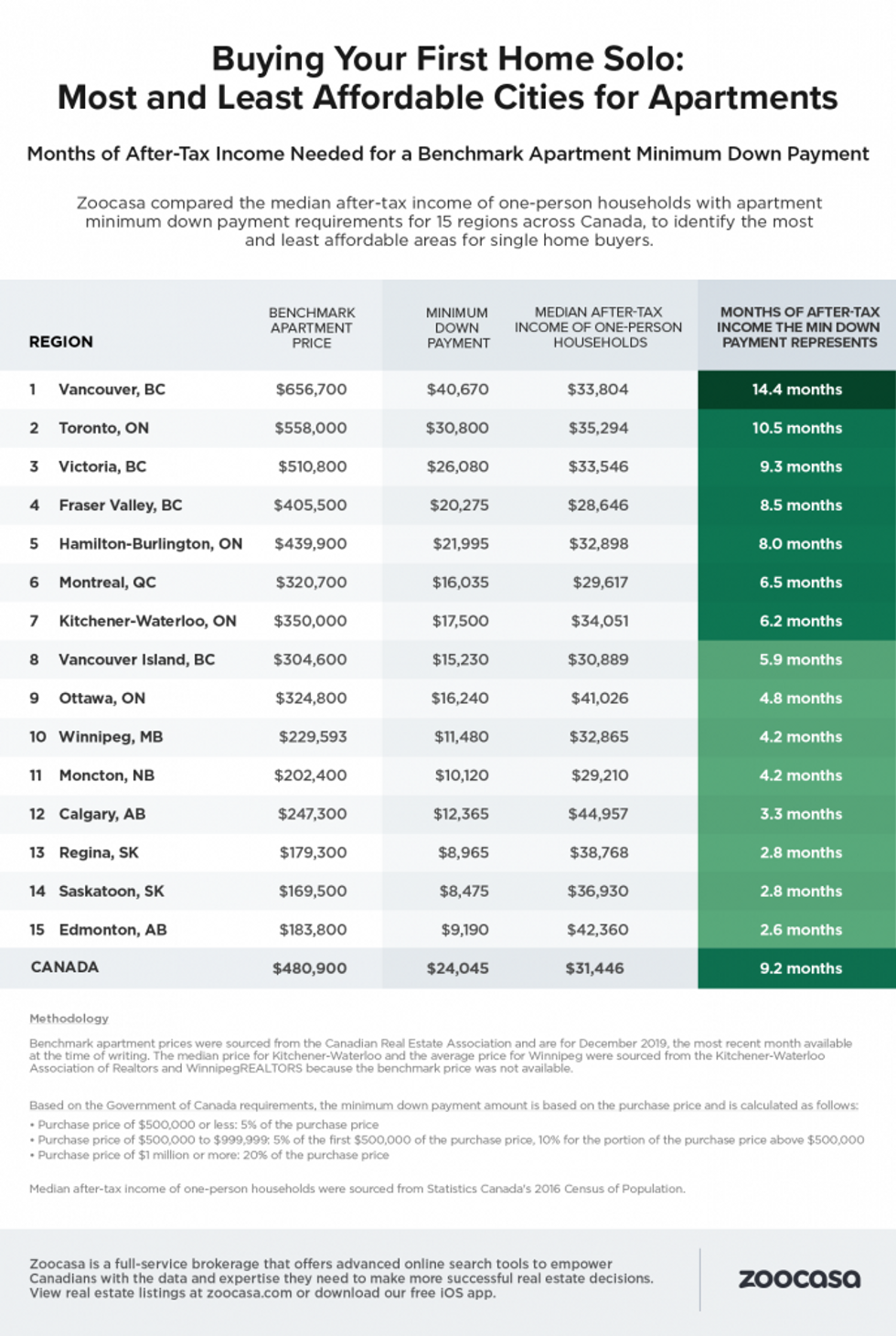

But where will self-partnered buyers’ budgets go the furthest? To find out, Zoocasa crunched the minimum down payment needed to purchase a benchmark apartment in 15 regions across Canada, and compared it to the after-tax single-household median incomes earned in each. The study also calculated how many months it would take for such a home buyer to save up the necessary down payment, assuming they could contribute 100% of their income annually.

Not surprisingly, the numbers reveal it is toughest to purchase a home on a solo budget in Canada’s biggest cities. For example, to purchase Vancouver real estate, which has long held the distinction as the nation’s most expensive, the required down payment would be greater than what is earned by a median single-income household in an entire year.

There, a benchmark apartment costs $656,700, requiring a minimum down payment of $40,670, outstripping the $33,804 earned by single buyers. Should that individual set aside their entire earnings to save for a down payment, it would take them 14.4 months to pull together the needed cash. Affordability is less steep, though still challenging, for homes for sale in Toronto; there, a benchmark apartment of $558,000 would require a down payment of $30,800, just shy of the median income of $35,294, requiring a 10.5-month savings timeline.

Rounding out the top three priciest regions for single home buyers is Victoria, where a benchmark apartment priced at $510,800 would require a minimum down payment of $26,080, meaning a single buyer earning $33,546 would need to save for 9.3 months.

Solo Budgets Go Furthest in the Prairies

As has been the long-term trend, single buyers seeking the greatest bang for their buck will find it in the Prairies; in the three most affordable cities, a benchmark apartment can be purchased for under $200,000, with required down payments making up a comparatively smaller portion of incomes.

Edmonton takes the top spot as most affordable for single-income buyers, with benchmark units going for $183,800, requiring a down payment of just $9,190. Meanwhile, city residents earn the relatively higher median after-tax income of $42,360; it would take just 2.6 months of setting funds aside to come up with the money needed to purchase a home. That’s followed by Saskatoon, with a benchmark price of $169,500 and a down payment of $8,476 – on the local income of $36,930, that would require 2.8 months to save. Regina comes third in terms of affordability with a benchmark price of $179,300 – that would require a down payment of $8,965, which would take 2.8 months of setting aside funds based on an annual income of $38,768.

Single Buyers Have Several Markets to Choose From

However, for single home buyers not looking to purchase a home in the Prairies, there are several midlevel markets offering decent affordability and local earnings in both western and eastern Canada. For example, in Ottawa – one of the nation’s fastest growing housing markets – the benchmark apartment can be purchased for $324,800, while median single-income households bring in $41,026. That would require 4.8 months to save up the required $16,240.

It would take a bit longer in the booming market of Montreal due to slightly lower incomes, though comparatively cheaper home prices make La Belle Provence a contender for first-time buyers. A benchmark apartment there comes in at $320,700, requiring a buyer earning $29,617 to save for 6.5 months to put together the $16,035 down payment.

Those interested in Calgary real estate will also see their dollars go considerably farther; the city is home to the highest median single-income in the nation at $44,957. Based on a benchmark apartment price of $257,300, and a minimum down payment of $12,365, it would take a buyer 3.3 months to save for their home purchase.

Check out the Infographic below to see how long it would take a single-income household to purchase the benchmark apartment in cities across Canada:

Methodology

Benchmark apartment prices were sourced from the Canadian Real Estate Association and are for December 2019, the most recent month available at the time of writing. The median price for Kitchener-Waterloo and the average price for Winnipeg were sourced from the KitchenerWaterloo Association of Realtors and WinnipegREALTORS because the benchmark price was not available.