Since the COVID-19 pandemic reached Canada, financial institutions across the country have permitted various loan payments -- mortgages included -- to be deferred.

The calls to pause aimed to support households working to manage their finances, amongst the rest of their lives, as the pandemic forced disruptions from all angles. But, according to the Bank of Canada, this helping hand has raised concerns about the potential for household defaults to spike once the deferral period ends.

Earlier this fall, the Canada Mortgage And Housing Corporation (CMHC) said about $1 billion worth of mortgage payments were deferred each month during the pandemic.

READ: Canadians Deferred $1B Worth of Mortgages Per Month During Pandemic: CMHC

Drawing mainly on credit bureau microdata from TransUnion Canada, Bank of Canada has investigated how these deferrals can speak to the financial health of households across the country, and the risks related to their financial stability as periods of pause come to a close. But these results -- while "encouraging" -- can't predict the future.

"It is still too early to reach any definitive conclusions because many deferrals remain active or have ended only recently," reads the bank's new analysis.

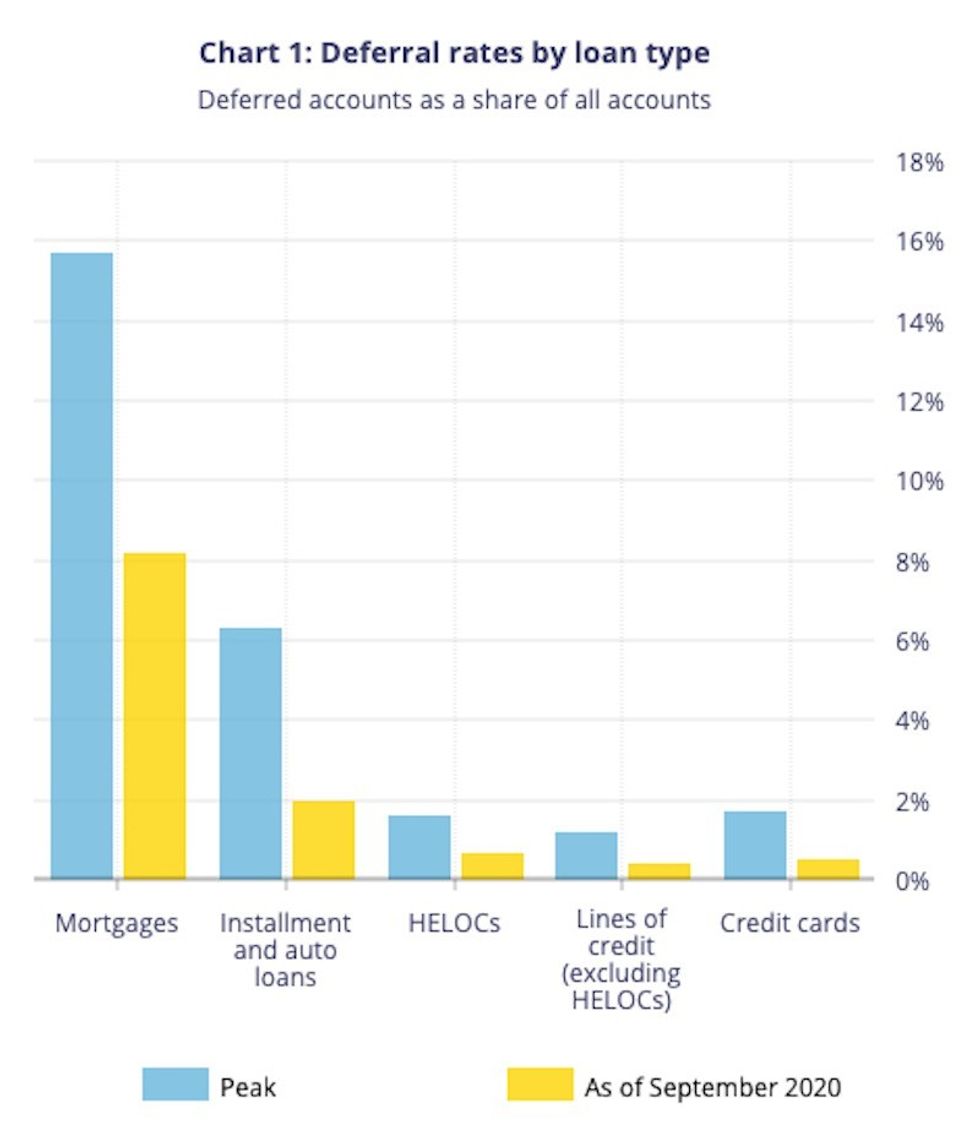

In June, CMHC announced that more than $180 billion in mortgage deferrals had already been made across the country since the start of the pandemic. By September, the Bank of Canada says a total of approximately 16% of mortgages in Canada had been deferred. As of that month, deferral rates had fallen below peak levels, but many loan deferrals remained ongoing.

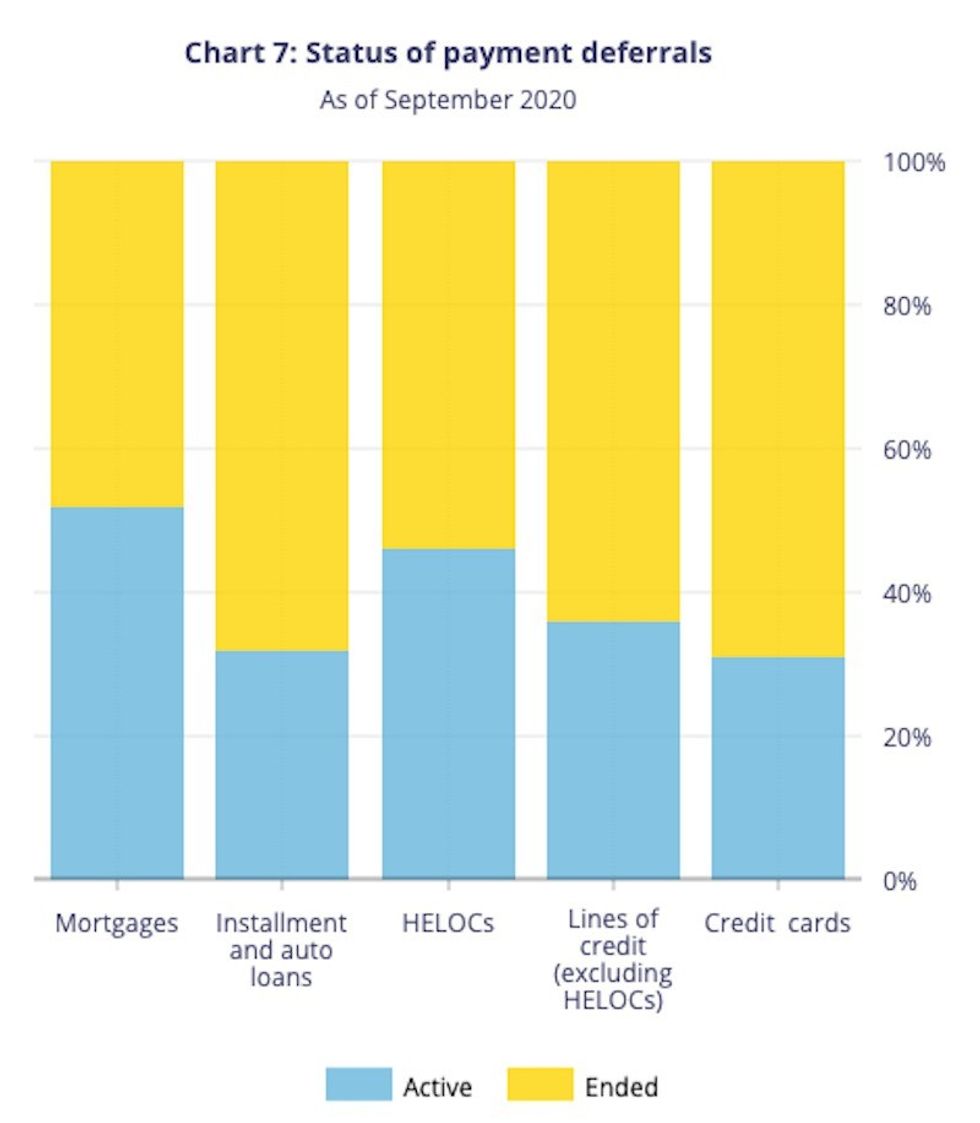

In fact, while many payment deferrals had ended by September, the numbers showed this to be most true for credit card deferrals; these, or auto loans, are the types of loans most deferred by renters.

Meanwhile, roughly half of mortgage referrals -- the most common type of dept deferred among borrowers who own their homes and are deferring some form of loan payment -- were still active. And while mortgage deferrals were most common, almost one-third of deferring homeowners deferred multiple loans.

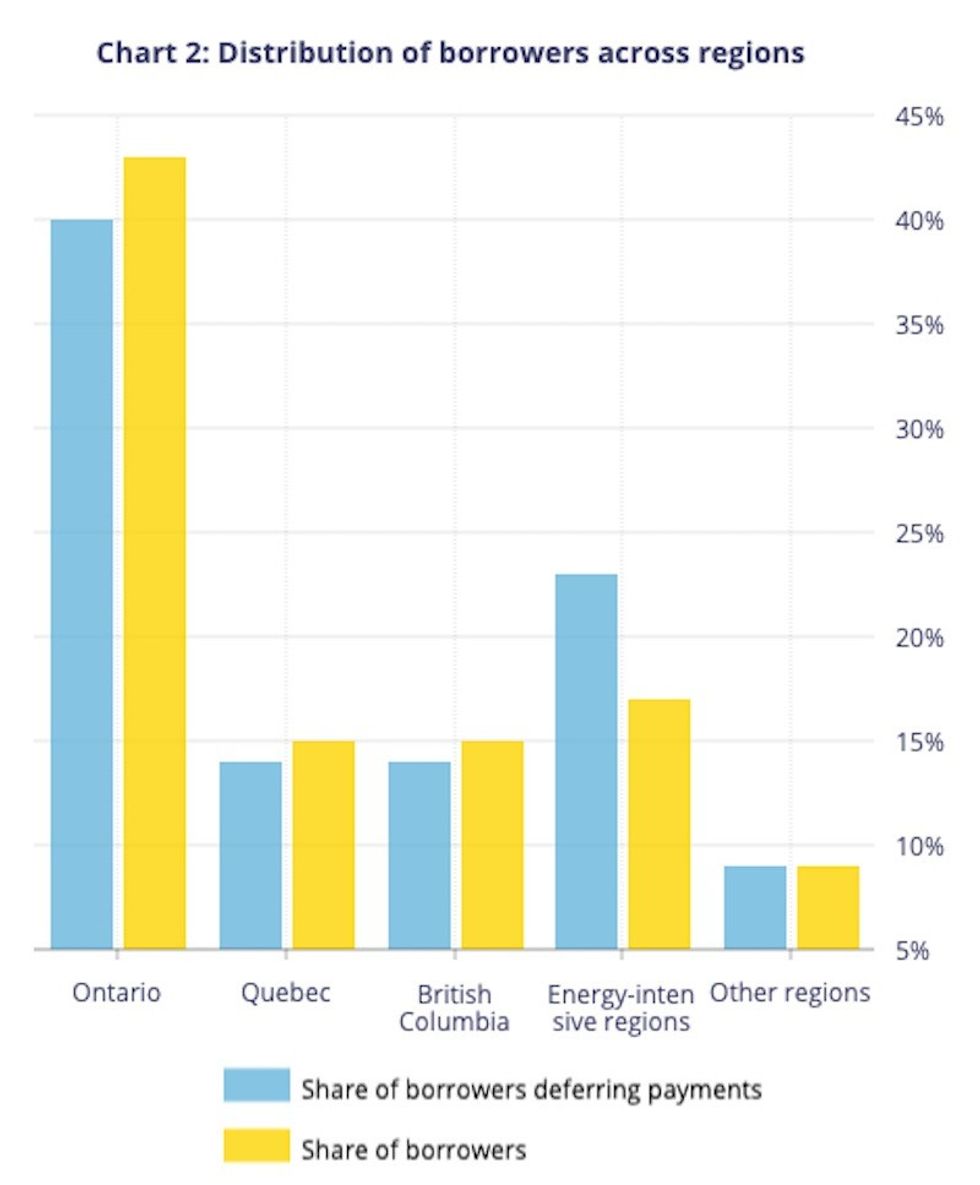

Location-wise, regions the Bank of Canada describe as "energy-intensive regions, where households were already grappling with the effects of low commodity prices," make up for a "disproportionate share" of the borrowers who have opted to defer payments.

Ontario specifically shows a particularly strong representation, with its share of borrowers nearing 45% and, under that same realm, its share of borrowers deferring payments hitting 40%.

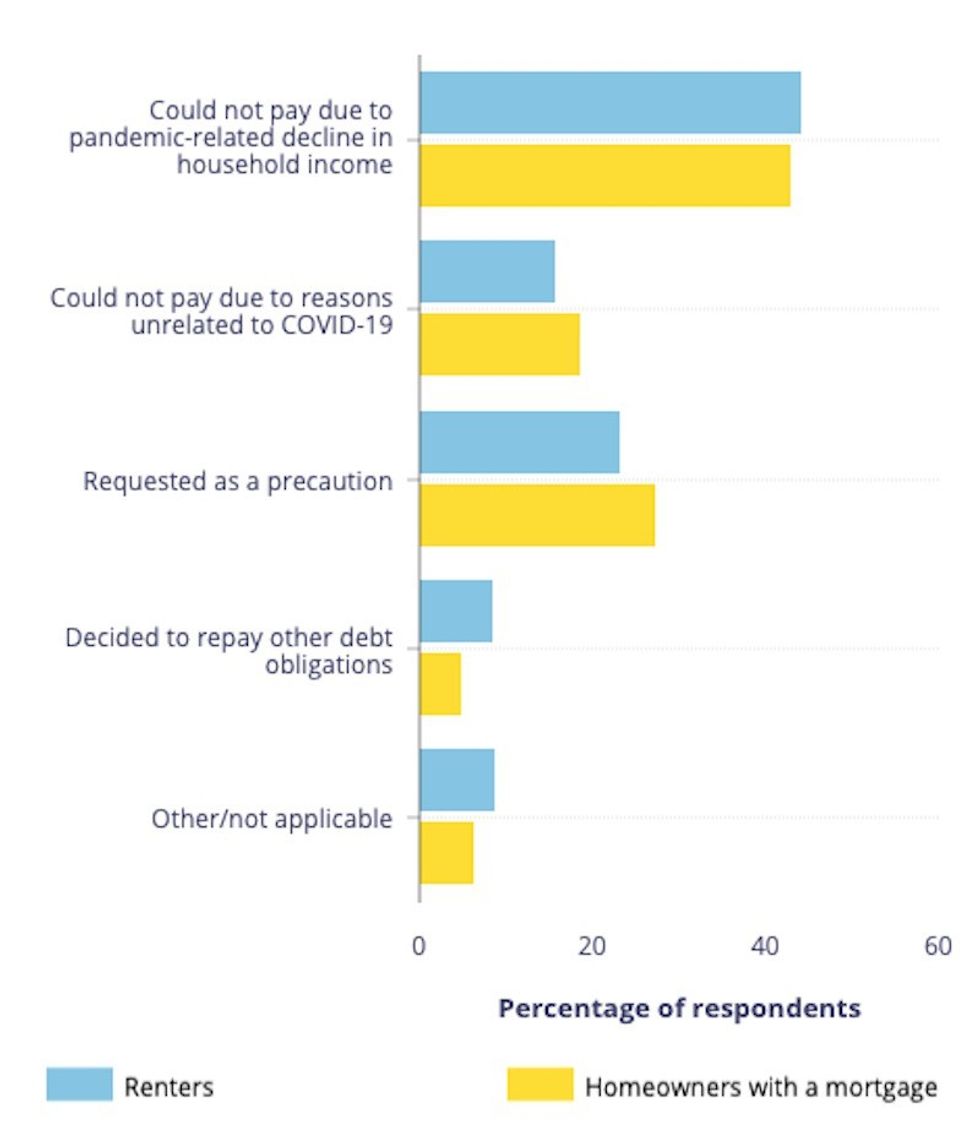

And, it's perhaps unsurprising, more than 40% of respondents cited COVID-19 directly -- specifically, a "pandemic-related decline in household income" -- as the reason they were opting to defer loan payments. Following close behind, nearly 30% of respondents proved to be acting from an apprehensive place: "requested as a precaution" was their reason for pausing payments.

In what could be interpreted as good news for the financial future that hovers over deferred loan payments, most borrowers opting to pause have healthy credit scores, the Bank of Canada reports, and most are not near their limits on revolving credit products.

The caveat there, though, is that "borrowers with deferred accounts tend to have lower credit scores than those whose accounts are not in deferral," -- a truth that was particularly poignant for renters, the data shows.

The Bank of Canada also reports that, as of September, most borrowers with expired deferrals had indeed resumed payments.

"In fact, arrears rates of expired deferrals are below rates that prevailed before the COVID‑19 pandemic," reads the analysis.

Of those that had not resumed by that time and were reported to be at least 30 days behind, it was not mortgage payments that were most impacted, but instalment loans and auto loans among renters instead. So while the water is still murky in the direction of homeowner finances following COVID-19 related deferrals, there are no (giant) red flags waving yet either.