Less than a week after releasing its second-quarter earnings, which showed that revenues from its appraisals and development advisory services are down, Toronto-based provider of real estate analytics Altus Group has revealed that it is in a period of review that could culminate in a sale.

“Altus Group periodically undertakes a strategic review to maximize stakeholder value. The Company is in the process of a review, which includes but is not limited to acquisitions, divestitures, and a sale or merger of the Company,” a Wednesday morning statement said. “The Company’s board of directors is committed to acting in the best interests of the Company and its stakeholders.”

“It is important to note that a review process may not result in any particular course of action,” the statement went on to say. “The Company does not intend to issue or disclose developments with respect to any of the above matters except as required under its regulatory obligations.”

Altus’ statement follows reports from Reuters on Tuesday that investment bankers are interested in taking the company private, according to two inside sources.

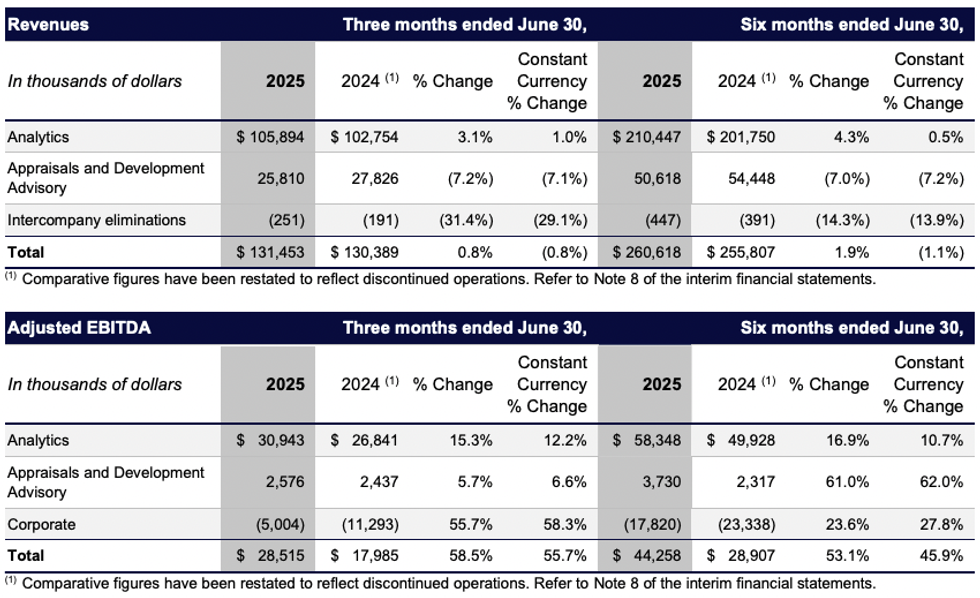

The company’s latest financial statements, released last Thursday, show a marginal 0.8% slip in overall revenues, a 30.3% drop in net cash provided by operating activities, and a 30.5% decline in free cash flow, quarter over quarter. They also show that revenues from Altus’ appraisals and development advisory services came in at $25,810,000 in the second quarter, which marks a 7.2% drop over the second quarter of 2024. Year to date revenues, at $50,618,000, are down 7.0%.

In addition, it appears that Altus is forecasting “flat-to-low single-digit revenue decline” in appraisals and development advisory through 2025. On the whole, the statements show that the company is now forecasting 2- 4% revenue growth for the year, which is down from its previously forecasted 3-5%.

On the flip side, the analytics portion of Altus’ operations observed a 3.0% gain to $105,894,000 quarter over quarter, as well as a 4.3% rise to $ 210,447,000 year over year. Recurring revenue from analytics also presented strong, growing 5.9% in the quarter to $100,800,000. Even so, the company is forecasting revenue in the segment to grow 3-6% through 2025, which is down from its pervious forecast of 4-7%. For recurring revenue, the projected growth this year is 5-7%, down from a previous forecast of 6-9%.

Altus Group is an authority in commercial real estate intelligence, and has been in the space for upwards of 30 years. The company puts out weekly and quarterly updates on industry conditions and a yearly cost guide, and they also work with entities like the Building Industry and Land Development Association (BILD) to produce insights on the residential sector. According to the company’s website, Altus currently has more than 2,000 employees and serves in 85 countries.