The Toronto Regional Real Estate Board (TRREB) released its Market Outlook and Year in Review report on Wednesday morning, and it paints a picture of a buyer-friendly 2025. According to the real estate board, a “well-supplied” market in the year ahead is expected to quell home prices in the Greater Toronto Area, keeping the annual growth rate below that of inflation.

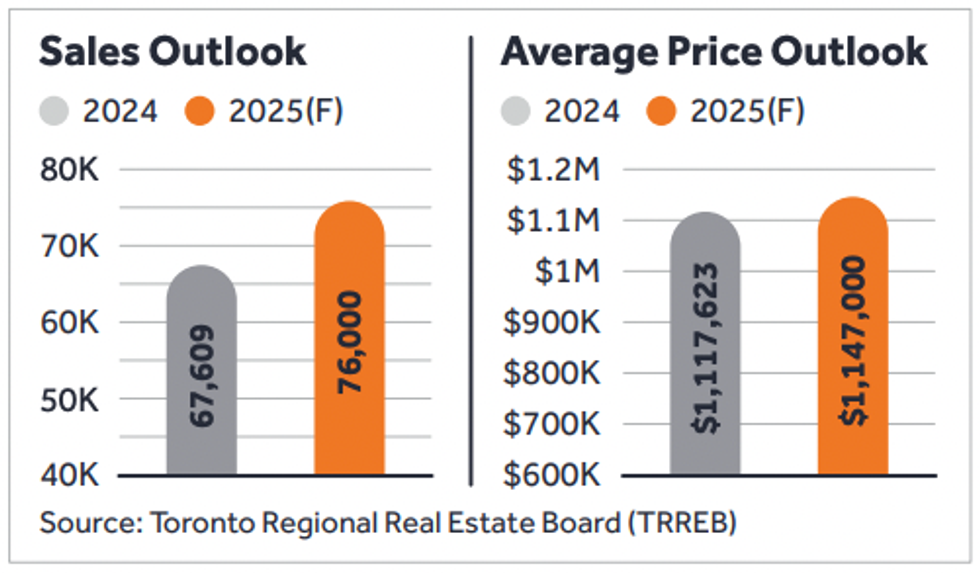

In its outlook, TRREB forecasts that the average selling price “for all home types combined” will reach $1,147,000 this year, which would mark a “moderate” rise of 2.6% over 2024. “Price growth will be more evident in the single-family market segments, including detached and semi-detached houses and townhouses,” TRREB said.

Slower overall price growth is expected to entice buyers to come off the sidelines in the year ahead, as will lower borrowing costs. As such, TRREB is calling for a total of 76,000 home sales this year, up 12.4% over 2024. Even so, the Board cautions that transaction levels could be “muted somewhat” by the impact of trade disputes on the economy and consumer confidence.

In particular, the real estate board warns that US tariffs on Canadian exports would “reduce the demand for a wide variety of goods and services,” which could lead to layoffs and stifle purchasing power. “More aggressive” interest rate cuts from the Bank of Canada could help to offset some of the tariff impacts, TRREB adds.

President and CEO of The Heaps Estrin Team, Cailey Heaps, says that while the “looming federal election creates uncertainty for Canadians,” the by-product could (ideally) be “an improvement over the status quo.”

“The recent change in US leadership and the polarizing actions by the President have certainly sparked concerns about the potential for a recession and the impacts of that on the economy,” Heaps says, adding that “job losses are likely to be felt more acutely outside of the city core, so that is less of a concern for the central Toronto market.”

“But we have to consider that GDP growth may stall for myriad reasons at the moment, so an economic contraction may be on the horizon,” she says. “What does this mean for real estate? Despite the economic uncertainty, Toronto has proven to be a resilient market and, while I expect we will experience some peaks and valleys over the course of the year, I predict the housing market in 2025 will see a marginal improvement over 2024 in Toronto.”

Heaps also shares that she has many buyer clients that are “anxious to enter the market in 2025,” amid the ongoing market correction and lower interest rate realities. At the same time, she says they are, understandably, “waiting to see how the tariff situation plays out in the coming weeks and months.”

In any case, Ipsos consumer polling conducting by TRREB and included in Wednesday’s outlook shows that buyer sentiment, at present, appears to be holding steady, with 28% of respondents reporting that they are “likely” and 9% say they are “very likely” to buy a home in 2025. “These results matched intentions for 2024,” TRREB noted.

The polling additionally reveals that first-time buyers accounted for 42% of intending homebuyers. That buyer group is anticipated to find their footing in the condominium apartment segment, which is likely to see a “flat-to-downward price trend.”

Also according to the polling, around two-thirds of renters “would not tolerate any further rent increases before seriously considering the purchase of a home” — particularly as borrowing costs and selling prices have become more approachable. “The transition of renters into homeownership, coupled with investors listing their condominium apartments for rent, will add to the supply of available units in the GTA condo rental market,” Wednesday’s outlook notes. “This will sustain a high level of rental inventory, which will see average rents remain below their recent peak.”

In terms of seller sentiment, the Ipsos polling shows that 37% of respondents say they’re “likely” to sell a home in 2025, while 14% say they’re “very likely” to do the same. Again, TRREB notes that this is in line with 2024 polling.

- What’s In Store For Interest Rates In 2025, According To Every Big Bank ›

- What Ontario's Cottage Market Could Look Like In 2025 ›

- These Are The Five Emerging Trends In Canadian Real Estate In 2025 ›

- 2025 Housing Outlook "Uncertain" Amid Geopolitical Shifts ›

- Toronto, Vancouver Home Prices Drop Amid Economic Uncertainty ›

- TD Calls For Further 10% Drop In GTA Condo Prices This Year ›