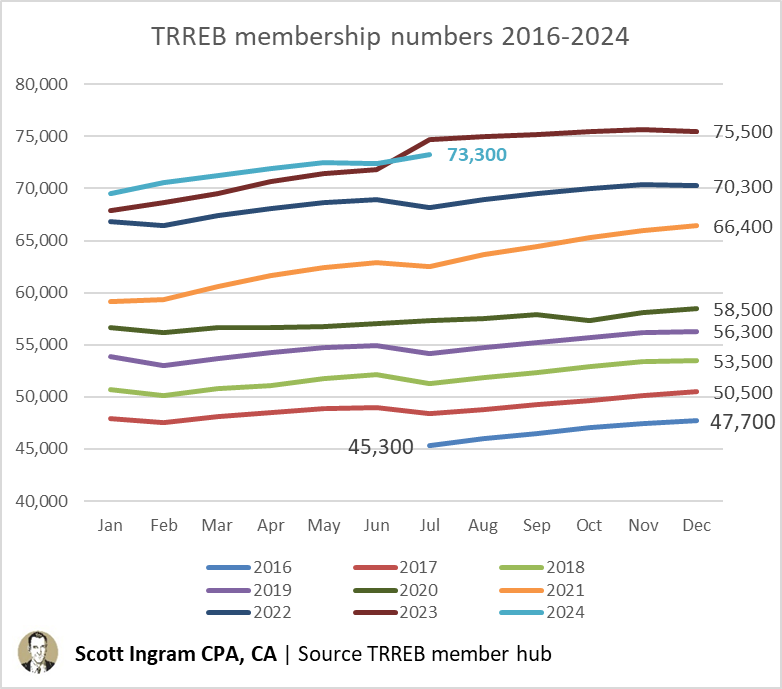

Toronto Regional Real Estate Board (TRREB) memberships declined by 1,363 year-over-year this July to 73,315, marking the first month since 2016, at least, to see a yearly decrease.

Scott Ingram, a TRREB member and chartered accountant, called attention to this unusual drop in membership via a Tweet shared last week. When contacted for comment, TRREB told STOREYS that it "does not share membership trends with the public." But Ingram believes there are two likely factors behind the decline.

"The first is way less favourable market conditions," Ingram tells STOREYS. "There have been a lot less sales, so less transaction scraps to go around, and prices have edged down too. Plus, things are staying on market a lot longer, which means you have to work harder to sell something."

He's right. It's no secret that home sales in Toronto and the GTA have slowed since the pandemic highs, when the market was hot and many folks saw an opportunity to profit as realtors. This July, for example, there were 5,391 home sales in Toronto — a number that pales in comparison to the 15,652 sales recorded in March 2021, according to TRREB data. Following that peak, sales remained higher than average for the rest of that year until, eventually, prices followed suit, hitting a record-breaking average home price of just over $1.3M in February 2022. For comparison, the average Toronto home costs $1.1M as of July 2024.

All this is to say that, for some, being a realtor isn't as lucrative as it was two or three years ago, especially for those who only work part time or on occasion. And when you add various membership fees into the mix, it becomes even less appealing.

"Outside of market conditions, OREA (the Ontario Real Estate Association) brought in mandatory health insurance for its members (ORWP), adding $660 to the bunch of other industry fees we already pay," explains Ingram. The health insurance plan, the Ontario REALTOR® Wellness Program, was introduced in January of this year and adds hundreds of dollars to other annual fees realtors may be paying, including TRREB, CREA, and other OREA dues, not to mention entrance fees for new realtors.

Of course, a TRREB membership is a valuable resource for active realtors to have. Founded in 1920, TRREB is Canada's largest real estate board, providing members with access to key resources like the Multiple Listing Service, Buyer Registry Service, Market Reports, and data — resources which essentially give members a leg up when it comes to amplifying listings and knowing what's on the market.

But for casual realtors who may not sell a single home over the course of a year, that's money wasted. "Long term agents are rolling with the punches, but all of those factors [...] make things a lot more discouraging to remain, or enter, for the side-hustlers," Ingram tells STOREYS. "So some haven't renewed, and people that have thought about joining have "remained on the sidelines," to use TRREB's parlance for buyers."

Steve Tabrizi, a Toronto broker and COO of RE/MAX Hallmark Group of Companies, shares Ingram's sentiment. He explains that over 80% of realtors conduct fewer than five transactions a year, and "increasingly volatile" market conditions are making it even harder for them to close those deals. "This unpredictability has led to reduced income, driving many agents to leave the industry, largely due to personal economic pressures," Tabrizi tells STOREYS.

On top of that, the industry is undergoing a technological, regulatory, and sociological evolution — one that is potentially squeezing many agents out of the profession.

"The rise of technology and online platforms has fundamentally changed the way real estate transactions are conducted," says Tabrizi. "Buyers and sellers are increasingly relying on digital tools, which has made it more challenging for some realtors to compete, particularly those who haven’t adapted to these new technologies."

As well, the recent introduction of the Trust in Real Estate Services Act (TRESA) to Ontario has resulted in "a substantial increase in regulatory and compliance complexities even for seasoned realtors and brokers," explains Tabrizi. These stricter rules bring a higher level of risk that has led some to leave the field, he says.

At the root of these regulatory changes, in Tabrizi's opinion, is the evolving behaviour of consumers. "Modern consumers are increasingly informed and self-reliant, often conducting their own research," he says. "Many agents struggle to clearly articulate their value proposition or justify their services, largely due to a lack of comprehensive knowledge, not only within their regulatory framework but also in understanding the economic landscape, contract law, and customer needs."

Toronto realtors currently stand at a cost-benefit-analysis-inducing crossroads of slow market conditions and an increasingly hard-to-traverse industry. For some, the changing real estate landscape will edge them out, especially if profits increasingly fail to justify financial and mental pressures realtors are experiencing. But those who can adapt will continue to see success.

"For the first time in over a decade, Ontario has seen a reduction of approximately 4.5% in the number of active realtors, and I believe this trend will persist," say Tabrizi. "It’s likely that the top 20% of agents will continue to control the majority of the market share."