Following record-breaking lows for GTA new home sales in May, data released by the Building Industry and Land Development (BILD) today shows sleepy conditions continued into June in the thanks to structural barriers and high costs to build.

In May, GTA new home sales stooped to 936 sales — the second lowest on record since BILD started keeping track in 1990 — with the lowest being May 2020 and the third lowest being in January 2009.

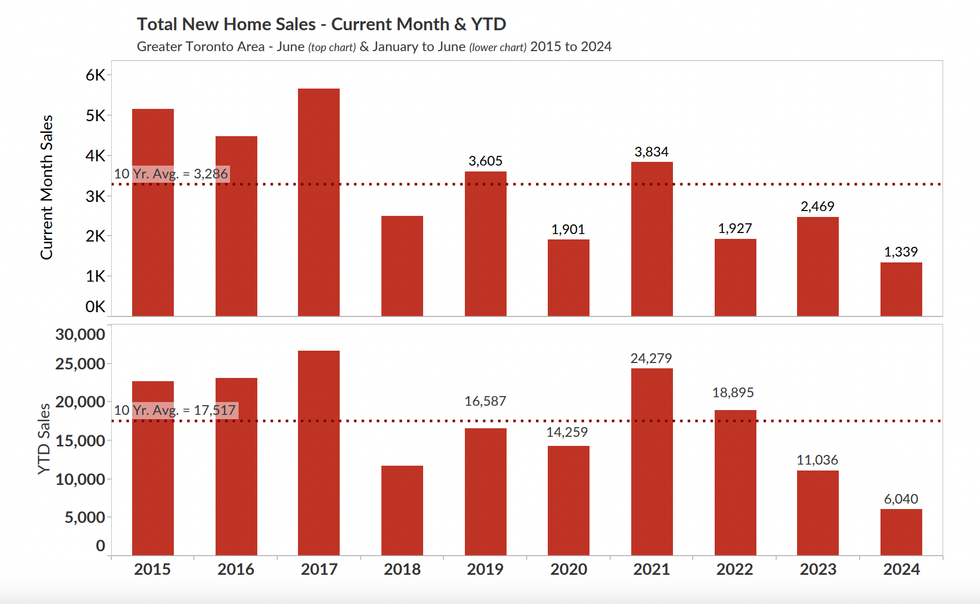

In June, that number ticked up to 1,339, but was still down 46% from June 2023 and 59% below the 10-year average, according to Altus Group, BILD’s official source for new home market intelligence. A month-over-month increase for sure, but a nominal one, and not enough to indicate a notable boost in supply and affordability, according to Justin Sherwood, SVP Communications and Stakeholder Relations at BILD.

"Significant ongoing structural issues, notably the cost to build and lengthy approval timeframes, are hampering the ability for new projects to come to market – and limiting affordability," he says.

Of the 1,339 new homes sold, sales were roughly split between condominium apartments and single family homes, with the former accounting for 732 units sold and the latter making up 607 units sold. This brought condo sales down 61% from June 2023 and 68% below the 10-year average, while single family home sales ticked up 5% from June 2023, though still 38% below the 10-year average.

It was business as usual for new home remaining inventory in June, which has hovered around 20,000 homes since fall 2023, except it jumped to 21,158 from 20,427 units last month, maintaining May’s combined inventory level of 14.5 months. Of those units, 82% of them were condominiums at 17,391 and 3,767 were single-family dwellings.

As for benchmark prices, they remained 'sticky' in June, with prices for new condominium apartments falling to $1,023,389, down 6% over the last 12 months, and new single-family homes ticking down to $1,613,613, also down 6% over the last 12 months.

"What we're seeing is price stickiness," Sherwood told STOREYS. After prices dropped by about 15–20% from their 2022 peak, "we’ve seen the average single family house price sit at around 1.6M and the average condo price sit at around 1M" — a stagnation that Sherwood credits to building costs, government fees, taxes, and charges, and the cost of land.

Justin Sherwood

Justin Sherwood

Sherwood says today's 0.25% interest rate cut is "a step in the right direction, but consumers are going to need to see a couple more cuts before they step off the sidelines,” adding that, ultimately, governments will need to take more action to increase supply and lower prices for consumers.

"Government fees, taxes, and charges account for 25% of the cost of a house, whether high-rise or low-rise," he says. "The easiest and quickest way to reduce housing costs is to moderate those costs, and it’s well within the jurisdiction of governments to change that." As well, Sherwood stressed the need for quicker approvals as "every month of delay adds $2.50 per sq. ft to the cost of building," he says. "And we’re looking at delays of 20 months, so you can do the math."