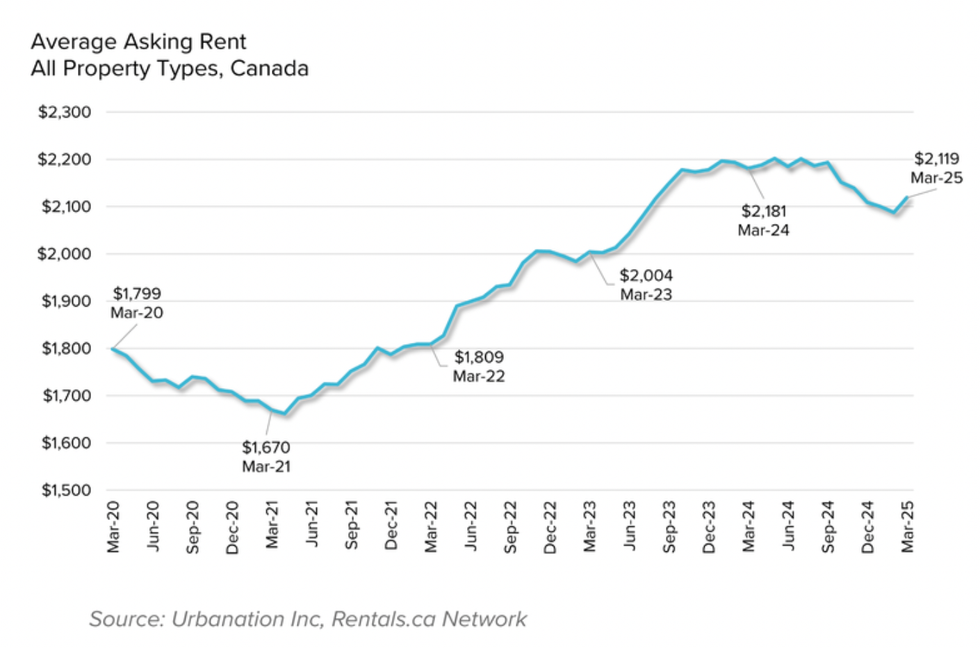

The latest rent report from Rentals.ca and Urbanation shows national average asking rent continued to decline on an annual basis in March, continuing a now six-month trend that began in November 2024 when rents began falling for the first time since 2021.

A win for renters and a loss for landlords, the reversal of skyrocketing rents seen in 2022 and 2023 is largely the result of reduced immigration, foreign temporary workers, and international students, as well as an influx of new rental completions coming to market.

While national average rent fell to $2,119 last month, representing a 2.8% year-over-year decrease, rents increased on a month-over-month basis for the first time since September 2024. Prices increased at a rate of 1.5% between February — when rents hit an 18-month low at $2,088 — and March.

Rentals.ca and Urbanation attribute the month-over-month increase to renters returning to market following the typically slower winter months, alongside a spike in interest due to more affordable conditions. Still, the downwards trend persists.

"Elevated supply driven by record apartment completions continued to weigh on rents in most parts of the country," reads the report.

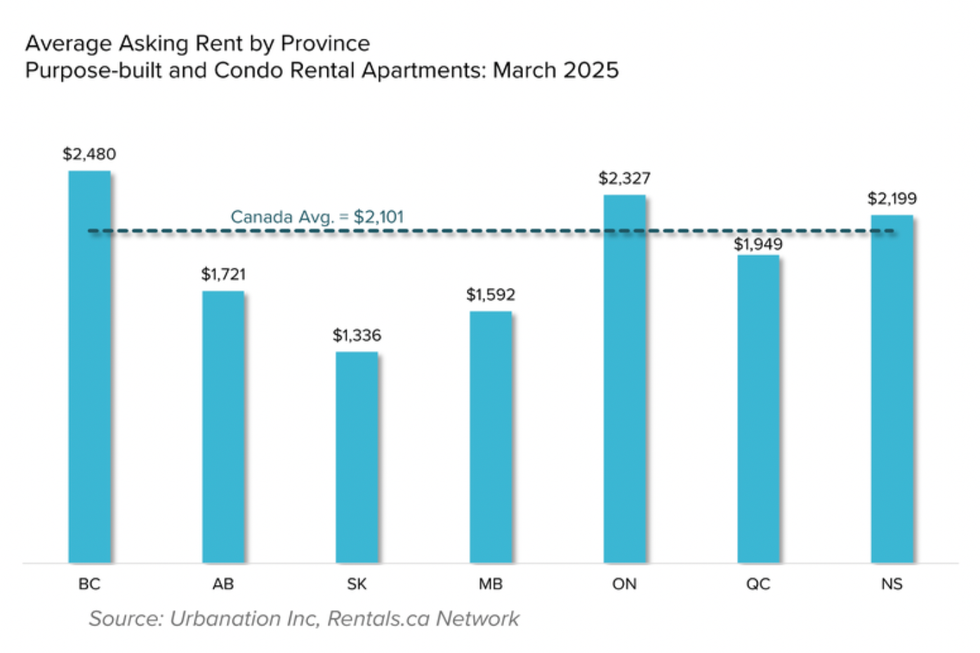

Ontario and Quebec saw the most substantial annual rent decreases in March, with Ontario posting a 3.5% slide to $2,327 and Quebec falling 2.5% to $1,949. Lesser declines were seen in BC and Alberta where rents fell 0.6% to $2,480 and 0.4% to $1,721, respectively, while Saskatchewan, Manitoba, and Nova Scotia saw rents continue to rise. Saskatchewan saw the most notable increase at 3.0% to $1,336.

The most dramatic decreases continued to be observed in the nations largest cities, including Calgary, which experienced the largest annual decline of 7.8% to $1,915, a two-year low. Calgary was followed by Toronto, where a 6.9% decrease brought rents to a 32-month low of $2,589 following 14 months of declines, and in Vancouver 16 months of annuals declines culminated in a 5.7% drop to a 35-month low of $2,822 .

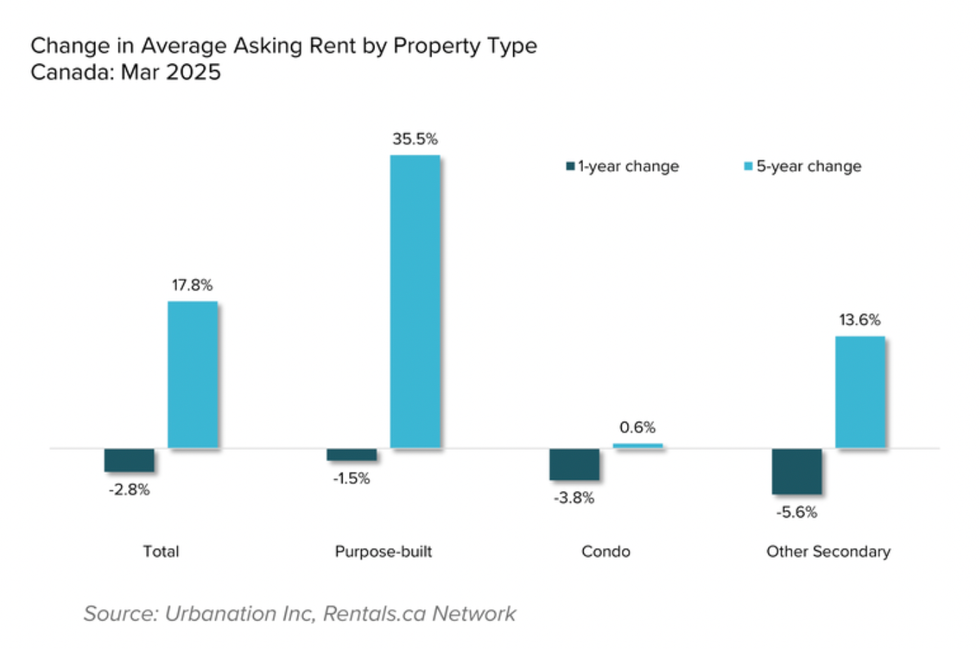

Still, on the purpose-built rental front, recent decreases follow a five-year period in which renters saw dramatic increases in these cities, including a 43.5% rise in Calgary, followed by 26.7% jumps in both Edmonton and Vancouver. Pulling up the rear, Toronto recorded a 12.1% increase in purpose-built rents over the last five years.

On the national level, average rents for purpose-built rentals grew by a whopping 35.5% in the past five years to an average of $2,086, while condo apartment rents, which have declined 3.8% in the last year to an average of $2,232, were only 0.6% higher than five years earlier in March 2020.

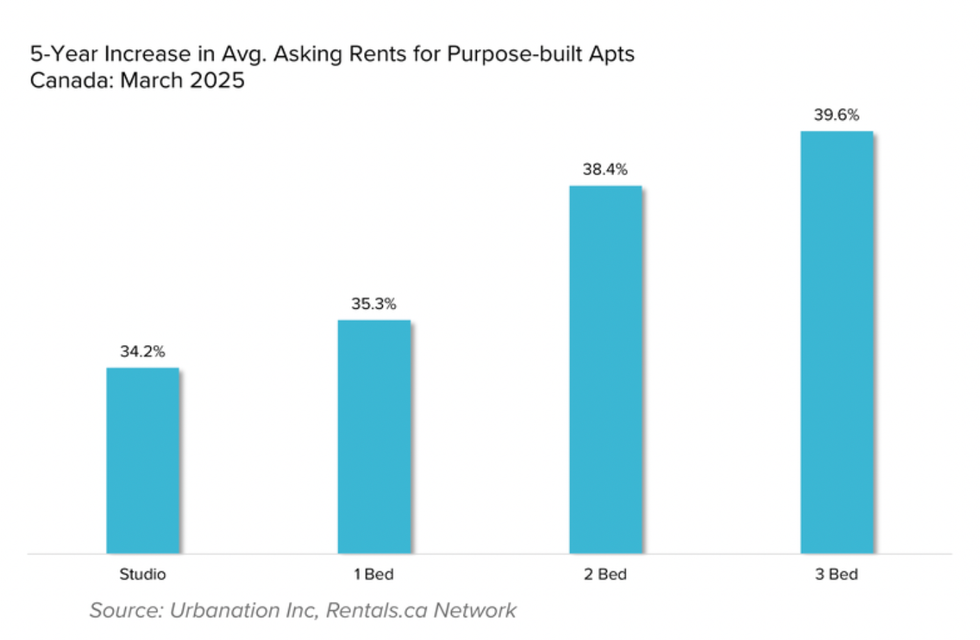

Looking at unit types, three-bedroom apartments saw the largest increases as rents for this unit type grew across all provinces in March, the largest of which was posted in Alberta where rents grew by 5.6% to $2,169.

Over the last five years as well, rent increases were concentrated in larger purpose-built rental apartments, including two- and three-bedroom units, which increased 39.6% and 38.4% during that time period. According to Rentals.ca and Urbanation, rent change for condos was negligible across all unit types over the last five years.

For shared accommodations, national average rents fell by 4% annually to $959 in March. Over the last year, the largest declines were seen in Montreal, where rent fell 9% to $862, and Toronto, where they fell 8% to $1,166.

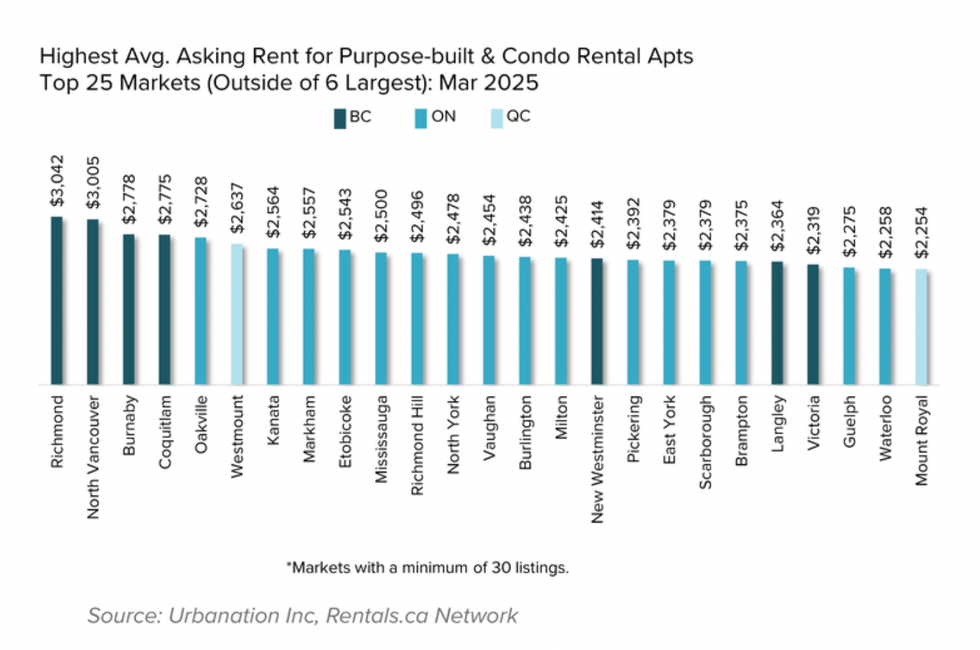

When it comes to affordability, the most recent data shows BC is home to some of the most unaffordable markets in Canada. These markets include Richmond at $3,042, North Vancouver at $3,005, Burnaby at $2,778, and Coquitlam at $2,775. Following close behind is Oakville in the Greater Toronto Area, averaging $2,728, and Westmount in the Greater Montreal Area, averaging $2,637.

If throwing your hard-earned money into monthly rent payments isn't appealing to you, the report shows the most affordable markets can be found in Alberta and Saskatchewan, including Lloydminster at $1,206, Fort McMurray at $1,300, Regina at $1,320, and Saskatoon at $1,414.

- “A Rare Occurrence”: Average Canadian Rent Falls For First Time Since 2021 ›

- Canadian Rent Growth Slows To 3-Year Low As International Student Enrolments Plunge ›

- Average Canadian Rent Reaches Lowest Point In Over 18 Months ›

- GTHA Projects Offering Rental Incentives Doubles In Q1 ›

- Canadian Rents Up 12% Since 2022, Despite Annual Dip ›