Summer's already feeling hot, but home values in Muskoka might be even hotter.

While sales in the the region appear to be slowing, desirable property types are seeing price hikes as an influx of new listings emerges.

According to new data from the Canadian Real Estate Association (CREA), residential non-waterfront sales activity recorded through the MLS System for the Lakelands region totaled 508 units in May, a 33.9% decrease from that same period in 2021.

Comparably, waterfront properties numbered 150 units in May of 2022, a 44.9% decrease from this same period the previous year.

READ: Sales Slow, But Prices Continue Rising in Muskoka’s Real Estate Scene

“Our housing market is playing out like many others in the province, with sales activity down from last year’s May record but more new listings returning to the market,” said Chuck Murney, President of the Lakelands Association of Realtors.

Ross Halloran – Broker and Senior VP Sales, Halloran & Associates, Sotheby’s International Realty Canada – agrees with Murney, but with one caveat.

"The next four weeks will confirm whether this is a temporary market adjustment or full-blown crash,” he says. “Historically, most waterfront sales occur from mid-April to mid-July, followed by a brief summer pause that usually picks up steam again in late summer (mid- to late August) right through the secondary peak fall season until the end of October.”

On a year-to-date basis, residential non-waterfront sales totaled 2,326 units over a five-month period; that’s a 27.3% decrease from the same timeframe in 2021. Conversely, waterfront sales experienced a greater downward trend with a 48.4% decrease in 2021 - that's 473 units sold over those five months.

"Again, low supply and a cooling of buyer demand equals [a] lower number of transactions" Halloran explains.

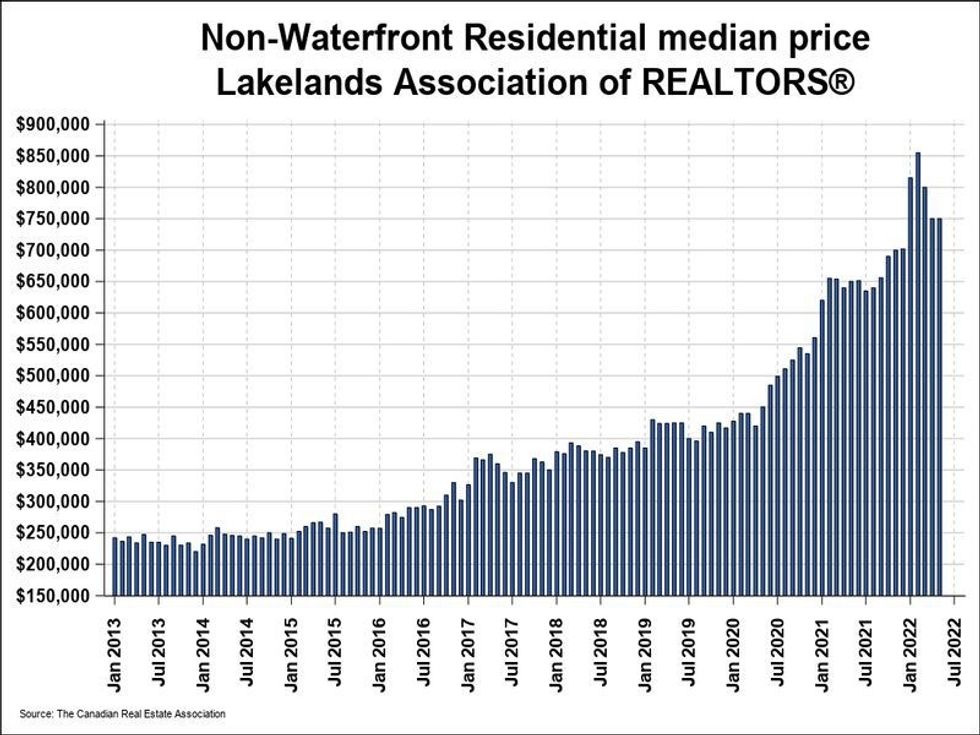

Last month, the median price for non-waterfront properties hit $750,000, up 15.4% from May of 2021. Furthermore, the year-to-date median price was $790,000, a sizeable 21.5% increase from the first five months in 2021.

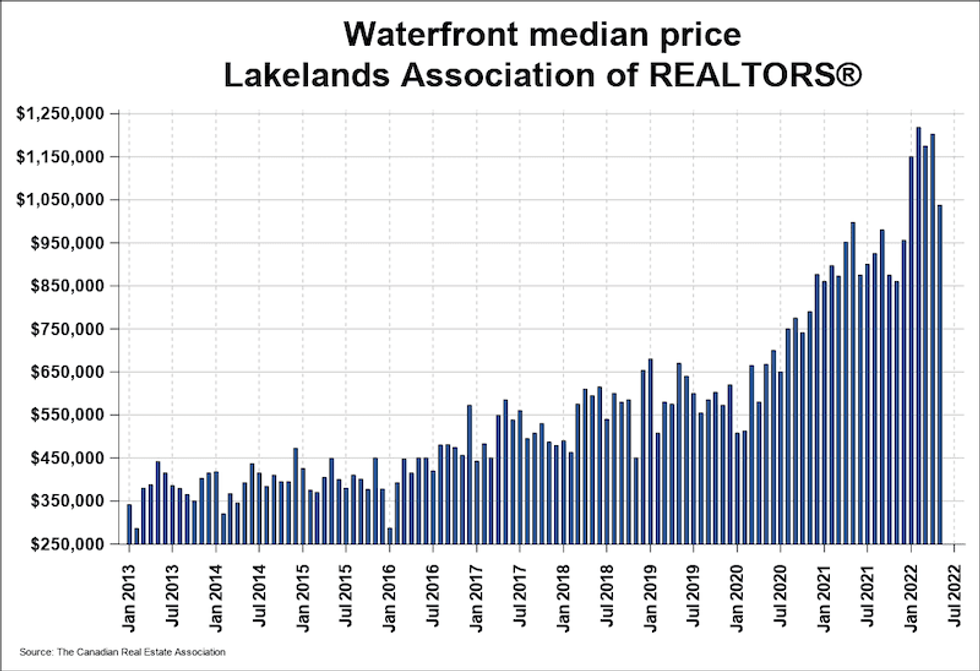

Comparably, waterfront properties saw their median price increase 4% from May of 2021, hitting $1,037,501.

“[We’re seeing] an approximate drop by 14% from April’s year-to-date median pricing, which further supports [a] transition to a more balanced market of inventory supply and buyer demand," says Halloran.

Meanwhile, the year-to-date median price was $1,150,000 -- a significant 23.7% increase from January through May 2021.

“[This is] a troubling modest increase given the low supply, and [it’s] a clear indicator of a softening or pause in buyer demand, along with more buyer pressure for lower average-list to final-sell-price ratios. ([The percentage] of 'list price and above' final sold prices are gradually decreasing to former 2018/2019 levels, where average sold prices were – and are now – approximately 95% of ask prices).”

The total dollar value of all non-waterfront sales totaled $436.1 million in May of 2022, a 23% decline from the previous year. Dropping sharply at 33.9% from 2021, the total dollar value of waterfront sales was $225.8 million in May of this year -- a "natural extension of fewer transactions at descending median values," according to Halloran.

The MLS Home Price Index (HPI) — which tracks price trends more accurately than can be done using average or median price measures — highlights the benchmark price for single-family homes was $833,600, an increase of 16.9% year-over-year. Townhouses/row units experienced a sizeable gain of 20.4%, putting prices at $662,100. Apartments showed the largest increase, up 23.3% from this time last year; the benchmark was $542,000.

“Low supply was still impacting average or median price measures in May, which are now gradually coming down in response to higher interest rates and a long-overdue gradual increase in supply inventory,” says Halloran. “[For example], an approximate increase from 25% of historic, lowest-ever inventory levels observed in April, up to approximately 50% of historic inventory levels trending a month later in May."

Potential cottage buyers should take note: in terms of competition, the waters are cooling. But when it comes to prices, you'd best be prepared for the heat.

This article was produced in partnership with STOREYS Custom Studio.