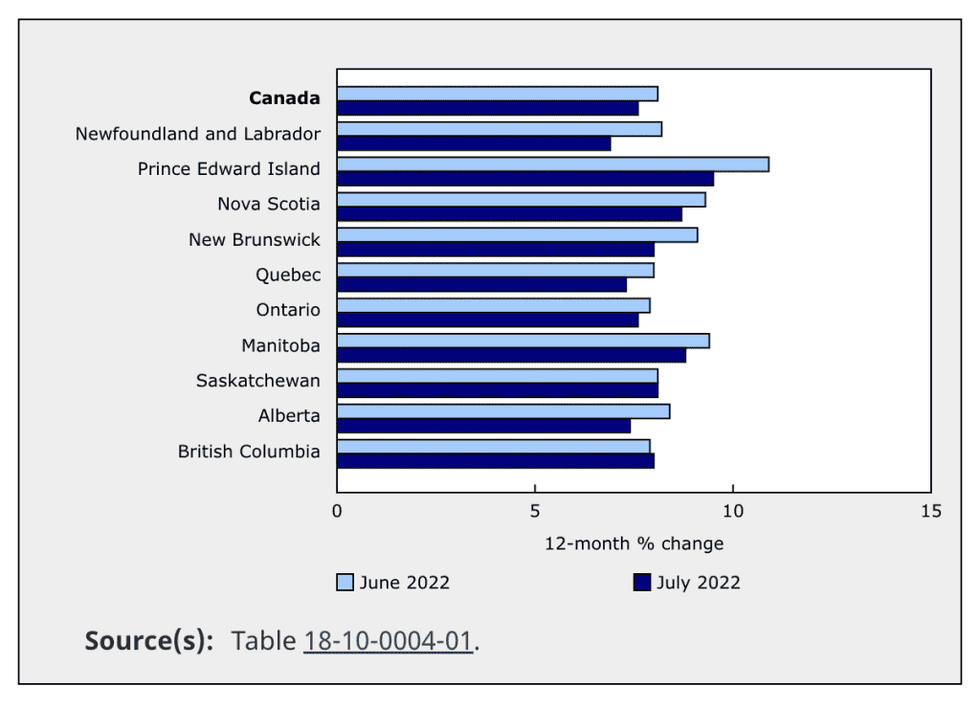

There’s more evidence that the scorching rate of inflation has reached its peak, as Statistics Canada (StatCan) reports growth of 7.6% in July. That’s the first month-over-month decline seen in 12 months, falling from June’s 40-year record of 8.1%.

StatCan pegs the decline on slowing gasoline prices, which rose 35.6% compared to 54.6% in June, the biggest monthly drop since April 2020.

Excluding that category, prices rose 6.6% within the benchmark basket of goods, following a 6.5% increase last month, including the cost of groceries, which rose 9.9%, and natural gas.

According to the data, on a monthly basis, the Consumer Price Index rose 0.1% in July, the seventh consecutive monthly increase. On a seasonally adjusted monthly basis, the CPI was up 0.3%. Both of these gains were the smallest, respectively, since December 2021, says StatCan. The cost of in-person services, such as flights (+25.5%), dining out, and hotel stays, also contributed to the monthly uptick.

Wages were also on the rise in July, posting growth of 5.2%, shrinking the gap in purchasing power, despite inflation outpacing those gains.

While home prices are not part of the CPI measure, the mortgage interest cost index makes up a substantial portion of the basket of goods. It rose 1.7%, the first increase since September 2020, as higher bond yields and interest rates have made their mark on the cost of borrowing.

Other increases in the home ownership category included a slower pace of growth for owned accommodation expenses (+9.7%), as well as homeowner’s replacement costs (+9.1%), “reflecting current trends in many regional housing markets across Canada.”

StatCan also flags that given today’s higher mortgage rate environment, upward pressure will be placed on rents, which rose 4.9% YoY in July, and up from 4.3% in June. Rental markets in Ontario lead the surge (up 6.4%) and in Alberta (+3.4%).

READ: National Average Rents Saw Another 10% Increase in July

This most recent reading aligns with the forecast from the Bank of Canada, which called for prolonged high inflation in the 8% range before chilling in the final quarter of the year.

Persistently high inflation has been the impetus behind the central bank’s aggressive hiking cycle, which kicked off in March, and has raised its benchmark cost of borrowing from a pandemic-era low of 0.25% to 2.5% today. Most recently, the Bank stunned markets and borrowers with a surprise 1% hike in July; it’s widely anticipated that a 0.75% increase is in the cards for its next announcement on September 7. In total, another three rate hikes are largely expected by analysts in 2022 -- but concerns of a recession could slow the Bank’s roll.

A recent analysis from RBC calls for the Bank’s rate to hit 3.5% this year, following a similar 3.5 - 3.75% from the US Federal Reserve, which the Canadian central bank takes its cues from. According to the lender’s report, this “will ultimately tip the US and Canadian economies into moderate recessions next year.”

The fact that inflation is starting to chill could be an indicator that the Bank of Canada will slow its approach; similar inflation data from the US Fed also saw inflation moderate last month, falling from 9.1% to 8.5%. Combined, this may be an early sign of rate relief on the horizon, as both central banks look to avoid stoking a recession -- but borrowers will have to wait and see what direction the BoC takes in its next rate move come September.