With fundamentals like a stable government, strong immigration, and steady growth in property prices at play, it’s really no wonder that investors over the years have been happy to slice themselves a piece of the Canadian real estate pie. But while all levels of government have been quick to chalk up investment activity to foreign buyers, new data from global commercial real estate firm Avison Young shows that the lion’s share of income property sales in Canada are actually thanks to domestic investors.

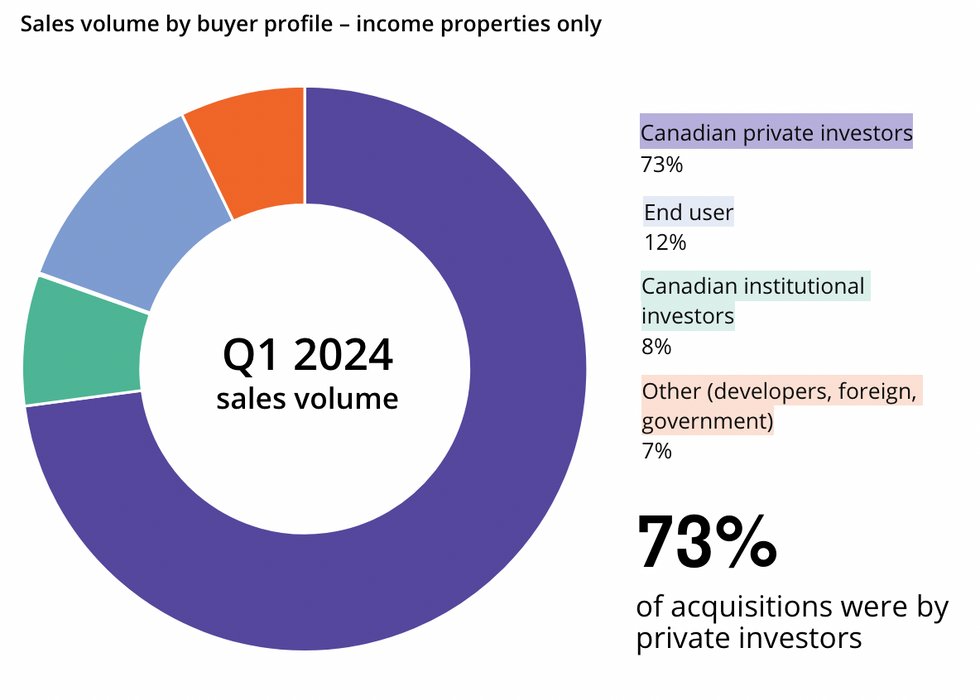

In fact, for the first quarter of 2024, Avison Young reports that “Canadian private investors dominated acquisitions of income-producing properties, representing 73% of transactions, while Canadian institutional investors made up a modest 8%.”

End-users had a 12% share of overall sales in the quarter, while other purchasing entities — including developers, government, and foreign buyers — only accounted for 7% of those same purchases.

The share of domestic investors in the sales pool is up from the quarter prior, when 63% of income property transactions were attributed to Canadian private investors and 7% to Canadian institutional investors. According to Avison Young’s Q4-2023 report, foreign investors accounted for a 14% share of income property sales, while other entities — this time, including developers, end-users, and government — accounted for 16%. The last quarter of 2023 was the first-ever time Avison Young published this nature of data.

Circling back to the Q1-2024 data, Jessica Toppazzini, Managing Director of Avison’s Vancouver’s office, points out that the “majority of the largest deals” recorded in Vancouver specifically so far this year have come from foreign investors, drawing attention to a sort of bifurcation that's happening at national and some local levels.

Speaking to Canada on the whole, Toppazzini notes that “Canada still remains attractive to foreign investors given our strong fundamentals and discipline, secure banking and a strong economic outlook in GDP, population growth and employment.”

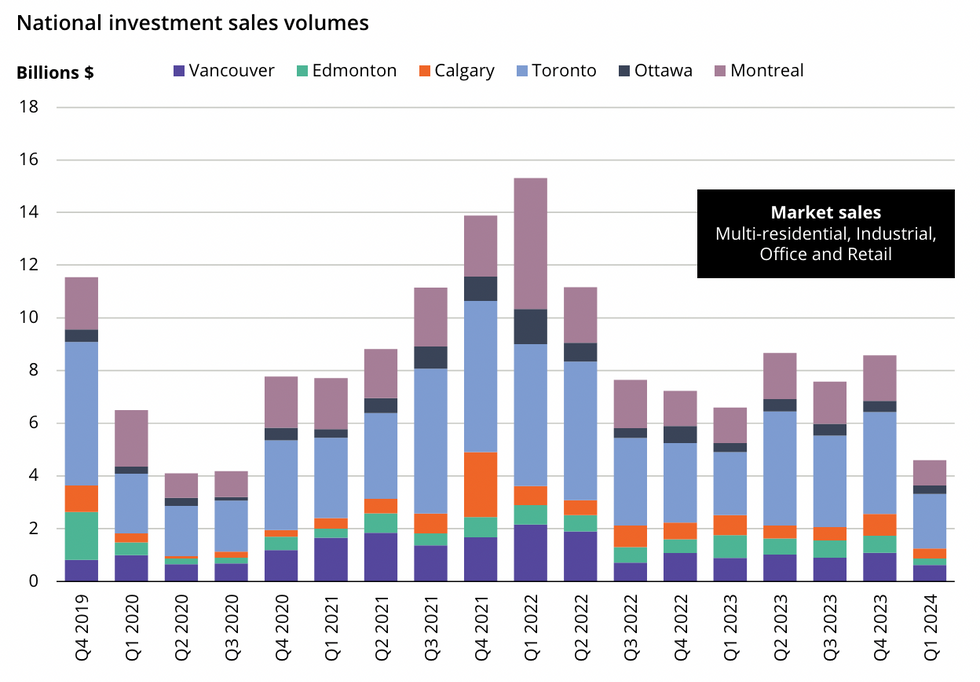

Avison’s Wednesday report also shows that overall sales activity dropped off considerably in the first quarter compared to the quarter prior, with the dollar value of investment coming in at just under $5B. In Q4-2023, that same metric was just above $8B.

Amy Erixon, who founded and heads Avison’s Global Investment Management practice, explains that interest rates, unsurprisingly, are to blame for that quarter-over-quarter disparity. “As private buyers have recently dominated the buyer pool, the highly anticipated future rate cuts decreased volumes in Q4 2023 and Q1 2024,” Erixon says. “Eager buyers may find the interest rate market remains higher for longer than hoped, while prices barely budge.”

Though investment sales so far in the year have been slow, relatively speaking, Matthew McWatters, Principal, Managing Director and Canadian Leader of Avison’s Valuation, Advisory, and Property Tax Services, points out that many investors, while waiting for interest rates to come down, are taking the opportunity to “explore alternative real estate investments driven by an increase in expected returns and risk management.”

“This is creating opportunities in niche sectors, such as data centres, as investors look to diversify their portfolios amid market uncertainty,” McWatters says.