While gains remain marginal compared to the first half of 2024, housing starts continued to tick up in June, according to the most recent data from the Canada Mortgage and Housing Corporation (CMHC).

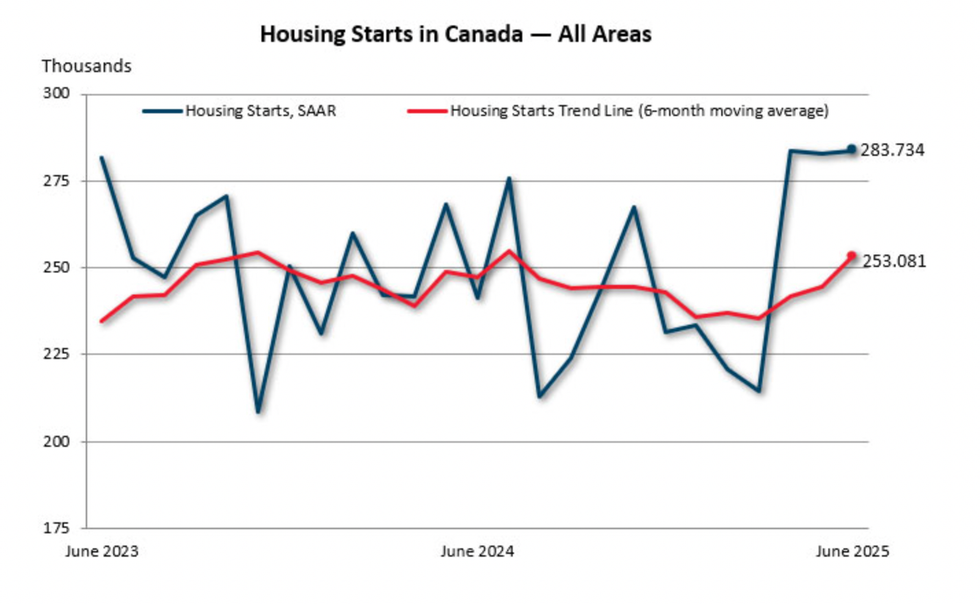

After surging 30% in April, the seasonally adjusted annual rate (SAAR) of housing starts remained more or less flat between April and June, meanwhile the six-month trend in housing starts grew by 3.6% to 253,081 units following a slight 0.8% increase in May. Actual housing starts were also up 14% year over year, clocking in at 23,282 units last month, compared to 20,509 units in June 2024.

Month over month, housing starts remained in the positives, but at 0.4%, the growth between May and June was also nominal, increasing from 282,705 to 283,734 units.

According to analysis from TD Economics, June's numbers, while tempered, "surpassed expectations, helping second-quarter starts growth notch a record gain." TD foresees this stable growth bolstering residential investment in the near-term and helping to support other sectors in our weakened economy.

With building permits at elevated levels, TD sees homebuilding maintaining it's solid clip in the near-term, but warns that factors like oversupply and low immigration are weighing on rents, driving down investment in new housing starts. Meanwhile, high construction costs and economic uncertainty stemming from a range of geopolitical conflicts, including the trade war with the US, could further weigh on sales, and thus, housing starts.

Progress, however, varies widely depending on geographic location and property types.

“Through the first six months of the year, national housing starts have increased marginally compared to 2024, however, new home construction varies significantly across Canada," said Kevin Hughes, CMHC’s Deputy Chief Economist. "Québec and the Prairie provinces have accelerated the pace of construction for single-detached homes and purpose-built rentals. By contrast, weak condo market conditions in Toronto and Vancouver have contributed to declines in overall housing starts in these regions."

Starting with Canada's three largest cities, Vancouver posted a 74% year-over-year jump in starts this month, boosted by a 97% increase in multi-unit starts. It should be noted that these June data points buck a longer-term trend of Vancouver dragging down national housing starts alongside Toronto, which saw its starts fall 40% in June, driven by a 47% drop in multi-units.

Looking back to the beginning of the year, Vancouver saw actual housing starts fall 48% in February, 59% in March, and 10% in May, broken up by a 37% increase in January and a 6% uptick in April. In Toronto, starts plunged 41% in January, 68% in February, 65% in March, 25% in April, and 22% in May.

In another reversal of recent trends, Montreal posted a 8% decline in actual starts in June, driven by a decrease in multi-unit starts after recording substantial gains in that segment over the course of 2025.

On the provincial level, only three provinces saw month-over-month seasonally-adjusted increases, led by BC at a 76% increase from 36,371 units in May to 64,194, followed by PEI with a 54% increase, and New Brunswick with a 12% increase. On the flip side, the Prairies struggled in June, with Manitoba posting at 39% decrease, followed by Saskatchewan at -15% and Alberta at -9%. Meanwhile, Ontario and Quebec both reported at 14% drop in housing starts.

- Canadian Home Sales 'Turn A Corner' In June, But CREA Calls For A Cautious Road Ahead ›

- Annual Pace Of Canadian Housing Starts Surge 30% In April ›

- Canadian Housing Starts Flat In May, At Lowest Level Since '09 In Ontario ›

- Rental Market Drives Canadian Housing Starts To Multi-Year High ›

- GTA Rental Supply Deficit To Hit 235K Units In Ten Years ›