The Greater Toronto Area’s spring selling season continued on a sluggish trend in April, with the Toronto Regional Real Estate Board (TRREB) reporting just 5,601 sales. Though that figure is up slightly from the 5,011 sales reported in March, it represents a 23.3% decrease year over year and makes this the second-slowest April for the region since 1996, when 5,070 sales were reported. The April to beat over the past 29 years happened in 2020, when the pandemic all but froze the market and just 2,975 sales were reported.

After adjusting for seasonal effects, April's transactions were up 1.8% to 4,267 sales.

In a press release, TRREB said that last month's sales “followed the regular seasonal trend with an increase relative to March,” but that “potential buyers continue to wait for lower borrowing costs and for certainty about the trajectory of the economy.”

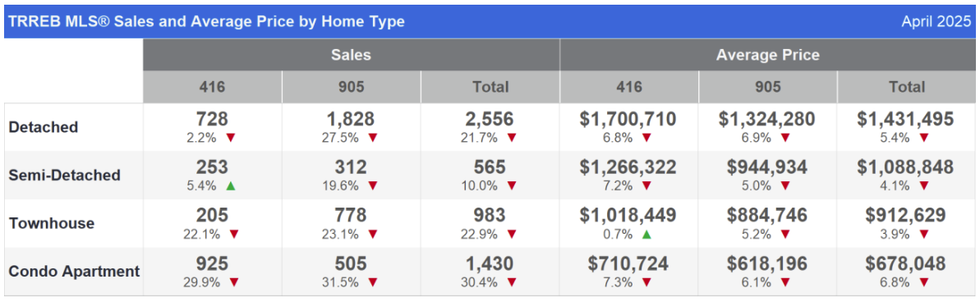

Most of April’s transactions were concentrated in the detached home segment, with 2,556 sales recorded (down 21.7% year over year), compared to 1,430 condo apartment sales (down 30.4%), 983 townhouse sales, (down 22.9%), and 565 semi-detached sales (down 10%).

As was the case in March, new listings continued to accrue on the market, with 18,836 recorded across all property types. That figure is up 8.1% from April 2024. Seasonally adjusted, new listings were down just 0.7%. April's level of new listings puts the sales-to-new-listings ratio at 30%, down from 42% the month prior. Since a ratio below 40% indicates a buyers' market, last month saw the GTA pushed deeper into buyers' territory.

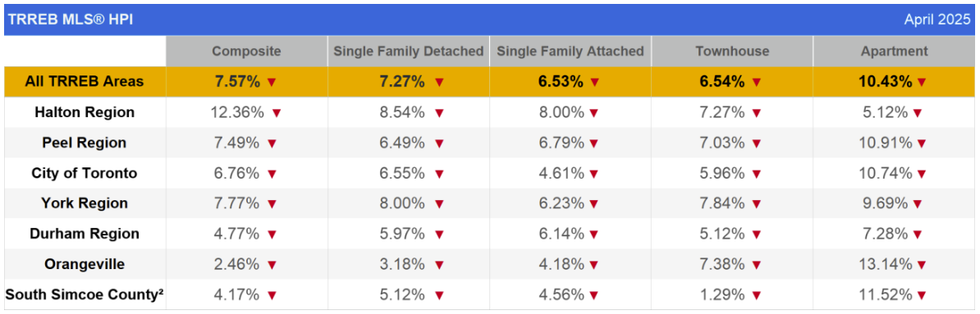

Meanwhile, the average selling price, at $1,107,463, slipped by 4.1% year over year, but by just 0.7% month over month after adjusting for seasonal effects. Also seasonally adjusted, the MLS® Home Price Index Composite benchmark was down 5.4%. The composite benchmark was down across all property types and all TRREB areas in the month, with the greatest declines observed in the apartment segment and the Halton Region.

With inventory levels continuing to be elevated, buyers enjoyed “substantial” choice in April, according to TRREB’s Chief Information Officer Jason Mercer. “Buyers took advantage of this choice when negotiating purchase prices, which resulted in a lower average price across market segments compared to last year,” Mercer said. “Lower prices coupled with lower borrowing costs translated into more affordable monthly mortgage payments.”

Although the next interest rate decision isn’t until June 4, the Bank of Canada has announced 225 basis points of cuts over the past 11 months, and economists are with TD, RBC, BMO, and CIBC are anticipating further interest rate cuts from Bank of Canada through this year, which should help to draw buyers into the market. Canada's relationship with the US will also have a part to play.

“Following the recent federal election, many households across the GTA are closely monitoring the evolution of our trade relationship with the United States,” said TRREB President Elechia Barry-Sproule. “If this relationship moves in a positive direction, we could see an uptick in transactions driven by improved consumer confidence and a market that is both more affordable and better supplied.”

In the longer term, TRREB is forecasting an average selling price of $1,147,000 across all property types, marking a moderate 2.6% rise over 2024, as well as 76,000 transactions by the end of the year, which takes into account a degree of tariff uncertainty and is well below the 2021’s record of over 120,000 transactions.

For the GTA's condo market specifically, TD has recently called for prices to come down another 10% this year, which would put values 15% to 20% off their summer 2023 peak.