[Update: On March 12, Dream Residential REIT announced that it had selected TD Securities as the financial advisor for the review.]

On Wednesday, after hours, Toronto-based Dream Residential REIT (TSX: DRR.UN) published its Q4 2024 report and year-end results, simultaneously announcing that its Board of Trustees had initiated a process to review the REITs operations with the goal of maximizing unitholder value.

"Working with management, the Board will retain a financial advisor to help assess and explore the strategic alternatives available to the REIT," the company said in a press release. "Given the persistent discount between the REIT's trading price, its net asset value (NAV) per Unit, and the Board and management's view of the REIT's intrinsic value, the Board concluded that it would be in the best interest of the REIT and the unitholders to conduct a complete strategic review of its business and organization."

According to the REIT, a definitive timeline for the strategic review has not been established and no decisions or transactions have been made.

"As such, the process is subject to unknown variables including the costs, structure, terms, timing and outcome," the company said. "There can be no assurance that the engagement of a financial advisor or the Strategic Review will result in any transaction or initiative or, if a transaction or initiative is undertaken, as to the terms or timing of such a transaction or initiative and its impact on the financial condition, liquidity, and results of operations of the REIT."

Additionally, Dream Residential REIT said it "does not intend to disclose further developments in connection with the review until it is determined that disclosure is necessary or appropriate or required."

The Board of Trustees currently consists of Vicky Schiff (Independent Chair), Leonard Abramsky (Independent), Fahad Khan (Independent), Brian Pauls (Dream Residential REIT CEO), and P. Jane Gavan (President, Asset Management, Dream Unlimited).

Dream Residential REIT

Still in its relative infancy, Dream Residential REIT was established on February 24, 2022 and commenced operations on May 6, 2022 following an initial public offering of 9,620,000 units for a total of $125,050,000 (USD) — $12.99 per unit.

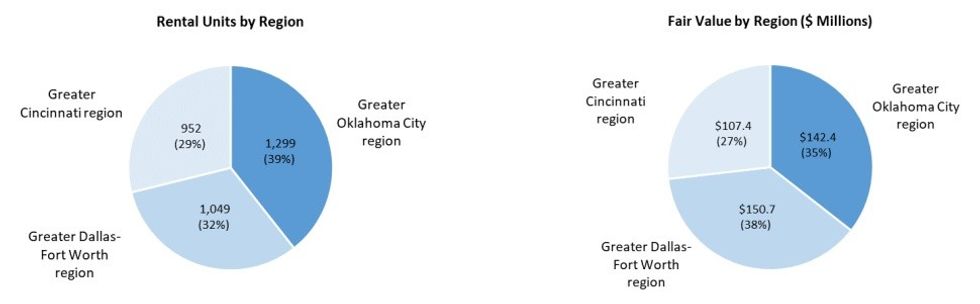

The REIT then acquired a portfolio of 16 "garden-style" multi-family properties with 3,432 total units, all located in the United States. On November 29, 2023, the REIT sold one of those properties — located in Wichita, Kansas — and its portfolio remains at 15 properties and 3,300 units as of December 31, 2024.

In its 2024 annual report also published on February 19, the REIT outlined the tenets of its strategy.

"We continue to pursue a disciplined external growth strategy that includes third-party acquisitions and investments," it said. "We expect to target multi-residential assets located in growing markets of scale that feature favourable economic and demographic trends. Based on our asset managers' experience and on-the-ground knowledge, we believe that we can identify strong assets that will outperform the market as well as underperforming assets where we can improve performance."

"We leverage our in-house property management team to implement value-add and cost-saving initiatives in our portfolio," the REIT added. "Our management team and asset managers have extensive experience executing on similar value-add initiatives. Having an internal property management team also enables us to take a disciplined approach to cost-saving initiatives at the individual property level and for the broader portfolio."

The REIT also said it operates with a focus on maintaining a strong balance sheet and liquidity position through secured fixed-rate mortgages with staggered debt maturities in order to mitigate interest rate risk and limit refinancing exposure. It said it also intends to enter long-term loans at fixed or variable rates when borrowing conditions are favourable and may also seek financing from other sources of low-cost capital.

Dream Residential REIT's unit price closed at $6.75 (USD) on Wednesday.