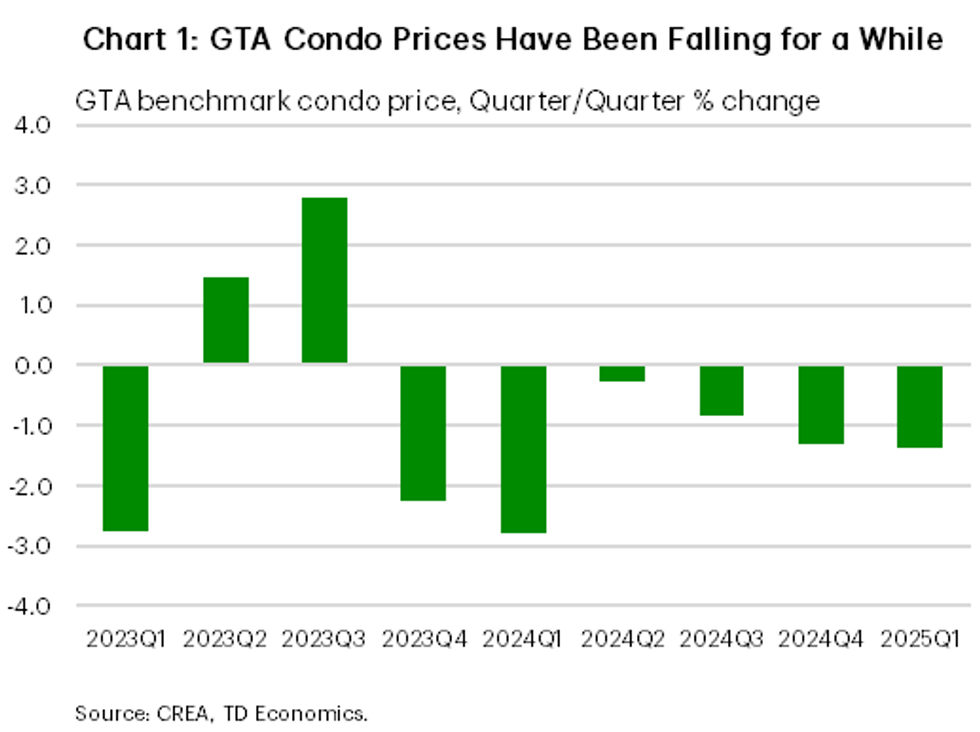

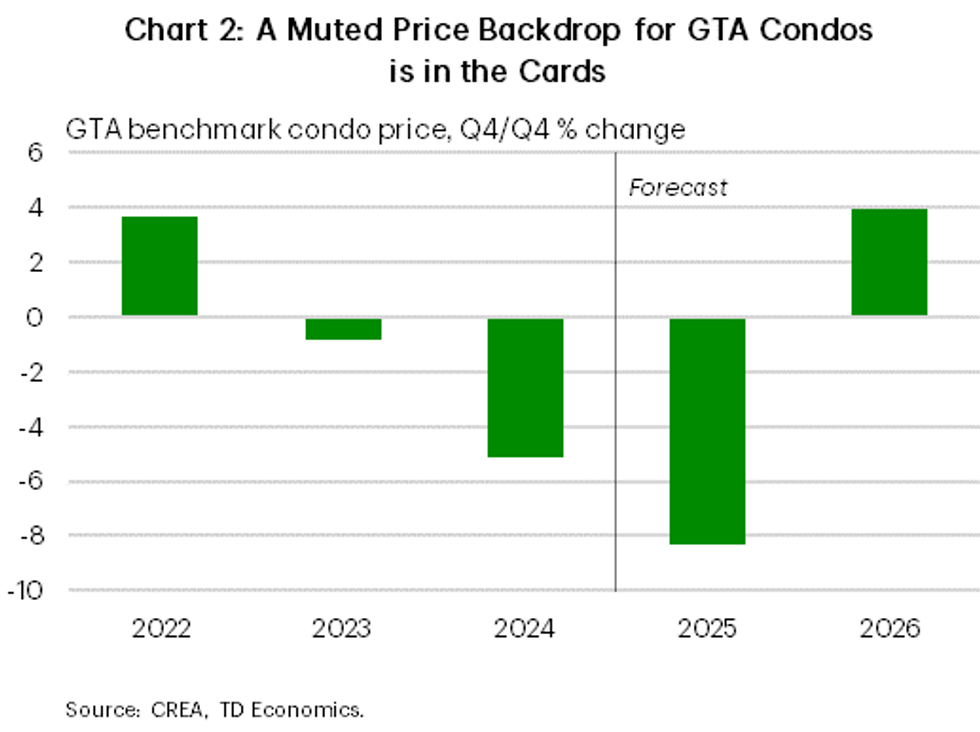

Recent data from TD Economics' GTA Condo Market Outlook points towards condo values falling by 15-20% from their peak in Summer 2023 by the end of 2025, with 10% of that decline taking place in this year alone.

The price slide projection comes after a pivotal year for the GTA resale condo market, when benchmark prices fell 4% on an annual basis and sales plummeted to levels not seen since the financial crisis of '08 and '09.

Driving the decline was a fall off in demand as condos became less desirable investment purchases due, in part, to higher interest rates compared to those of the pandemic buying frenzy days, alongside a "glut" of supply, effectively tipping the market into buyers' territory in 2024.

Continued weakness into 2025, alongside a number of unforeseen developments, has led TD to revise their September projection, which saw resale condo price decline tapering off in early 2025. Now, TD economists expect prices to fall through the rest of this year, undoing much of the appreciation condos enjoyed during the pandemic. Still, prices remain 10-15% above pre-pandemic levels, includes the report.

The revised projection is largely the result of reduced demand stemming from trade war-related uncertainty, slower population growth, and the continued elevated delivery of new condo supply. More specifically, the US-led trade war has sidelined many buyers who are now less inclined to make major purchases. One study from TD revealed that 25% of respondents were "less likely to make a major purchase given the trade tensions," while a projected 7% unemployment rate by Q3-2025 and slowing wage growth are poised to only make things worse.

Also on the demand side, lower immigration targets are slowing population growth across Canada and putting downwards pressure on rents, thereby reducing investor sentiment. In Q4-2024, average rent for a one-bedroom resale condo in the GTA fell 5% year over year, according to TD.

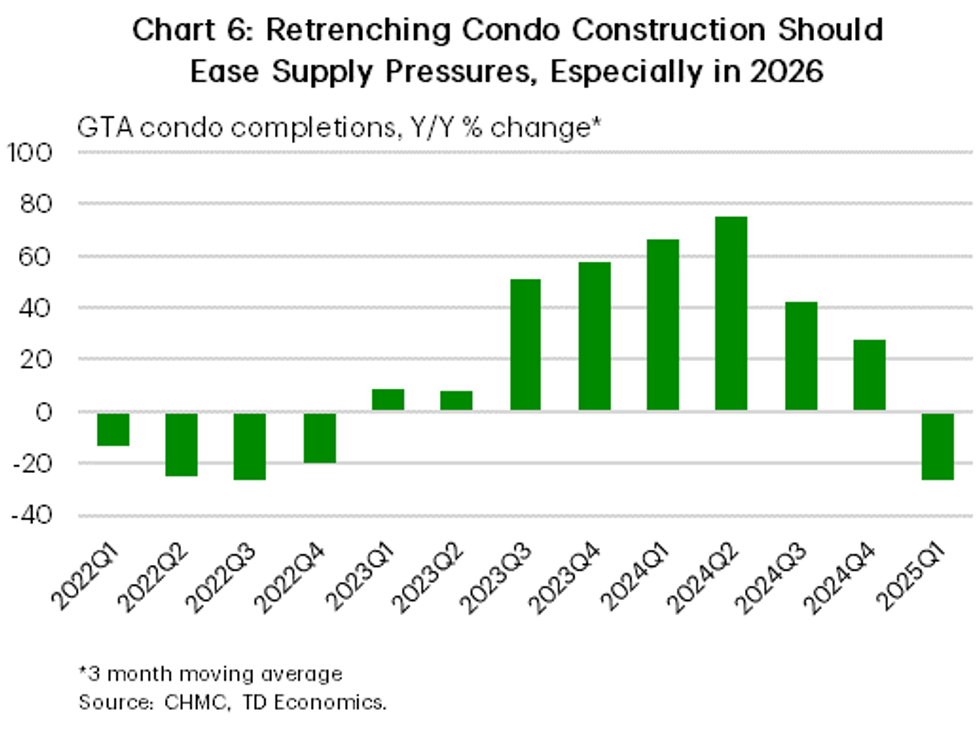

On the supply side, historically high levels of condo completions seen in 2024 should continue to fall over the course of 2025, but will remain high compared to previous years, further contributing to downwards pressure on prices as supply deepens.

Looking to 2026, TD expects the market to be "firmer" but says "chances of a heroic rebound appear slim.”

Some tailwinds expected to breath a hint of life back into the condo market next year include lower interest rates, as the Bank of Canada is expected to cut their policy rate by an additional 50 bps this year, bringing it to 2.25%, and decreased uncertainty surrounding tariffs.

On top of these factors, condo completions are expected to decrease more meaningfully in 2026 and new pro-housing growth policies from newly-elected Liberal government, such as the elimination of GST for first-time homebuyers on homes priced at or under $1 million, could increase demand for condos.

But headwinds in the GTA condo market remain strong, hence TD's doubts regarding a "heroic rebound."

As of now, population growth is still expected to slow, investors are still unlikely to return to the market, and prices are likely to remain within the 'unaffordable' range for many everyday buyers. Additionally, recovery from tariff-related uncertainty will take time, "reflecting scaring on the psyche of households and businesses from the trade war," as TD puts it.

- GTA Condo Supply Is Approaching A Number “The Market Has Never Seen” ›

- What The GTA Housing Market Can Expect In 2025 ›

- Toronto Home Sales Slide 23% In March As Listings Pool On The Market ›

- Toronto Real Estate Board Forecasting 'Buyer-Friendly' 2025 ›

- "Havoc": GTHA New Condo Sales Plunge 90% Below 10-Year Average ›

- From Pandemic Peaks To Pricing Reality: What GTA Sellers Need To Know ›