Canadian rents continued to slide in June, with the most pronounced declines reported in BC and Alberta and in Canada's largest cities. Driving the decline is a combination of low immigration and over supply leading to higher vacancy rates and longer vacancy terms, under which landlords are beginning to cave.

“Rent decreases at the national level have been mild so far, with the biggest declines mainly seen in the largest and most expensive cities," said Shaun Hildebrand, President of Urbanation. "However, it appears that the softening in rents has begun to spread throughout most parts of the country.”

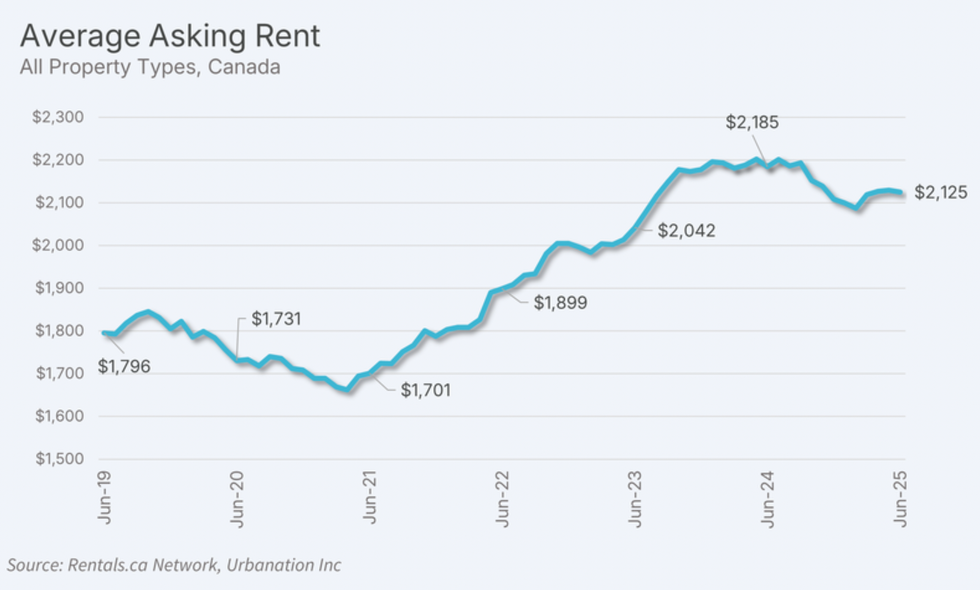

At the national level, rents fell 2.7% year over year to $2,125 in June, according to the latest rent report from Rentals.ca and Urbanation. June marked the ninth month in a row to see annual decline, and the report reveals that sliding rents were driven largely by secondary market units.

The secondary market (i.e., not purpose-built rental apartment buildings) saw condo apartment rents fall 4.9% and single-family home and townhome rents drop 6.6%, while the primary market (purpose-built rental apartment units) experienced a lesser dip of 1.1% on a year-over-year basis. Purpose-built rentals have also seen more marked growth over the past three years, with asking rents up 24.6%, compared to a 1.6% increase for condos and a 0.2% dip for homes and townhomes.

According to today's 2025 Mid-Year Rental Market Update from the Canada Mortgage and Housing Corporation (CMHC), both purpose-built rental and secondary market landlords are struggling to fill units, but the latter group is more likely to respond by lowering rents while the former is more inclined to use measures like incentives to fill units, hence the discrepancy in year-over-year rent declines between purpose-built and non-purpose-built rentals. At the same time, CMHC reports that some operators have said they may need to lower rents in the coming years as they continue to compete with a well-supplied secondary rental market.

For now, purpose-built rental completions remain well above 10-year historical averages in most markets, creating a build up in supply. And meanwhile, immigration continues to slow, further driving down rental rates as newcomers, especially temporary foreign workers and international students, typically rent upon arriving in Canada as opposed owning.

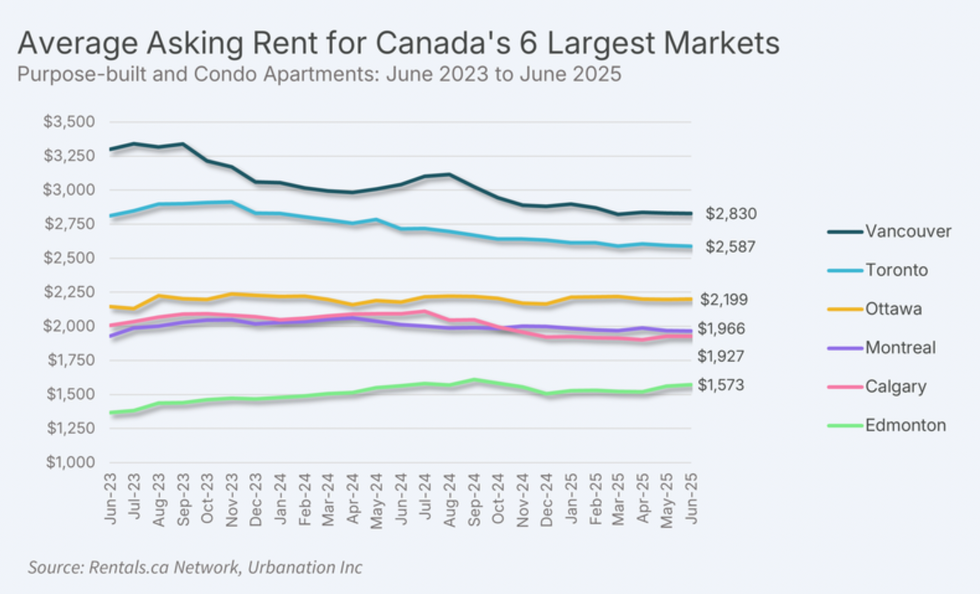

According to CMHC, regions most impacted by slowing immigration include Vancouver, Toronto, and Halifax, while international student caps are generally hitting marks in BC, Ontario, and Nova Scotia. In light of current realities, CMHC predicts vacancy rates will continue to climb over the course of 2025.

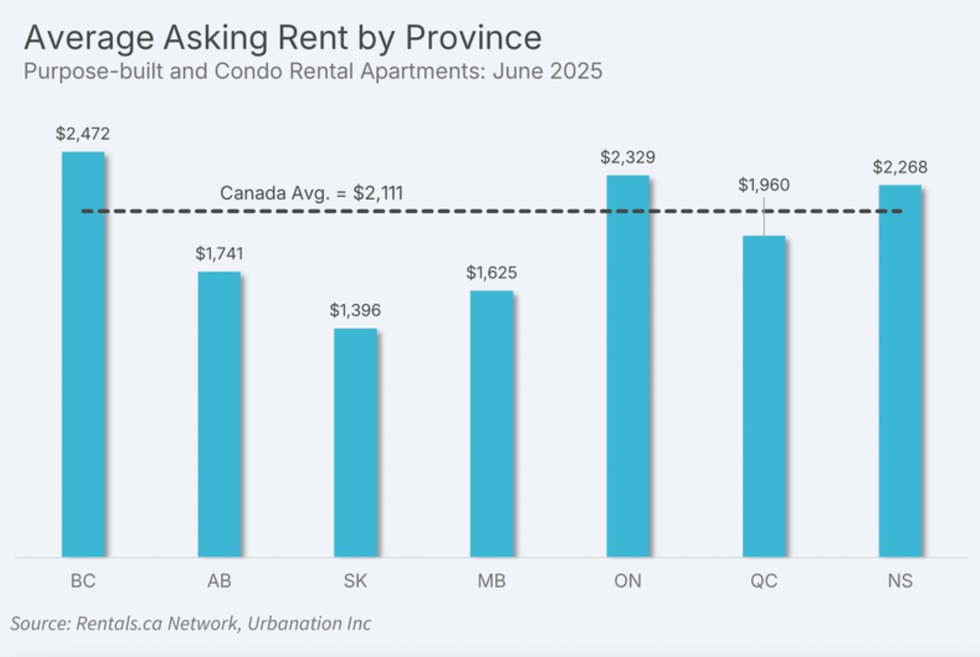

Coming back to the Rentals.ca and Urbanation data, BC and Alberta saw rents fall further than any other provinces last month, posting 3.1% year-over-year declines each, followed by Ontario at 2.3%. Meanwhile the Prairies were calling last month as rents in Saskatchewan jumped 4.2% year over year, making it the only province to see an annual increase.

On the municipal level, four out of Canada's six largest cities experienced yearly rent declines, with the exception of Edmonton and Ottawa, which both posted "modest increases" of 0.6% and 1%, respectively. Bringing up the rear, according to the report, were Calgary, Vancouver, Toronto, and Montreal at -7.9%, -7%, 4.7%, and 2.3%, respectively.

Across unit types, one- and two-bedrooms struggled the most in June, with both seeing rent drops of 3.5% year over year, while three-bedroom purpose-built apartments rose 4.4% year over year to an average of $2,755, which according to the rent report was the strongest performing segment last month.

Asking rent for shared accommodations continued to decline in June as well, with rents falling 5.1% annually to $939. In Ottawa, where there is a shift to more expensive co-living units, rents rose 12.8%, while Vancouver drove the overall decline with a 11.6% drop.

- Recent Immigration Cuts Could Lower Rents, Shrink Housing Supply Gap ›

- Ontario's Rental Supply Gap Projected To Surpass 200,000 In Next 10 Years ›

- Canadian Rents Up 12% Since 2022, Despite Annual Dip ›

- Canadian Rent Decline "Compounding" As July Sees 3.6% YoY Drop ›

- August Marks 11th Consecutive Month Of National Rent Decline ›