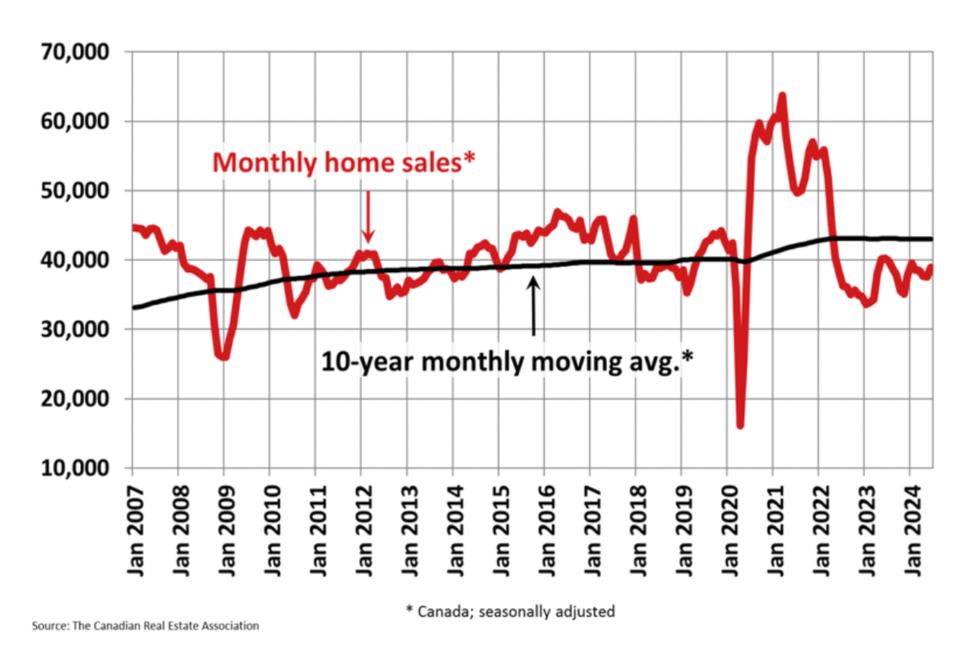

Despite murmurings from local real estate boards that last month’s interest rate cut was largely inconsequential for housing, the Canadian Real Estate Association (CREA) is reporting "signs of renewed life" in their June statistics report.

“It wasn’t a ‘blow the doors off’ month by any means,” says Shaun Cathcart, CREA’s Senior Economist. “But Canada’s housing numbers did perk up a bit on a month-over-month basis in June following the first Bank of Canada rate cut.”

By how much? Sales picked up 3.7% up from May, which isn’t nothing. Plus, there was a 1.5% month-over-month increase in new listings, with the highest numbers being in the Greater Toronto Area and British Columbia’s Lower Mainland.

This increase landed us at 180,000 active listings at the end of June, up from 175,000 at the end of May, and up 26% from a year earlier. Still, that figure is below the historical averages of around 200,000 listings for the season.

But, adjusted for season, the month-over-month increase was actually more like 0.5%, suggesting the national inventory buildup may be slowing down. And with new listings lower than sales gains, the market tightened 53.9% compared to 52.8% in May.

That puts the long-term average for the national sales-to-new listings ratio at 55%, well within the 45% to 65% ratio range that is generally consistent with balanced housing market conditions.

With 4.2 months of inventory reported at the end of June, we’re still in a buyers market, though that figure is down from 4.3 months at the end of May — note that this is the first month-over-month decrease in 2024.

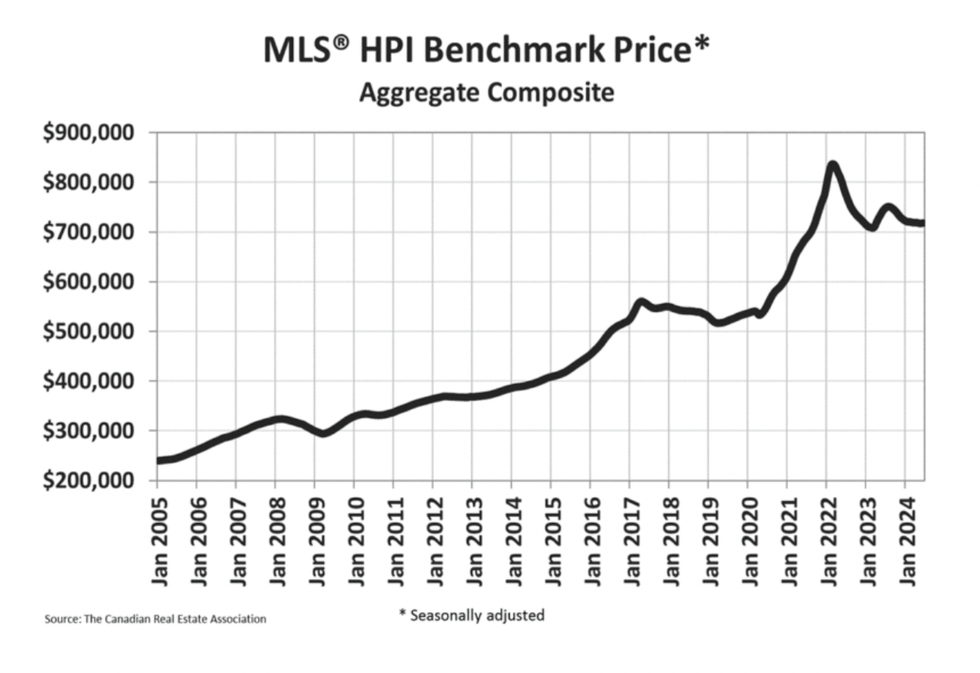

Lastly, the National Composite MLS® Home Price Index (HPI) ticked up 0.1% to $696,179 for the first month-over-month gain since last July, with Calgary, Edmonton, Saskatoon, and to a lesser extent, Montreal and Quebec City, continuing to lead the charge, though prices are still generally sliding sideways across much of the country.

But recently, increased activity has been observed in markets like Ontario cottage country, Mississauga, Hamilton-Burlington, Kitchener-Waterloo, Cambridge, London-St. Thomas, and Halifax-Dartmouth.

Despite June’s many encouraging stats, monthly activity did come in 9.4% below June 2023, but as Cathcart says, “that’s a story about last year. What’s happening right now is that sales were up from May to June, market conditions tightened for the first time this year, and prices nationally ticked higher for the first time in 11 months.”- "Calm is Good" In Canada's Housing Market: BMO ›

- May Was The Second Lowest Month For New GTA Home Sales Since 1990 ›

- Home Sales Expected to Increase Following Rate Cut Despite "Another Sleepy Month" In May ›

- June's Inflation Drop "Sets The Table" For July Rate Cut ›

- Immigration And Migration Are Reshaping Canada's Luxury Home Markets ›

- Despite Slow July, CREA Predicts "Slam Dunk" For Home Sales In 2025 ›