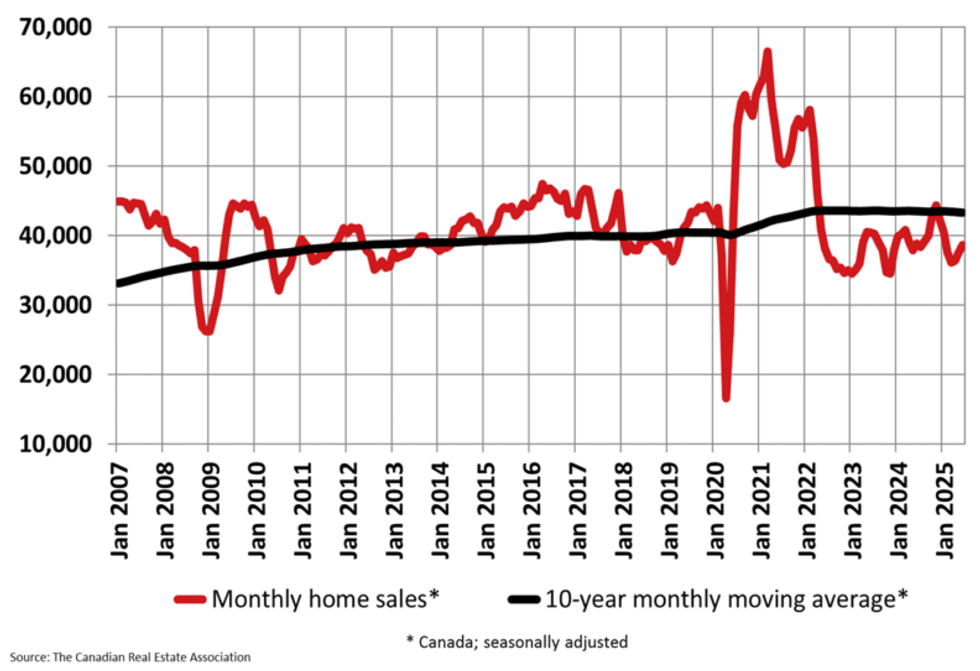

Canadian home sales posted a modest gain in June, offering a brief flash of activity in what’s been a largely sluggish year in most markets. According to the Canadian Real Estate Association's (CREA) latest statistics package, released Tuesday, national sales rose 2.8% month over month and 3.5% compared to June 2024.

"Over the past two months, the recovery in sales activity was led overwhelmingly by the Greater Toronto Area (GTA), where transactions, while remaining historically low, have rebounded a cumulative 17.3% since April," the association said in a press release.

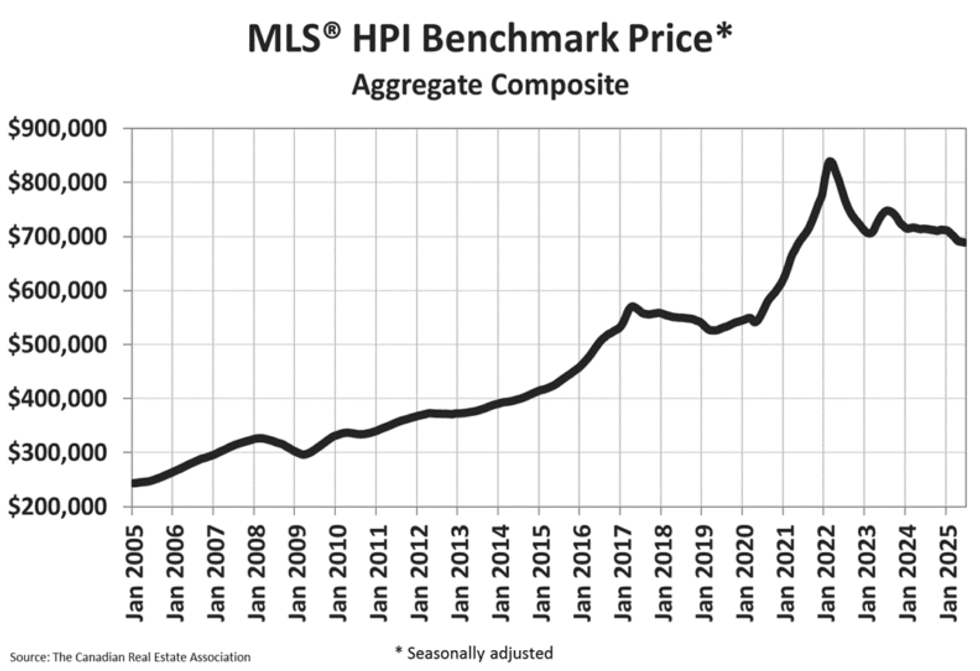

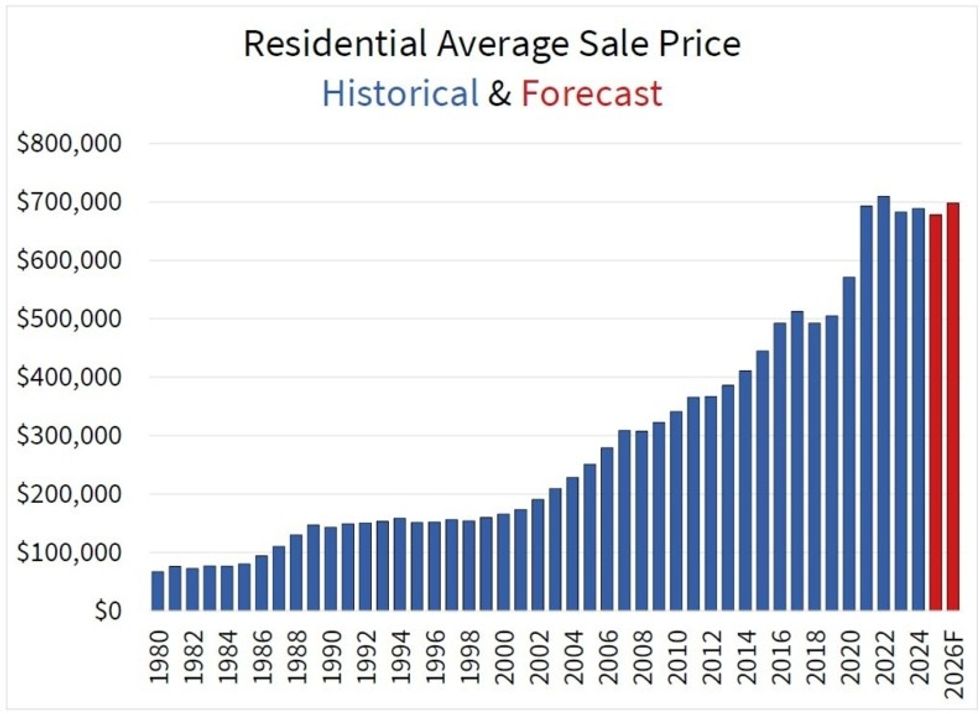

Despite the increase in transactions, prices continue to tread water. CREA’s MLS® Home Price Index (HPI) dipped 0.2% from May and was down 3.7% year over year. The non-seasonally-adjusted national average sale price came in at $691,643 in June, representing a 1.3% decline from the same time last year. While these shifts are modest, they point to a market that remains cautious and reactive to broader economic cues.

In Monday's release, CREA Chair Valérie Paquin noted that more buyers are beginning to re-engage with the market in "most" regions. "If the spring market was mostly held back by economic uncertainty, barring any further big shocks, that delayed activity could very likely surface this summer and into the fall," she said.

Meanwhile, new listings were down 2.9%, putting the national sales-to-new-listings ratio at 50.1%, up from 47.3% in May. The long-term average for the metric is 54.9%, and anything between 45% and 65% suggests the market is in a place of balance. There was also 4.7 months of inventory by the end of last month, slightly below the long-term average of five months of inventory. Again, this suggests the market is in a place of balance.

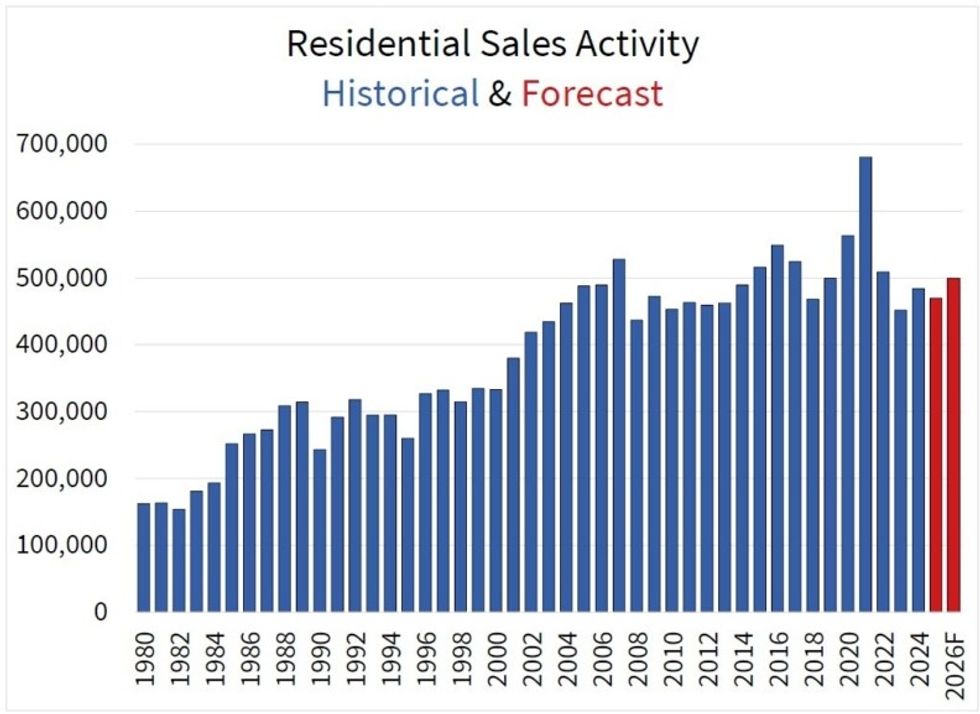

Looking ahead, CREA is tempering expectations for what’s to come. According to a revised forecast, also released Tuesday, "sales and average home prices are now forecast to post small declines in 2025 compared to 2024, as the tariff chaos and uncertainty that drove so many buyers back to the sidelines earlier this year ended up taking a larger bite out of activity in British Columbia, Alberta, and Ontario than was expected three months ago."

"The good news is markets appear to be entering their long-expected recovery phase, fuelled by pent-up demand, lower interest rates, and an economy that is expected to avoid worst-case tariff scenarios," the forecast went on to say. "As such, it’s looking like the timing of the start of that recovery may have been shifted from the spring to the summer by the cloud of extreme economic uncertainty earlier this year."

CREA is now calling for around 469,503 home sales in 2025, marking a 3% dip over 2024. Ontario, BC, and Alberta are the provinces that are set to see their sales decline year over year, "slightly offsetting gains everywhere else." On the price front, the national average is predicted to slip 1.7% year over year to $677,368, and that figure is around $10,000 off of CREA's previous forecast from April.

Looking further forward to 2026, CREA is calling for sales to tick up by 6.3% to 499,081. The association points out that level of sales would "put activity back on track with what was expected in the April forecast," while simultaneously marking "the fourth straight year for sales failing to crack the half million mark, something that has only occurred seven times going back to the first recorded instance in 2007."

Finally, the national average home price is anticipated to see a 3% bump between 2025 and 2026 to $697,929, marking the sixth consecutive year where the metric hovers around the $700,000 mark.

All in, CREA is not forecasting a housing market crash. Rather, it sees the current environment as a holding pattern — one where modest sales growth and price stability may persist, provided economic conditions don’t deteriorate further. For buyers, that could mean more opportunities to negotiate, while sellers may need to adjust expectations to reflect slower demand.

AI was used in the production of this article. It was conceptualized, edited, and published by a human.