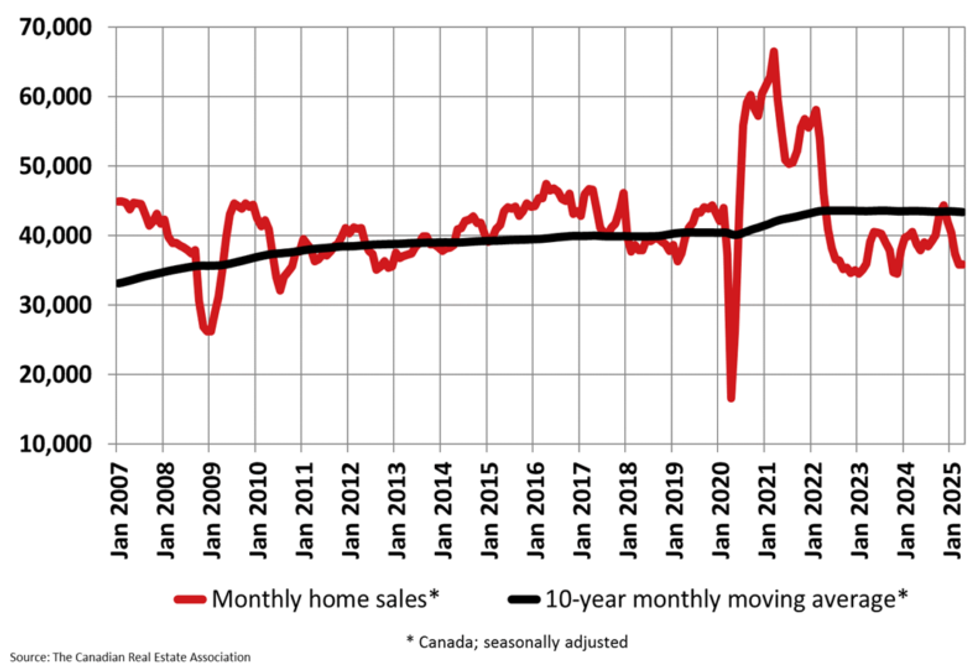

Canadian housing was bogged down by high interest rates through 2022 and 2023, with many expecting that rate cuts would entice buyers back into the market. But that rebound has yet to materialize. According to the Canadian Real Estate Association (CREA), home sales edged down 0.1% between March and April 2025 — a marginal dip that signals continued hesitation among buyers.

While sales remained essentially flat, it still marks an improvement over what has been a months-long downtrend. In March, transactions were down 4.8%. They were also down 20% from a “recent high” seen in November 2024.

After adjusting for seasonal effects, April’s sales were also down 9.8% on a year-over-year basis.

“At this point, the 2025 Canadian housing story would best be described as a return to the quiet markets we’ve experienced since 2022, with tariff uncertainty taking the place of high interest rates in keeping buyers on the sidelines,” says CREA’s Senior Economist Shaun Cathcart in a press release.

“Given the increasing potential for a rough economic patch ahead, the risk going forward will be if an average number of people trying to sell their homes turns into a large number of people who have to sell their homes, and that’s something we have not seen in decades.”

For the time being, it seems that sellers are exercising caution, with new listings slipping 1% month over month. That brought the national sales-to-new listings ratio at 46.8%, which is up from the 46.4% recorded in March. “The long-term average for the national sales-to-new listings ratio is 54.9%, with readings between 45% and 65% generally consistent with balanced housing market conditions,” says CREA.

A ratio below 45% points to a buyers’ market, which suggests that we are not far off from buyers’ territory.

Total active listings – including both new and existing – reached 183,000 in April, marking a 14.3% increase year over year. Still, active listings remain below the long-term seasonal average of approximately 201,000 listings.

The months of inventory metric — which measures how long it would take to sell current listings at the current pace of sales — held steady at 5.1 between March and April. That aligns closely with the long-term average of five months. CREA notes that values below 3.6 months indicate a sellers’ market, while anything above 6.4 months points to a buyers’ market.

Inventory levels are particularly elevated in British Columbia and Ontario, CREA adds, but remain tight across most other provinces.

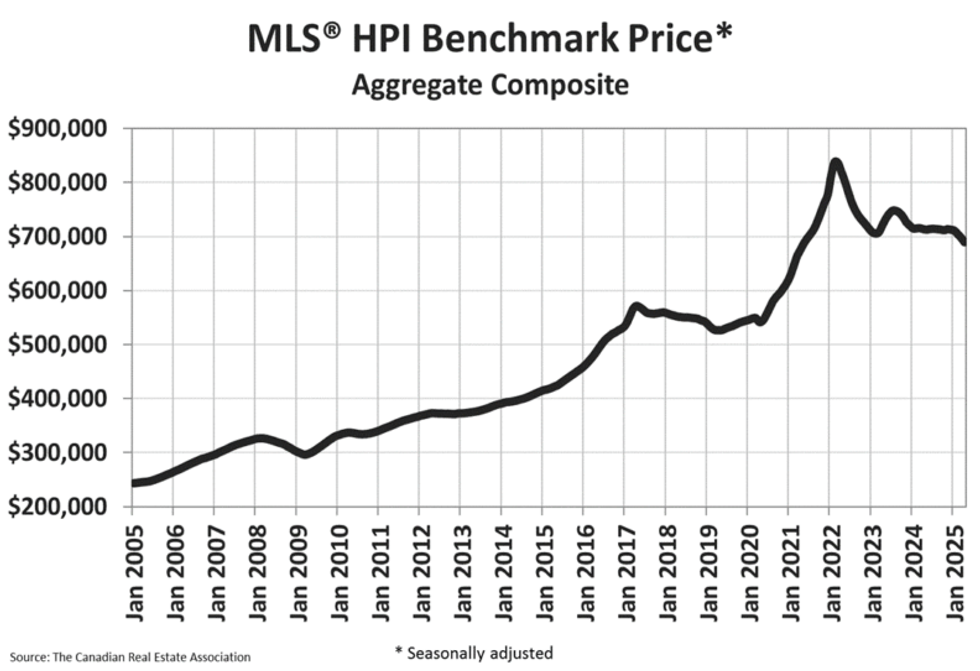

Meanwhile, prices continued to decline. The national composite Home Price Index (HPI) dropped 1.2% month over month in April. On a year-over-year basis, the unadjusted HPI fell 3.6%. The national average home price, also unadjusted for seasonal effects, came in at $679,866 — down 3.9% compared to April 2024.