Canadian business insolvencies surged by 36.8% last quarter from a year earlier, a 35-year high, says a report from the Canadian Association of Insolvency and Restructuring Professionals (CAIRP).

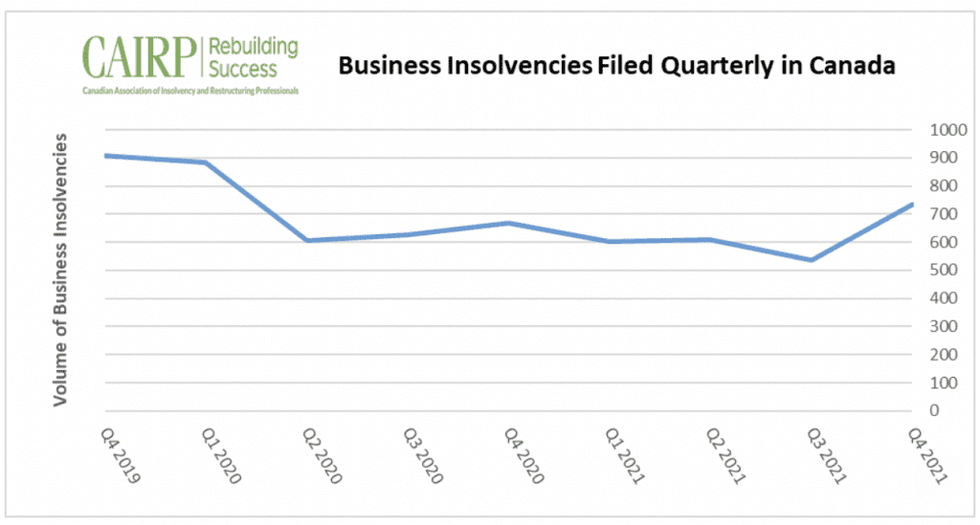

There were 733 business insolvency proceedings filed under the Bankruptcy and Insolvency Act in the fourth quarter of last year, which fell by 19.2% from Q4 2019, but rose by 9.7% over the fourth quarter of 2020. Insolvencies in 2021 declined by 11% year over year.

CAIRP suspects the reason is government subsidies have been buoying businesses, even as they took on additional debt as a consequence of COVID-related lockdowns. The Canadian Federation of Independent Business says the average COVID-19 debt for Ontario small businesses is $190,000 and that only 35% of small businesses have maintained normal revenues, while 18.5% are actively considering bankruptcy.

Read: Provincial $10k Grant is Too Little Too Late for Toronto's Bars and Restaurants

Many of the businesses have survived thanks to ultra-low interest in addition to government support, and CAIRP says many “small, fragile companies” might choose to walk away rather than consider insolvency or restructuring. With revenues still down for most businesses, COVID-19 support measures have plunged them into deep debt and many risk defaulting, especially as inflation wreaks havoc on them.

Retail, Food Services Struggling the Most

The sectors of the economy that recorded the biggest decrease in insolvencies in 2021 were retail trade, accommodation and food services, while construction, transportation and warehousing recorded the largest increases.

Consumer insolvencies increased by 5.5% in Q4 2021 from a quarter earlier to 22,266 individual bankruptcy filings or proposals, but they declined by 4.7% from Q4 2020 and by 36.7% from the same period in 2019. CAIRP says consumer insolvencies might return to pre-pandemic levels in late 2022 when interest rate hikes take effect. Moreover, Canadians who relied on government pandemic support will also struggle with mounting household debt and debt servicing costs.