2024 is shaping up to be the year of the interest rate cut — on Canadian soil, at least. This is according to a report that came out last week from RBC Economist Claire Fan, which lays out five predictions for when the Bank of Canada, the US federal reserve, the Bank of England, the European Central Bank, and the Reserve Bank of Australia will begin lowering their respective policy rates.

Fan writes that the BoC, more or less, has all the pieces in place to begin cutting rates at its June meeting. She even goes as far as to forecast the degree of the cut: 25 basis points, which would bring the benchmark rate to 4.75%.

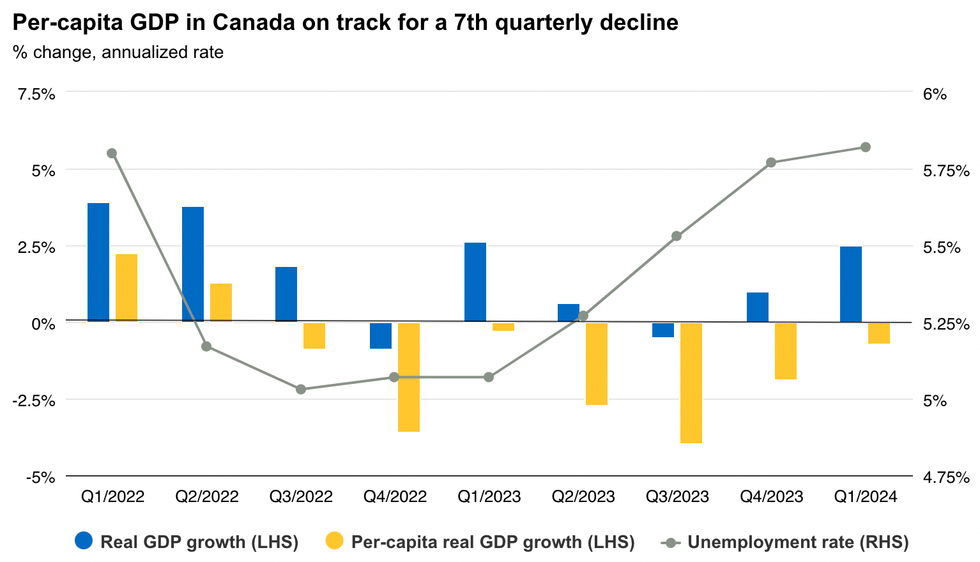

Since Canada’s central bank’s last meeting, Fan explains that “data releases over the last month have pointed to further softening in economic growth and inflation.” For example, the latest gross domestic product reading, released by Statistics Canada at the end of April, showed a very moderate, 0.2% rise in February. Meanwhile, on the inflation front, we’ve seen deceleration in Consumer Price Index for months now, with the latest reading coming in at 2.9% in March.

Fan also points to the fact that, although BoC Governor Tiff Macklem has been quite coy when it comes to rate cuts and their timing, he has indicated that cuts are likely “over the course of this year.” For Macklem’s standards, that’s a pretty bold and revealing statement — and one that he likely wouldn’t dole out lightly after speaking too soon on easing monetary policy last year.

“As labour markets continue to weaken and inflation readings in Canada also come lower, all ducks seem to be in a row for the Bank of Canada to start cutting the overnight rate as soon as June, with 100 basis points of total cuts expected for this year,” Fan adds.

On the interest rate cut front, Canada is ahead of the curve, according to Thursday’s report from RBC. South of the border — where the benchmark rate is currently sitting at a 23-year high of around 5.3% — it’s stacking up to be a trickier trajectory to the first cut, Fan writes, pointing to the fact that the feds have acknowledged that “progress with inflation stalled in recent months.”

She adds: “The tone of chair Powell’s comments erred on the dovish side, saying directly it’s ‘unlikely that the next policy move will be a hike.’ Contingent on inflation reversing back lower over the year we expect the Fed will start cutting in December.”

RBC’s expectation for the Bank of England, the European Central Bank, and the Reserve Bank of Australia is that their respective rates will remain unchanged at their next meetings, and like the US, all messaging from those entities is currently leaning dovish.

- "Supported By Fundamentals": TD Doubles Down On July Interest Rate Cut ›

- Bank Of Canada To Drop Interest Rate To 2.25% By 2025: TD ›

- Interest Rate Cuts Likely “Over The Course Of This Year”: Bank of Canada ›

- Opinion: The Time For Lower Interest Rates Is Now ›