April was a mixed bag for housing starts, reveals new data from the Canada Mortgage and Housing Corporation (CMHC). While starts were up overall, Ontario and BC continued to see substantial year-over-over declines.

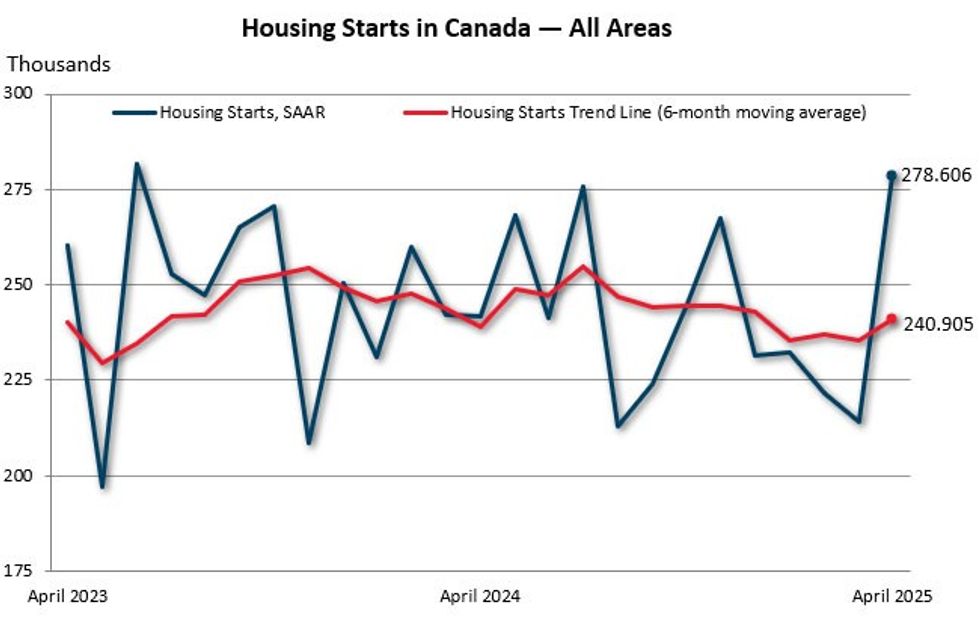

After falling across the board in March and February, the seasonally adjusted annual rate (SAAR) of housing starts rose a remarkable 30% month over month in April. The six-month trend increased 2.4%, and actual housing starts were up 17% year over year in centres with a population over 10,000 — the "highest actual housing starts for the month of April on record," according to CMHC.

April's numbers shine in comparison to March when starts fell 3.3% month over month, the six-month trend dipped 0.7%, and actual starts were down 12.5% on an annual basis.

In an analysis of the April data, Desjardins Economist Kari Norman pointed out that the 30% rise " blew the consensus of economic forecasters (235,000) out of the water."

"However, we remain firm in the belief that this large increase in month-to-month data speaks to natural fluctuations of multi-unit starts and their reporting dates, rather than an indication of a turnaround in the sector," Norman said. "The first four months of the year were 3% lower than the same period a year ago.

On a material level, this translates to actual starts in centres with a population over 10,000 increasing from 18,539 units last April to 21,720 units this April. Meanwhile, the monthly SAAR across all areas in Canada rose from 214,205 units in March to 278,606 units last month. In rural areas, the monthly SAAR rose to 18,818 units from 10,870 units in March.

High activity in April boosted the year-to-date total for 2025 to 67,022, down only 2% from the same period in 2024.

While April brought a welcomed change of tune with housing starts hitting a historic high, CMHC highlighted that starts in some of Canada's largest and most expensive markets are still falling short while tariffs continue to take their toll.

“The increased starts activity in April was driven by increases across all housing types in Québec and the Prairie provinces, while starts in Ontario and British Columbia declined on a year-over-year basis again this month," said CMHC’s Deputy Chief Economist, Kevin Hughes. "The current economic uncertainty will have consequences for the supply and demand of new housing. CMHC will be monitoring these effects closely over the coming months."

In Ontario and BC, housing starts fell 10% and 3% on annual bases, but on year-to-date bases, they were down 31% and 22%, respectively. On the other end of the spectrum, year-to-date housing starts rose 94% in Saskatchewan, followed by 55% in Quebec, and 47% in Newfoundland.

Out of Canada's three largest cities, Montreal saw the most notable year-over-year increase, at 64%, while starts in Vancouver rose by a lesser 6% and starts in Toronto fell by 25%. On year-to-date bases, those number came in at 82%, -25%, and -52%, respectively.

- After A Top-Down Approach On Housing, BC Is Starting To Listen. Is That Enough? ›

- Housing Starts Slow In February, Tumbling 68% In Toronto And 48% In Vancouver ›

- March Sees Housing Starts Plummet 65% In Toronto, 59% In Vancouver ›

- Canadian Housing Starts Flat In May, Plunge In Ontario ›

- June Housing Starts "Surpassed Expectations," Toronto Still Weak ›