Canadian home prices continued to climb in June, according to the latest Teranet-National Bank Composite House Price Index, released Thursday.

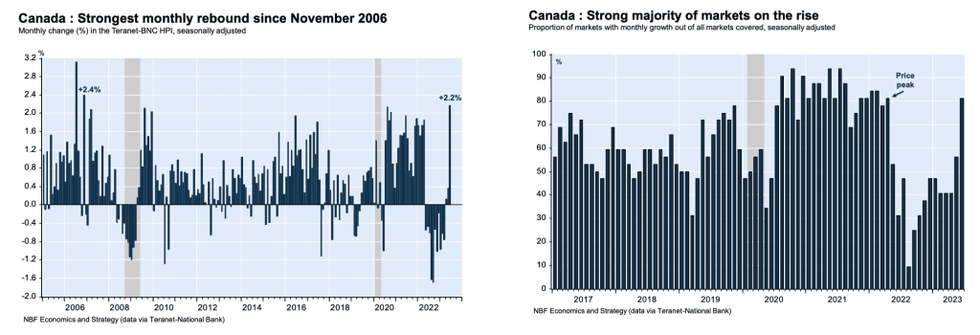

June’s reading shows that, before seasonal adjustments, the index edged up 2.6% between May and June. After adjusting for seasonal effects, the index saw a 2.2% rise, “marking the third consecutive monthly increase, but also the largest price rise in a single month since November 2006,” according to Daren King, Senior Wealth Advisor and Portfolio Manager at National Bank Financial, who examined the data in a report published this morning.

Referring to June's month-over-month gain as a "spectacular jump," King goes on to describe how "recent rises in the composite index" have served to partially erase a cumulative decline of 8.7% from a peak reached in April 2022.

“This rebound is even more impressive given that 81% of cities covered in June saw an increase during the month, the best diffusion of growth since the composite index peaked last year," continues King.

Of the 11 CMA’s considered in the index -- namely, Victoria, Vancouver, Calgary, Edmonton, Winnipeg, Hamilton, Toronto, Ottawa-Gatineau, Montreal, Quebec City, and Halifax -- nine posted increases. This included Toronto (+2.9%), Vancouver (+2.6%), Quebec City (+2.6%), Halifax (+2.3%), Calgary (+2.1%), Victoria (+1.9%), Montreal (+1.4%), Ottawa-Gatineau (+1.0%) and Edmonton (+0.2%).

Conversely, Winnipeg saw prices fall by 0.2% during the month, while prices remained stable in Hamilton.

Data is also available for 20 CMAs not included in the index, of which 15 saw prices increase. Brantford led the pack with a price gain of 8.7% (after seeing a drop of 8.2% the previous month), followed by Sherbrooke with a gain of 5.8% (following a drop of 4.5% the previous month). The largest price decreases were observed in Saint John (-3.3%) and St. Catharines (-1.2%).

King attributes the broad degree of price gains to “strong demographic growth and the lack of supply of properties on the market.”

However, he adds, “the Bank of Canada’s recent rate hikes and the economic weakness expected in subsequent quarters will represent a headwind for house prices thereafter.”

Year over year, the national composite index dropped by 5.1% in June, which was “a smaller annual contraction than the previous month” when the index fell by 7.6%.

Also on an annual basis, three of the 11 CMA’s considered in the index observed price gains, including Calgary (+6.5%), Quebec City (+5.2%), and Edmonton (+1.3%). On the flip side, prices dropped off in Hamilton (-13.4%), Ottawa-Gatineau (-8.4%), and Toronto (-6.7%).

As well, year-over-year gains were observed in five markets not included in the index, with the strongest growth observed in Trois-Rivières (+6.7%), Lethbridge (+5.1%), and Sherbrooke (+4.8%). Meanwhile, lagging markets included St. Catharines (-14.4%), Brantford (-14.0%), Abbotsford-Mission (-13.3%), and Peterborough (-13.2%).