While Canadian real estate prices fell slightly in May -- down 1.1% from April to an average of a little over $688,000 -- Canada's housing market is still flashing red warning signs that haven't been seen since the lead up to the 2008 financial crisis.

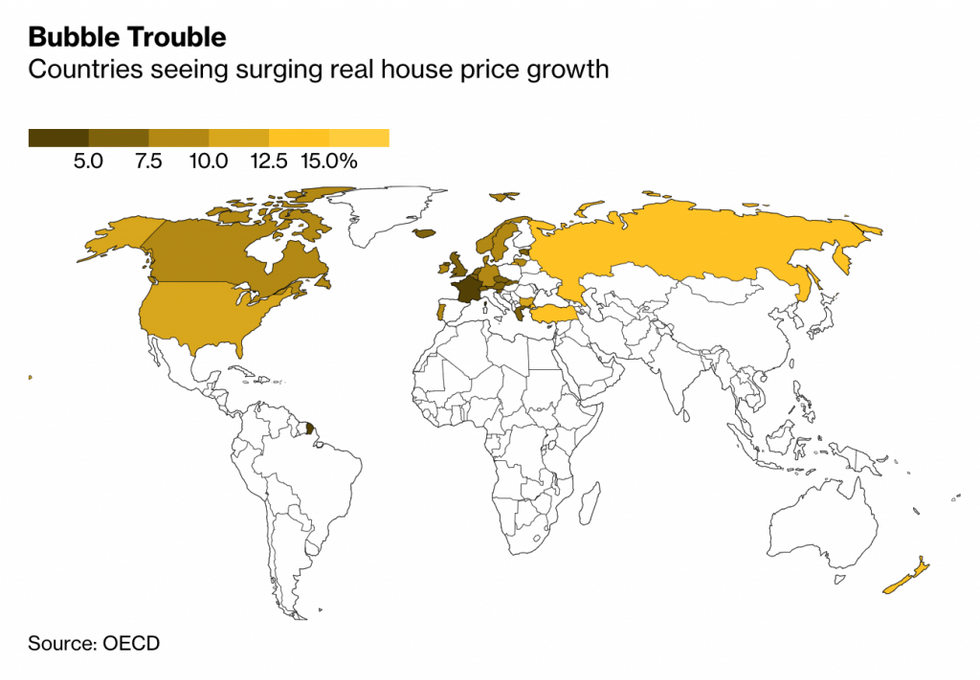

However, it's not just Canada's housing market that's causing cause for concern, as real estate prices around the world are also showing bubble-risk warning signs, according to a new report from Bloomberg Economics.

Bloomberg Economics says New Zealand, Canada, and Sweden rank as the world’s top three frothiest housing markets, based on the key indicators used in the Bloomberg Economics dashboard, while the UK and the US aren't far behind.

“A cocktail of ingredients is sending house prices to unprecedented levels worldwide,” economist Niraj Shah wrote in the report. “Record low interest rates, unparalleled fiscal stimulus, lockdown savings ready to be used as deposits, limited housing stock, and expectations of a robust recovery in the global economy are all contributing.”

READ: What Would a Canadian Real Estate Bubble Burst Actually Look Like?

According to Bloomberg, additional factors impacting housing demand include residents working remotely from home looking for more space and tax incentives offered by some governments to home buyers.

Bloomberg says its analysis focused on member countries of the Organisation for Economic Co-operation and Development (OECD) -- an intergovernmental economic organization with 38 member countries, founded in 1961 to stimulate economic progress and world trade.

Bloomberg Economics' dashboard features five indicators to estimate a country's 'bubble rank.' Countries with a higher ranking indicate a greater risk of a correction.

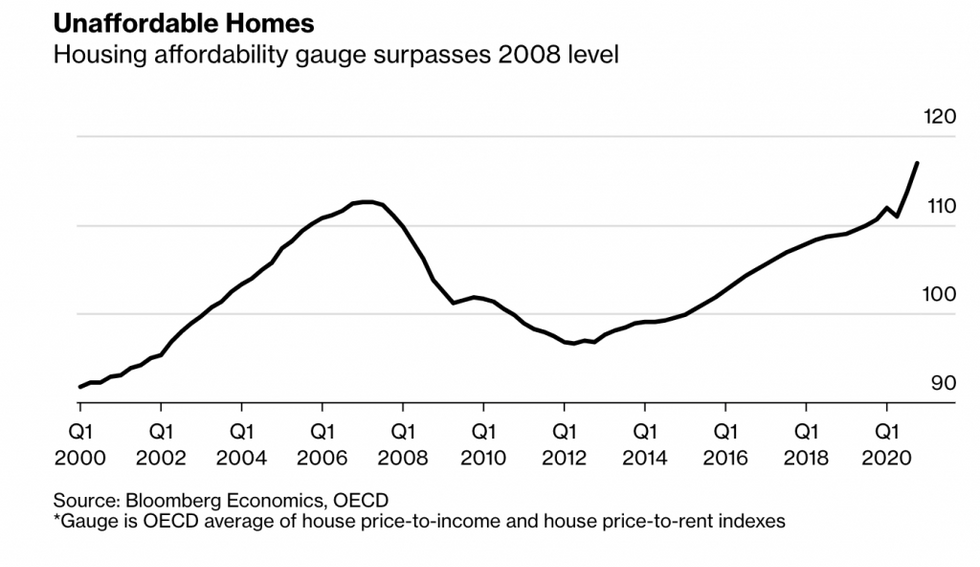

Bloomberg says among the indicators, price-to-rent and price-to-income ratios help assess the sustainability of price gains, while house price growth measures current momentum.

According to the Bloomberg Economics analysis, for many countries in the OECD, the price ratios are currently higher than they were in the lead up to the 2008 financial crisis.

However, even as risk metrics rise, Bloomberg says with interest rates low, lending standards generally higher than in the past, and macro-prudential policies in place, the spark for a crash isn’t obvious. Rather, Shah says, "the period ahead will more likely be characterized by cooling rather than collapsing."

"Yet the risk is greater when there’s a synchronized boom in house prices -- as is the case in the current cycle," according to Shah.

“When borrowing costs do start to rise, real estate markets -- and broader measures put in place to safeguard financial stability -- will face a critical test,” said Shah.

In Canada, the average home price in the country jumped nearly 13% in 2020, and the CMHC recently forecast that the national average price could rise another 14% by the end of 2021. By the end of 2022, however, the national mortgage agency expects the average price of a home to reach $679,341.

Canadian policymakers have introduced measures to help ease the country's frenetic market more recently. Still, RBC economist Robert Hogue says they are only a "partial fix" to Canada's imbalanced housing market.

"And so long as demand-supply conditions remain tight, prices will escalate further. Rising prices, in fact, will be an integral part of the rebalancing process,” said Hogue.

Like the CMHC's forecast, Hogue believes price increases will also be in the double-digits in 2021, although a “much-desired soft landing” has been pushed into 2022.

The bank’s 2021 home price forecast has now increased 13% to $697,400 for the national RPS HPI benchmark, from a gain of 8.4% previously. “We expect price pressure to start easing later this year, setting the stage for a more modest 3.3% appreciation in 2022,” said Hogue.